Why bulls are being foolish on Cardano

- Cardano price has seen an uptick this morning in ASIA PAC trading.

- ADA price, however, has suffered a 12% devaluation in just three trading days.

- Expect to see this uptick be short-lived and set to trap bulls in the process.

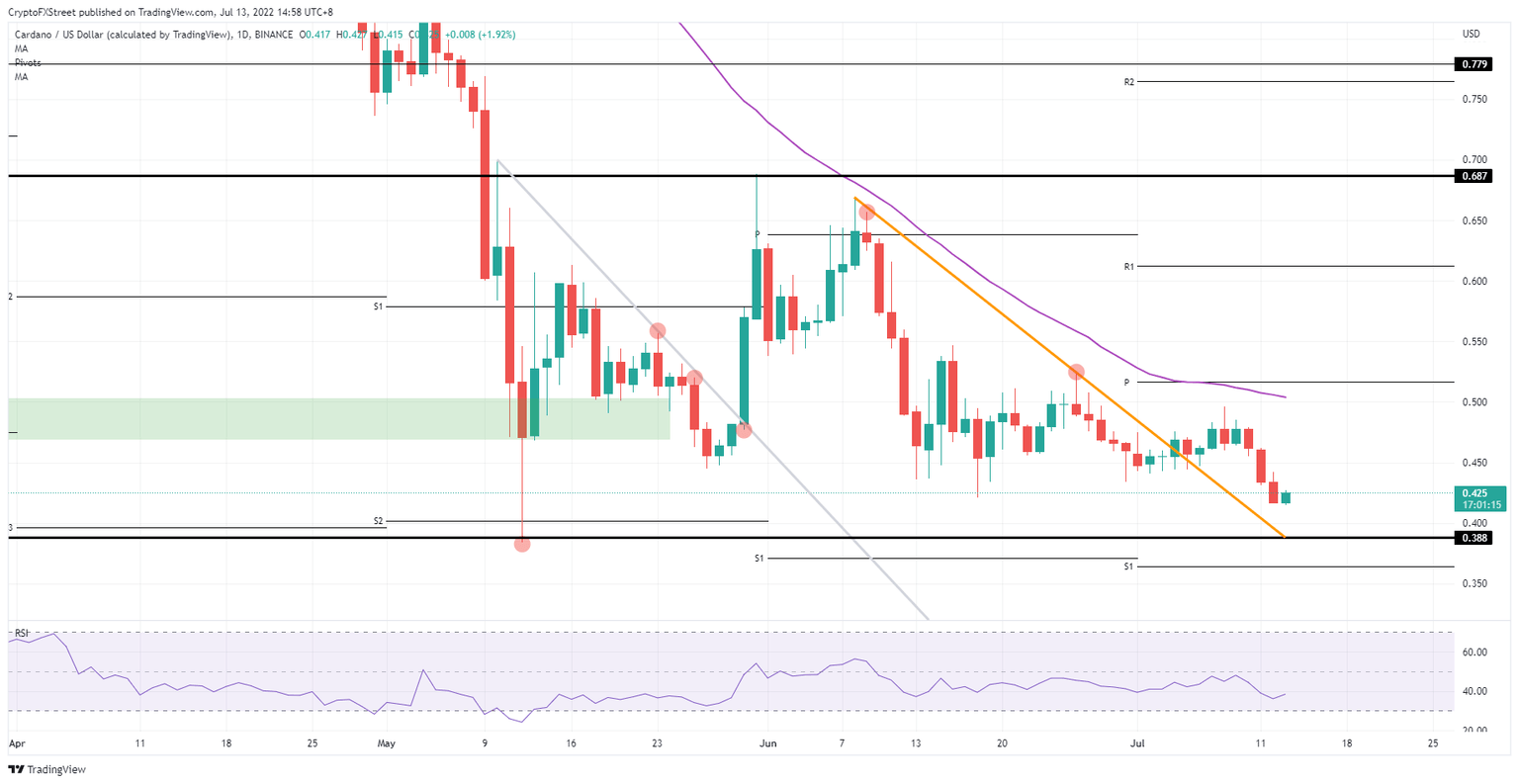

Cardano (ADA) price has received an uppercut with price action evaporating another 12% of value. Although several cryptocurrencies are showing signs of a reversal this morning, traders must be aware of the technicals, as some could hold an unpleasant surprise when trying to pre-position for a recovery. As ADA price is trading nowhere near any supportive handles, expect to see a possible bull trap being formed with Cardano price still set to drop another 8% before hitting any support levels that could finally underpin price action for a bounce to the upside.

ADA price bouncing on thin air

Cardano price is showing similar patterns as most cryptocurrencies this morning after receiving a three-day losing streak that has been axing prices even further. Although no new lows have been printed for 2022, bulls need to trade this signal carefully as, in the case of Cardano, no fundamental support elements are nearby that could be used as an entry point, and no levels in the near vicinity to place their stops away safely. Bulls just jumping in on this current green daily candlestick are showing poor trade management and could be in for a bull trap with a squeeze of at least 8% or over, which is quite a negative loss to bear when positioning for a long to $0.50.

ADA price is thus a wait-and-see trade with traders awaiting the drop towards $0.388 or near $0.40 before starting to buy up. Several cryptocurrencies are showing that their price action is getting underpinned, which is a very good motivation to use for determining to go long, but also needs a supportive factual element on the chart as well. Stops can be placed below $0.38, and profit targets set at $0.50, making it a 1-to-6 trade, which is a good trading strategy worth venturing into.

ADA/USD Daily chart

Of course, risk to the downside comes with a catalyst that could bring ADA price action below $0.38. But even that would not be such a big issue as the previous current monthly S1 support level are close, near around $0.36. That is a very slim area for bears to move in before getting hit by the next profit-taking level. With the Relative Strength Index nearing very close to being oversold, fresh bears are refraining from adding or joining the downtrend for now.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.