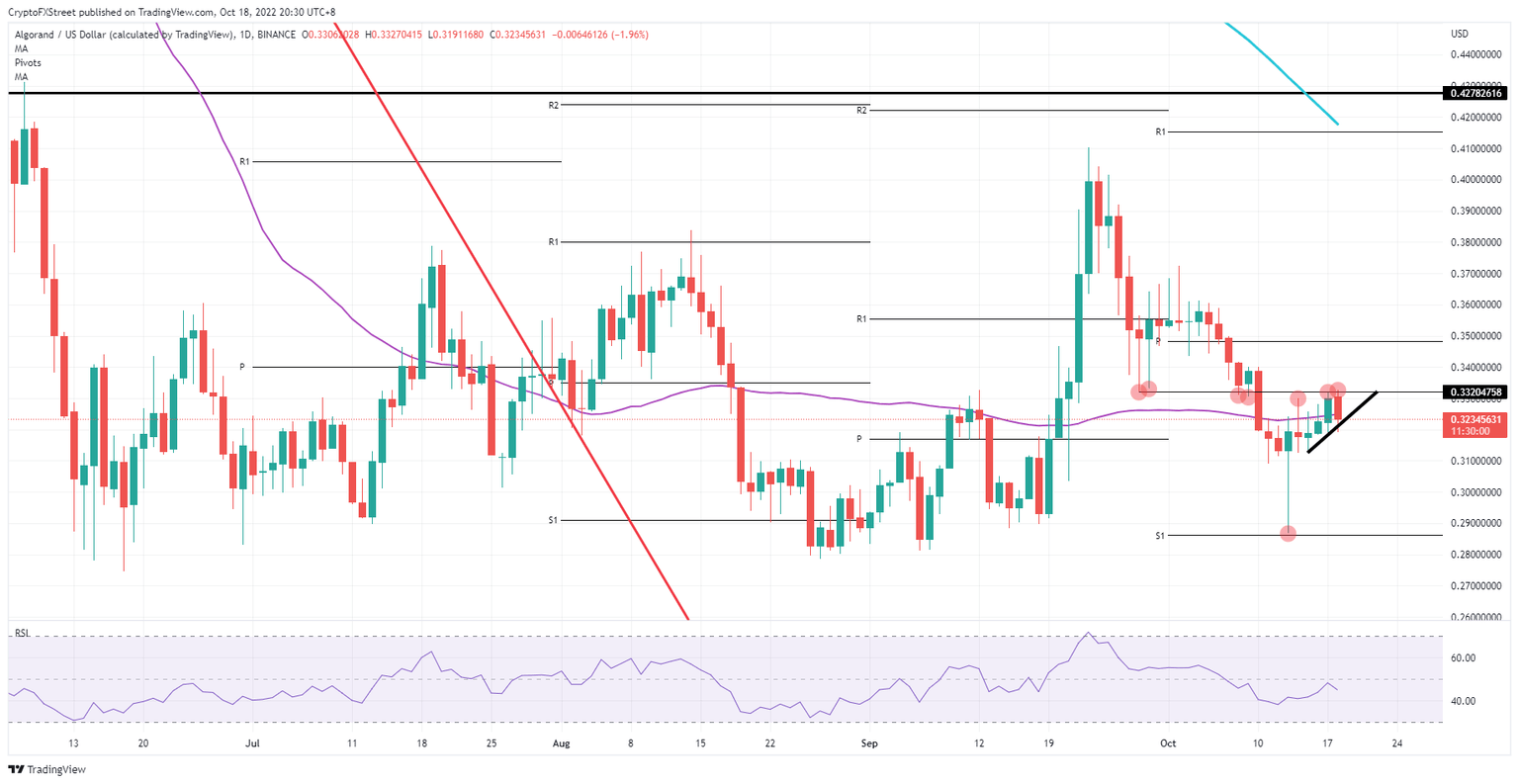

Algorand price action drops as a trendline caps the upside

- Algorand price action takes a step back, slips near 2% intraday.

- ALGO price action undergoes firm rejection against a historic pivotal level.

- Expect further continuation if the support line does not hold, S1 could be retested.

Algorand (ALGO) price action is undergoing a firm rejection against a historic pivotal level. ALGO price has not been able to enjoy the tailwinds that current equity indices are providing, with the Nasdaq leading the charge being up 2.30%. For now, the supportive short-term trend line looks to hold near $0.32. Although this level exposes the weak spot for the bulls and could see more tests from bears, once it breaks it could trigger a 10% drop.

ALGO price action dangling above 10% losses

Algorand price has not been able to react to bulls charge in equities, with the Nasdaq leading the charge. It must be painful for cryptocurrency traders to see that a small dislocation is happening as equities get a chance to recover while cryptocurrencies are lagging in their performance. Some majors, such as Bitcoin price action, score higher points, but the alt-coins are almost going nowhere.

ALGO price action received its firm rejection against $0.33, making it a double top with the high of Monday and going back to September 28. If bulls are already struggling with this technical level, are they supposed to break through a monthly pivot or even a moving average? Expect to see pressure building on the ascending short-term trend line, with a breakdown potentially seeing a drop as on October 13, and testing roughly $0.29 again near the monthly S1.

ALGO/USD Daily chart

Should the stock market indexes rally that firmly, expect to see tailwinds mount so massively for ALGO price action that a pop to the upside is made inevitable. That would mean that $0.33 gets cleared, and price action jumps to $0.35 and hits the monthly pivot. Suppose the current market turnaround will be enough for Algorand price action to jump above. In that case, which isn't very likely, should another catalyst event occur with some positive fallout, expect to possibly see an attempt to break $0.37 to the upside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.