Why Algorand price could continue to pack on negative returns in December

- Algorand price shows rejection from a critical barrier, which could entice a sweep of 2020 liquidity levels.

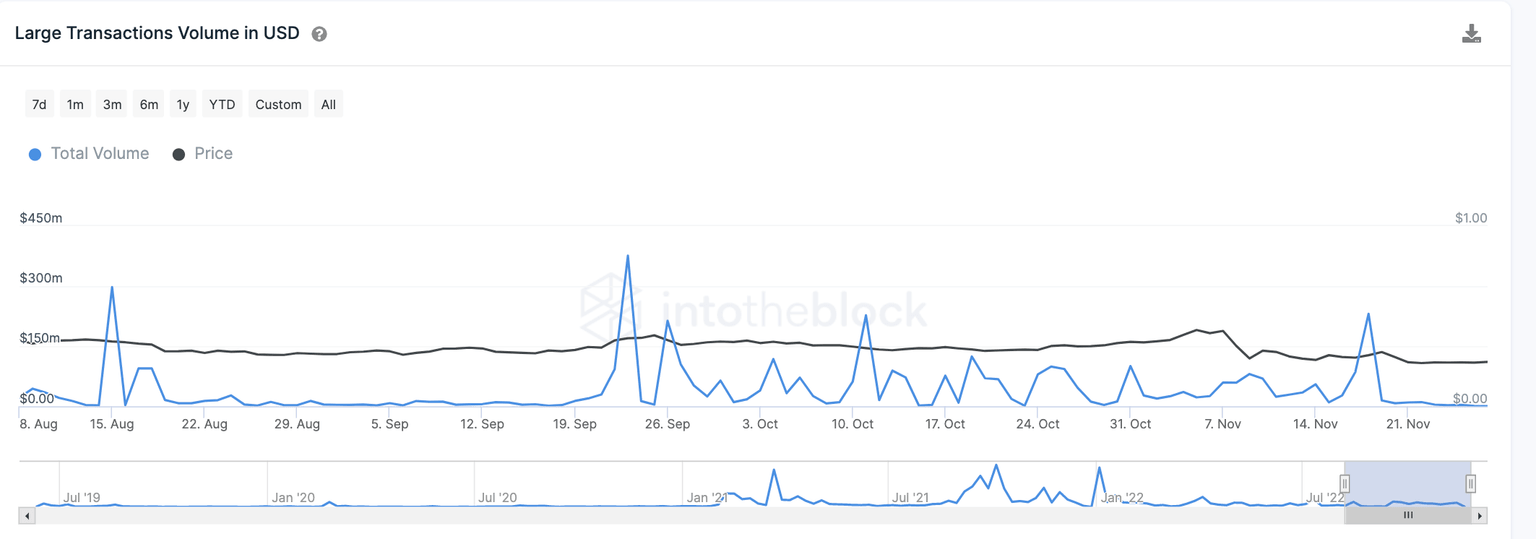

- ALGO shows an uptick in large transactions, which has resulted in significant selloffs this year.

- A flip of the 8-day exponential moving average into support could invalidate the bearish stronghold

Algorand price continues to pack on negative returns for November. As the final days of the month approach, knife-catching bulls are skimming through all digital assets looking for a last-minute opportunity. Unfortunately, the ALGO price may not be a top pick to bounce anytime soon, as the technicals show confounding evidence of bearish control.

Algorand price looks problematic

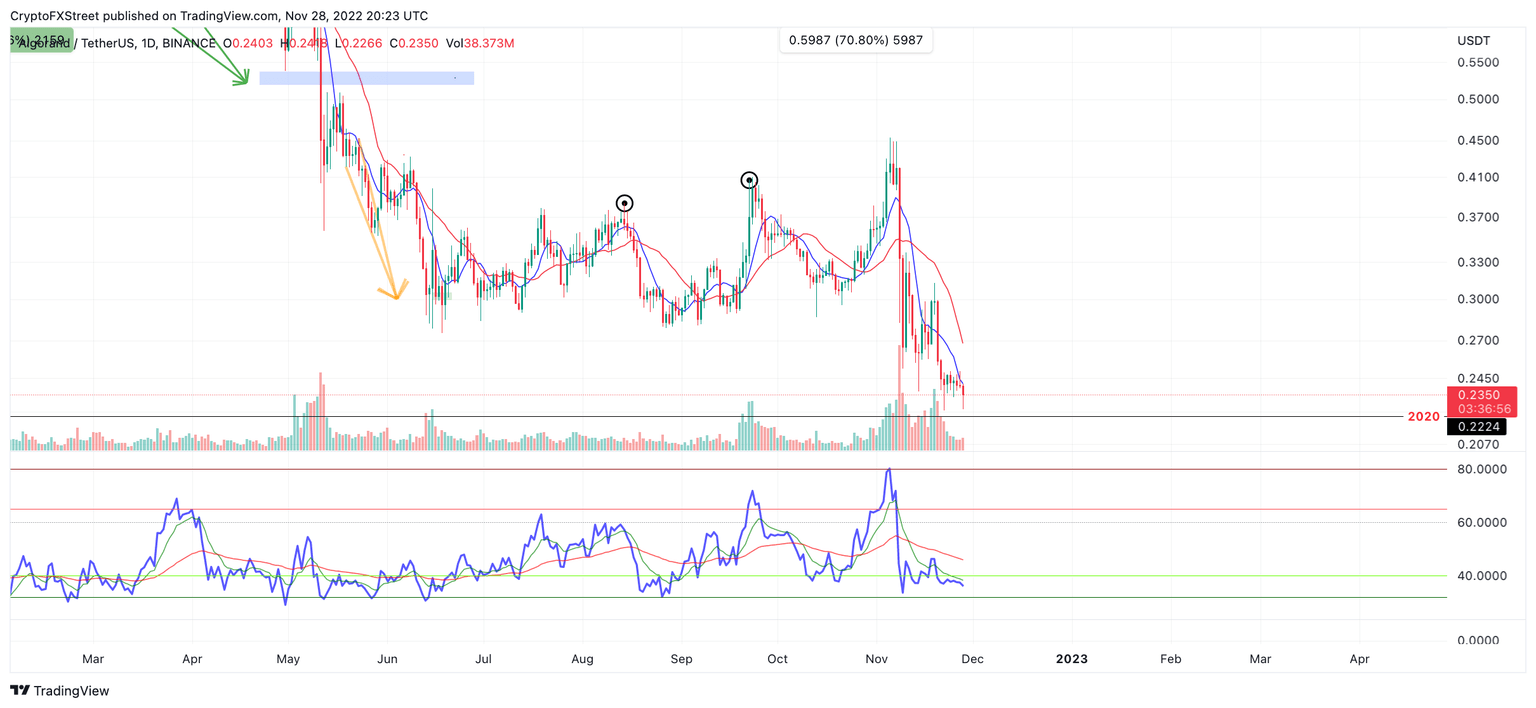

Algorand price has endured a 47% decline since the beginning of the month. As the selloff progresses, the price action has become congested near $0.20 as the bulls and bears grappled over a week over a trading range.

On November 23, the bulls printed a morning star pattern, signalling for sidelined bulls to enter the market. Classical price action traders likely placed their stop under the monthly low at $0.225 in hopes of a retaliation rally against the bearish onslaught.

On November 27, the bulls bolstered their first attempt at reconquering the 8-day exponential moving average (EMA), but unfortunately, the price was rejected and had been trading beneath the indicator ever since.

Algorand price currently auctions at $0.233 and has yet to invalidate the bullish signal. However, on-chain metrics hint that the move south could be coming soon. According to Into-the-Blocks' Large Transactions by Volume Indicator,

The indicator had a similar reading on August 15 and September 23 at $375.8 and $297.4 million. Interestingly enough, the Algorsand price fell by 23% and 27% in less than a week after indicators’ influx spikes were displayed.

IntotheBlock's Large Transactions Indicator

Algorand price is already down 20% since the indicator's reading but can continue to fall as the rejection of the 8-day EMA could provoke the breach of the newfound monthly low at $0.237. A breach of the low would likely promote further downtrend price action targeting the 2020 liquidity at $0.224 for an additional 8% dip in market value.

ALGO/USDT 1-day chart

The bulls will need to conquer the 8-day EMA to secure the confidence amongst bulls and invalidate the bearish thesis. A breach above the moving average could promote a rally towards the 21-day simple moving average of $0.270, resulting in a 17% increase from the current Algorand price.

Here's how Bitcoin price moves could affect Algorand price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.