Why this boring phase of LUNA price will result in handsome returns

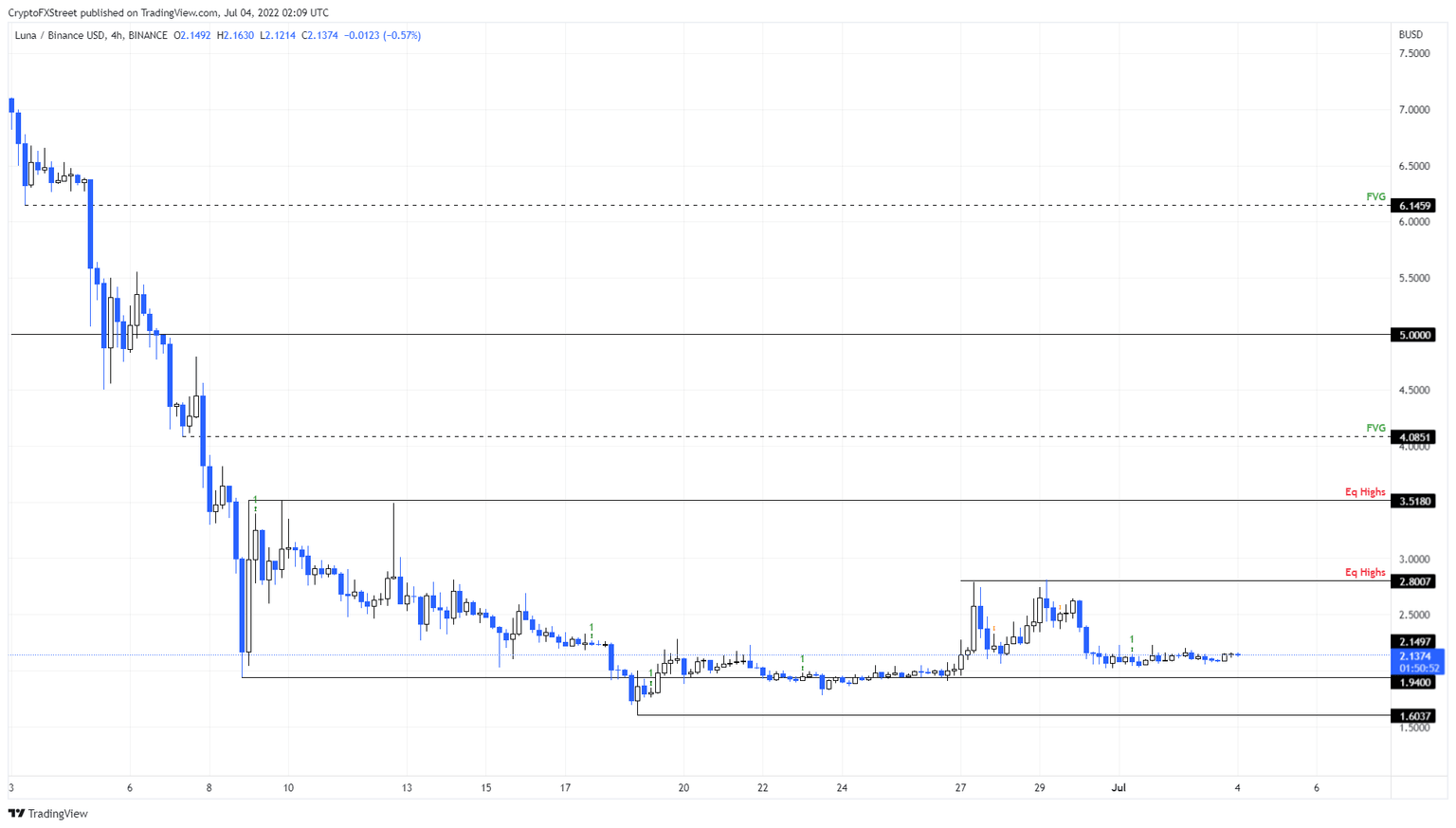

- LUNA price shows tight wounding around the $2 psychological level, signaling a volatile move.

- A retest of $1.94 before an explosive move to equal highs at $2.80 could occur.

- A four-hour candlestick close below the $1.94 support level without a quick recovery will invalidate the bullish thesis.

LUNA price has been consolidating tightly since June 30, after undoing the gains seen over the previous week. This small range, suggests that an explosive move is around the corner, although the direction of a breakout remains to be seen.

LUNA price prepares for volatility

LUNA price rallied 46% on June 26 and June 27, setting up a swing high at $2.80. This rally immediately witnessed a 26% pullback and was quickly followed by a 36% run-up to set up another swing high at $2.80, creating an equal high.

Resting above $2.80 is a bunch of buy-stop liquidity from traders that shorted this move. Hence, it would make sense from a market maker perspective to push LUNA price higher to collect this liquidity. However, the recent consolidation makes it so that the breakout could go either way.

Considering that Bitcoin price shows a slight affinity towards a temporary bullish move, investors can expect LUNA price to do the same. A quick 32% rally that sweeps the $2.80 level will fulfill the upside objective and potentially limit the upswing here.

However, from a long-term perspective, there are three equal highs that were formed at $3.51 and in some cases, this run-up might extend to this level to collect liquidity. In total, this move would constitute a 67% ascent.

LUNA/USDT 1-day chart

While things are looking up for LUNA price, a four-hour candlestick close below the $1.94 support level will indicate that the bulls are weak. If the altcoin fails to recover quickly above this support, it will further confirm that the sellers are in control and invalidate the bullish thesis detailed above.

In such a case, LUNA price might crash 16% to revisit the June 18 swing low at $1.60.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.