Terra’s LUNA has small window to eke out gains for this week

- Terra price faces harsh conditions as it tries to hold on to any gains.

- LUNA price technically performed a bullish breakout.

- If more upside is to come looks questionable as the RSI is still stuck in oversold.

Terra (LUNA) price surprised friend and foe by setting out a bullish breakout in this trading week where most cryptocurrencies continued being on the back foot. Last week as well, LUNA price went against the current by booking a weekly close while most cryptocurrencies had enjoyed a soft patch in the markets and rallied on the back of it to recover some losses. If LUNA can reach the end of Sunday evening on a profitable note remains to be seen, as global market sentiment remains fragile and a regulatory framework from the EU could cause issues.

LUNA price has some more headaches to come

Terra's price is trying to hold on to slim gains that it had booked at the beginning of the week and slowly but surely saw evaporating towards Friday evening. On a weekly base, a bullish candle could be in the making as Sunday trading still can do miracles. However, although this could be a sigh of relief, more headaches and tail risks are being formed in the near future as following the US, the EU has announced it will also build a framework for cryptocurrencies to move in and limit any exuberant events.

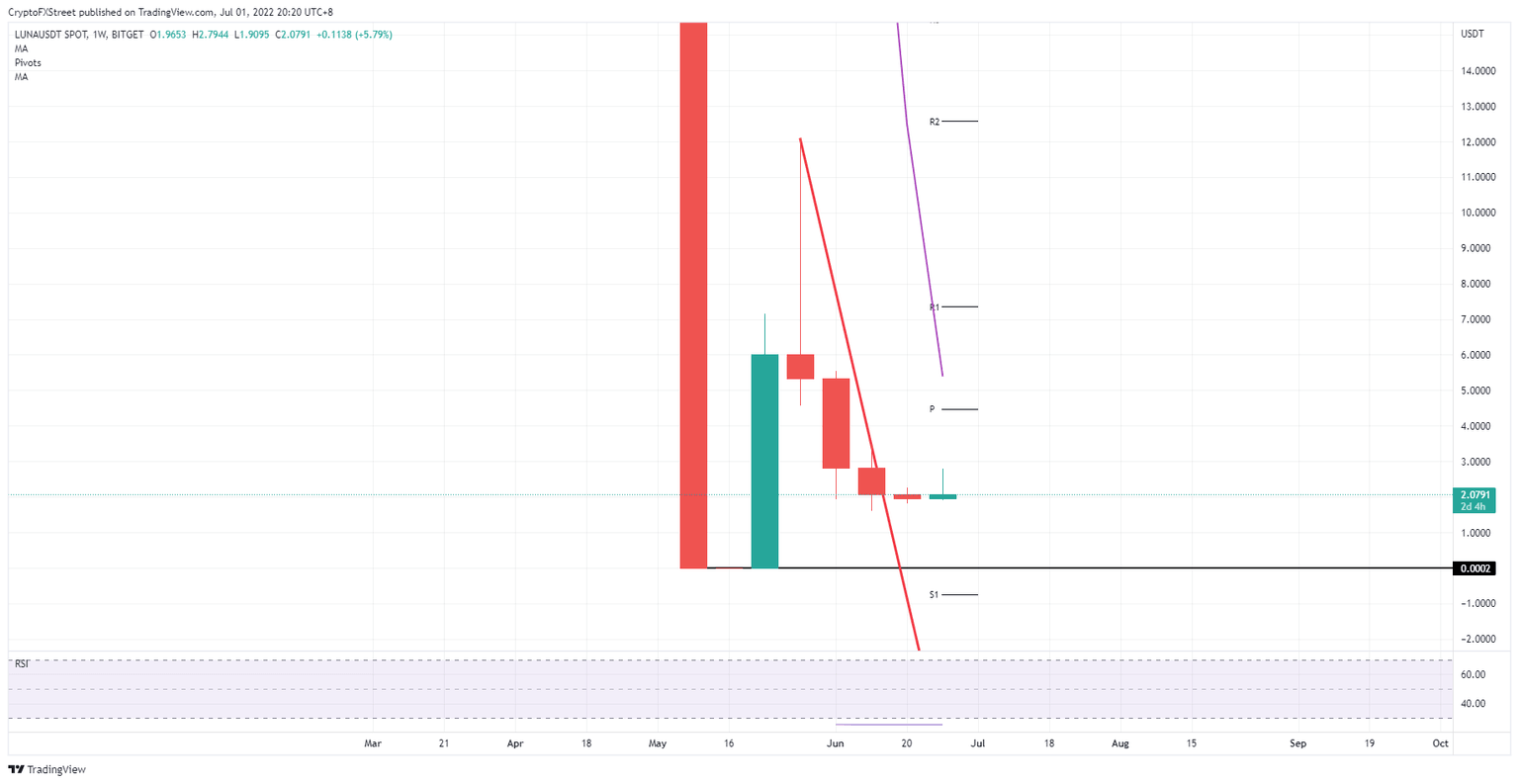

LUNA price could see its little pop as quickly fade as it came and, going into next week, start to turn into a loss again. The losing streak of four consecutive negative weeks would only be interrupted by one small outlier. With the downtrend continuing, expect first a test at $1.63, which is the low of mid-June. Once that level breaks, expect to see that $1.00 level to be working as a magnet and attracting LUNA price action lower towards it.

LUNA/USD weekly chart

The upside surprise from the normal trading week could result in a more bullish tone. Certainly, as of July kicks in, a drop in volume presents itself, which means that bulls could have the occasion to take over the steering wheel from the bears. Price action could quickly pop higher on slim trading towards $4.00 around the monthly pivot.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.