The domino effect makes Algorand price tumble, and there is nothing bulls can do about it

- Algorand price action has taken a massive step back since the ECB meeting on Thursday.

- ALGO price action gets battered by mainly dollar strength and investors' absence.

- Expect to see more downside now the rally has been broken.

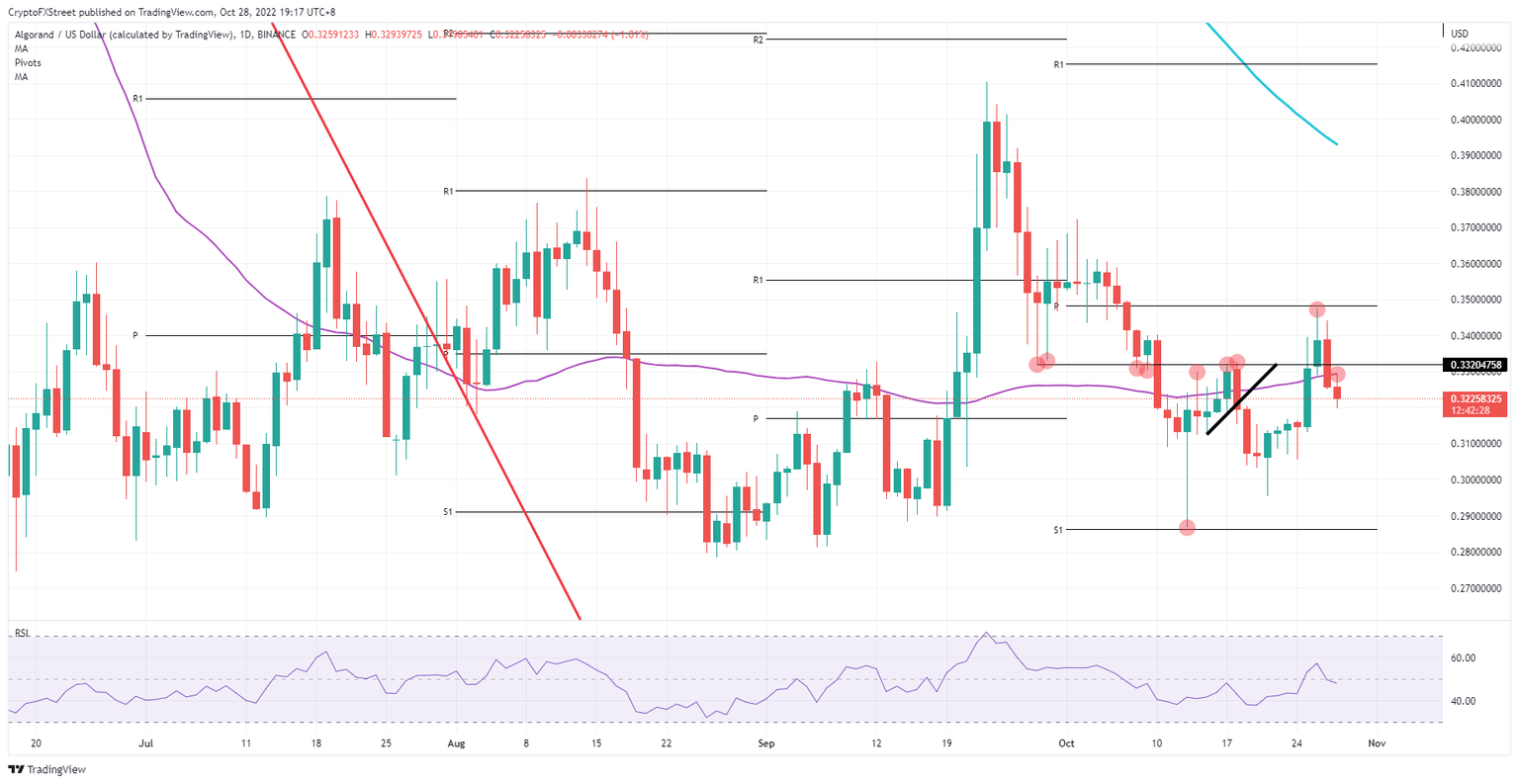

Algorand (ALGO) price action is taking a beating of almost 5% in just one and a half trading days. Luckily for the cryptocurrencies, it was up 7% before, which still means it is likely to make a marginal profit for the week, making it not a lost cause. But traders must be aware that something has snapped as the rally has been broken with no real support to bounce off nearby.

ALGO price is a perfect example of spillover effects

Algorand has little directly to do with the ECB, but it does feel the repercussions if one of the big central banks moves or delivers a message that shakes up the markets. This is what happened on Thursday when the ECB ‘dropped the ball again’ towards its rate hike decision and commitment to the eurozone economy. The hike was expected and met expectations, but it was dead silent on the fragmentation tool to control the rising rates at which countries are funding themselves – arguably the elephant in the room.

ALGO price action saw investors being disappointed by many unaddressed topics and issues and punished the euro, and made the dollar more expensive and stronger, which in turn saw Algorand price action weaken. The altcoin ended up dropping over 3% on Thursday and is at risk of pulling back below $0.31. by the closing bell.

ALGO/USD Daily chart

One element that could still work in favour of Algorand price is that in the coming week big retailers and other services are still set to report their earnings in the US. After the massacre from Thursday with Meta and Amazon, some more positive news could create tailwinds supporting cryptocurrencies. That would mean that ALGO price action could be seen back up at $0.35, its high of Wednesday.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.