Ethereum Shanghai hard fork and token unlock: A complete guide to unstaking ETH

- Ethereum Shanghai Hard Fork’s activation in March 2023 will be closely followed by a token unlock of at least 35,008 ETH.

- To facilitate Ethereum unlock, the nodes storing data and processing transactions need to ensure that their withdrawal credentials are updated.

- Ethereum price is on track to hit the $1,500 level in another leg up, according to the Elliott Wave Theory.

Ethereum Shanghai Hard Fork is the next key milestone for the second-largest cryptocurrency by market capitalization. The event is closely followed by a token unlock, where at least 35,008 ETH will be unlocked shortly after the hard fork is successful.

This post outlines how validators can prepare for token unlock, the minimum volume of ETH tokens that are likely to flood the market and what to expect from Ethereum price.

Also read: Ethereum Shanghai Upgrade: Guide to the ETH hard fork, unstaking and liquid staking projects

Ethereum Shanghai hard fork would pave the way for unstaking ETH tokens

Ethereum network’s Shanghai upgrade is the next major developmental milestone post the altcoin’s Merge. The Merge marked ETH’s successful transition from proof-of-work to proof-of-stake consensus mechanism and reduced energy usage by 99.9%. The Shanghai hard fork will be closely followed by ETH token unlock.

Ethereum tokens staked in the deposit contract will be unlocked for the first time since 2020. While several Ethereum Improvement Proposals are bundled in the Shanghai hard fork, the ETH token unlock is the event that developers and the community is most looking forward to.

Developers are targeting March 2023 for the activation of Shanghai and staked ETH withdrawals. All validators wanting to withdraw their staking rewards will have to ensure their withdrawal credentials are updated to the new “0x01” format. As defined by Ethereum.org, a validator is a node in a proof-of-stake system responsible for storing data, processing transactions, and adding new blocks to the blockchain.

Users in the Ethereum community who staked 32 ETH in the ETH2 deposit contract, activated their validators on the altcoin’s blockchain network. Updating validator withdrawal credentials is a requirement for nodes who want to exit, stop validating, and withdraw the full balance of their staked ETH.

Based on the number of active validators on the network as of January 10 (497,138 active), a maximum number of 16 withdrawals will be processed per block. There is no gas cost associated with withdrawals. Each validator that intends to unlock staked ETH will go through two separate queues: an exit queue and a withdrawals queue. Both full (32 ETH) and partial withdrawals will be processed simultaneously.

The existence of 1,094 exited validators on Ethereum suggests that there will likely be at minimum 1,094 full withdrawals processed and >35,008 ETH un-staking from the Beacon Chain (responsible for consensus logic and ETH protocol) shortly after the activation of Shanghai.

Find more information on withdrawing staked ETH, updating withdrawal credentials here:

Ethereum developers are targeting March 2023 for the activation of Shanghai and staked ETH withdrawals. In my latest report, I give a detailed overview of how staked ETH withdrawals will be enabled on Ethereum. Here's the tldr

— Christine Kim (@christine_dkim) January 9, 2023

(Thread inspired today by @kellyjgreer )

With ETH token unlock fast approaching, the altcoin’s price could face mounting selling pressure unless the event has been priced in. Technical expert Crypto_Ed_NL weighed in on the ETH price impact.

Ethereum price has another leg up before a correction

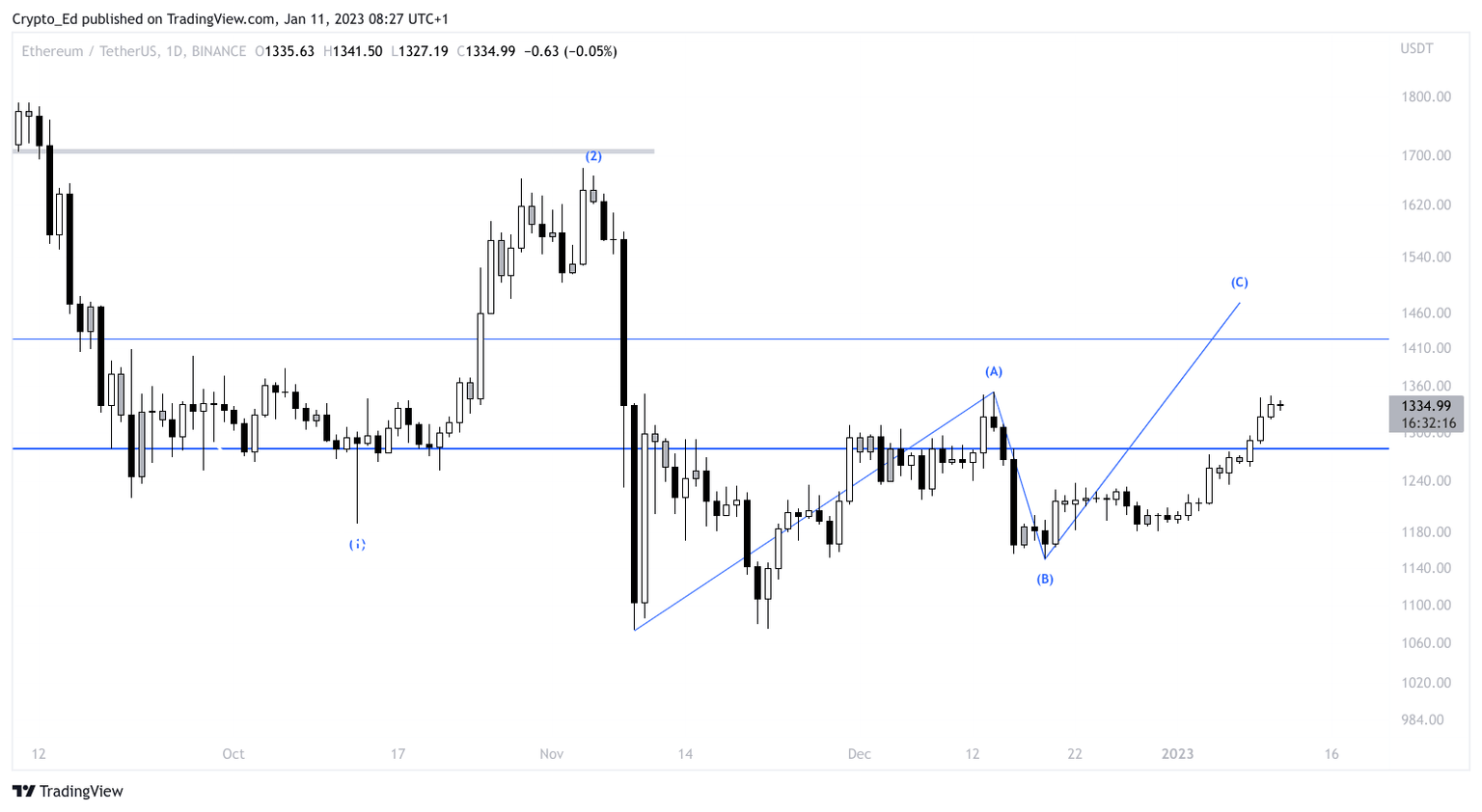

Pseudonymous crypto analyst and trader Crypto_Ed_NL applied Elliott Wave Theory to Ethereum in the chart below. The expert believes Ethereum has bullish potential and the altcoin could climb another leg up before a correction in its price.

ETH/USDT price chart

According to Elliott’s wave theory, the market price of the asset alternates between an impulsive, or motive phase, and a corrective phase on all time scales of trend. Impulses are divided into 5 lower-degree waves, where waves 1, 3, and 5 are impulses and waves 2 and 4 are smaller retraces of waves 1 and 3.

As seen in the chart above, ETH price has completed its second wave and is prepared for the next impulse, wave 3. The expert argues that a break above A at $1,360 would validate the bullish thesis and the model, signaling a run up to the $1,500 level, represented by C on the chart.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.