Terra's LUNA price re-routes south, here's what changed

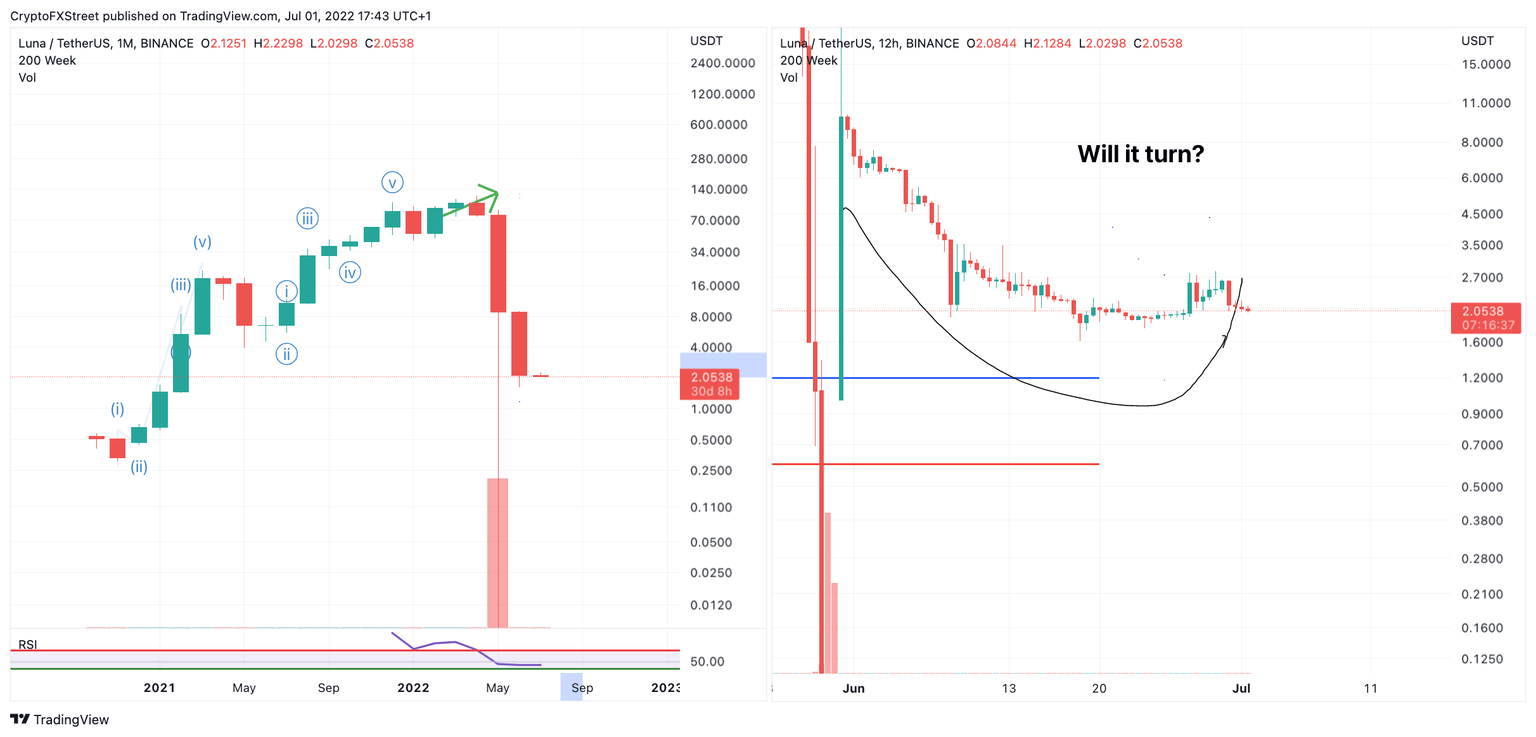

- Terra's LUNA price prints a bearish engulfing candlestick on the monthly chart.

- LUNA price saw rejection at the 2.70 barrier, which provoked bearish traders to add pressure.

- Invalidation of the bearish downtrend is a breach above $2.82.

Terra's LUNA price sees sudden rejection and a bearish monthly close. Investors should consider additional drops in the LUNA price throughout the summer,

Terra's LUNA price ends the party short

Terra's LUNA price began to show optimistic signs amongst investors as the bulls were finally able to breach above the $2.50 barrier towards the final days of June. Unfortunately, on the day of June's monthly settlement, kamikaze traders showed up to short the controversial digital currency last minute, wiping all of the celebratory gains established.

LUNA price at the current time of writing trades at $2.06. The bears have wiped 36% of profit since the newfound high at $2.82 occurred on June 29. A large piercing cable stick through the $2.50 barrier, followed by consecutive doji hammer sticks, signals bearish strength as bulls have difficulty producing a substantial retaliation. A breach below $2.00 could be the catalyst to another LUNA liquidation targeting $1.50 and potentially the VPOC at $.59 sometime during the summer.

LUNA/USDT 1 Month & 12-Hour Charts

Bullish trailers should consider staying out of the way unless another bullish breakout occurs.

Invalidation of the beamish trend is a breach above the swing high at $2.82. If the bulls can hurdle this barrier, they may be able to rally as high as $3.50, resulting in a 77% increase from the current Terra LUNA price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.