Ethereum price eyeing $1,400 as Shanghai hard fork nears launch

- Ethereum price is up by 11% since the start of the new year.

- Bullish targets lie between $1,400 and $1,450.

- The uptrend would be void if the $1,230 level was breached.

Ethereum price is performing resilient uptrend price behavior that has yet to show signs of retreat. The next surge could prompt a 10% rally in the coming days.

Ethereum price is not letting up yet

Ethereum price is displaying bullish signs that are hard to ignore. Since January 1, the decentralized smart-contract token has risen by 11%, blowing past the $1,250 support zone that held ETH suppressed for nearly three weeks. On January 5, the bulls produced a settle above the barrier and catalyzed the impulsive uptrend rally currently being displayed.

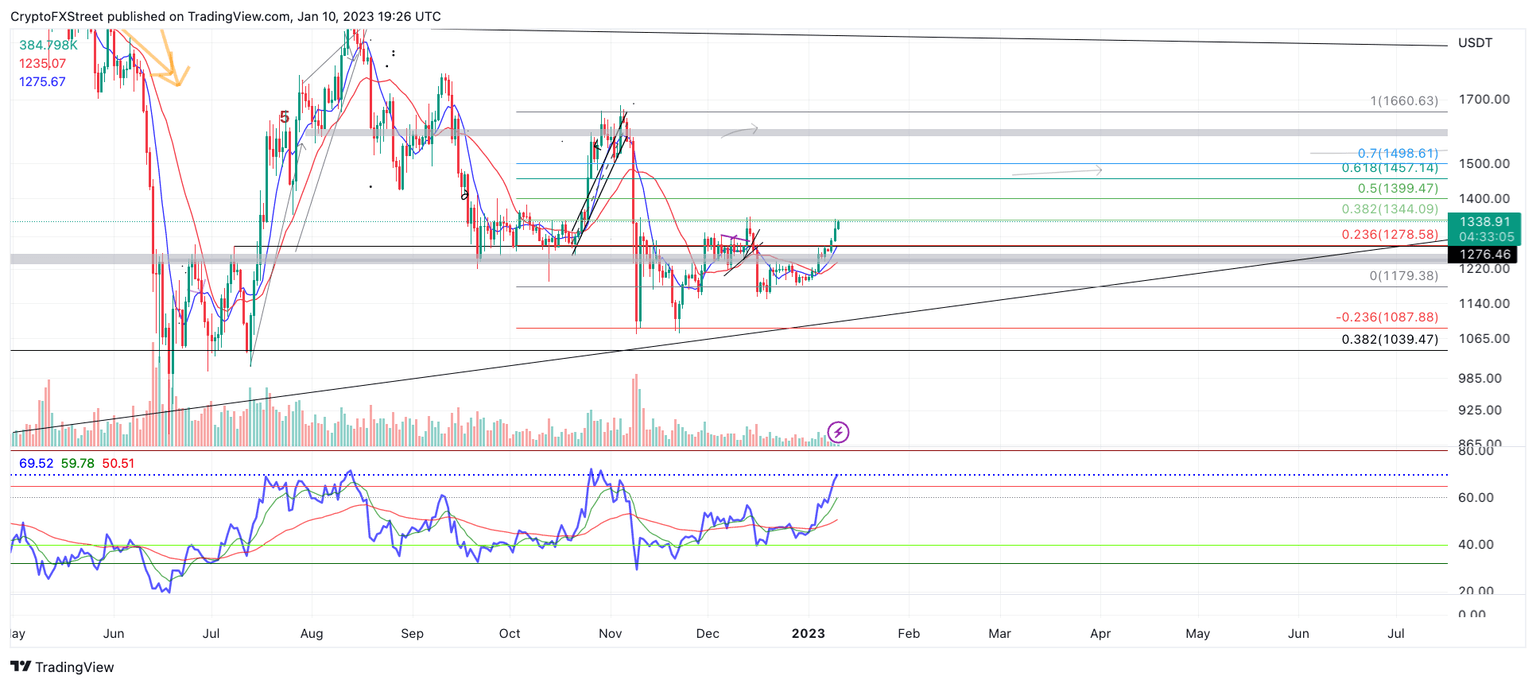

Ethereum price is now auctioning at $1,342. The bulls are inching closer to blowing past the December high of $1,352. The key monthly level should be watched closely. A daily candlestick above the barrier would scream bullish and aid a rally towards $1,400 and potentially $1,450. The targets are extrapolated through a Fibonacci Retracement tool that surrounds November’s trading range.

Shanghai hard fork on the horizon

The bullish technicals come at an interesting time in the market as Ethereum developers are preparing to launch the network update protocol as early as March of 2023. Shanghai hard fork, an update that will provide Ethereum investors with innovative staking capabilities while dually keeping network fees to a minimum. Several crypto advocates have called the anticipated update exactly what crypto needs to promote a new bull run.

ETH/USDT 1-day chart

For traders looking to join the uptrend move, invalidation of the bullish trend could arise from a breach of the $1,230 liquidity zone. The barrier lies adjacent to the 21-day simple moving average and was vital for the previous 30% uptrend rally that occurred between October 22 and November 6.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.