Week ahead: March Mayhem continues with Fed, but cryptos emerge victorious

This week will be unusually interesting for both the stock and crypto markets due to quite a few things, so let’s cut to the chase.

The Week ahead

- Fed’s interest rate decision

- FOMC Meeting

- FOMC press conference

- How crypto fits into ongoing Banking Crisis and

- This week’s crypto narrative

The United States Federal Reserve is scheduled to announce its interest rate decision on March 22 at 18:00 GMT. The decision is to help curb inflation which currently sits at 6%.

Due to the banking crisis, the central bank has stepped in to prevent a further run on the banks. This decision has put the Fed in a mighty tough position. As a result, market participants are speculating on two outcomes

- Fed will pause interest rate hike

- Fed will stick with a 25 basis points (bps) hike

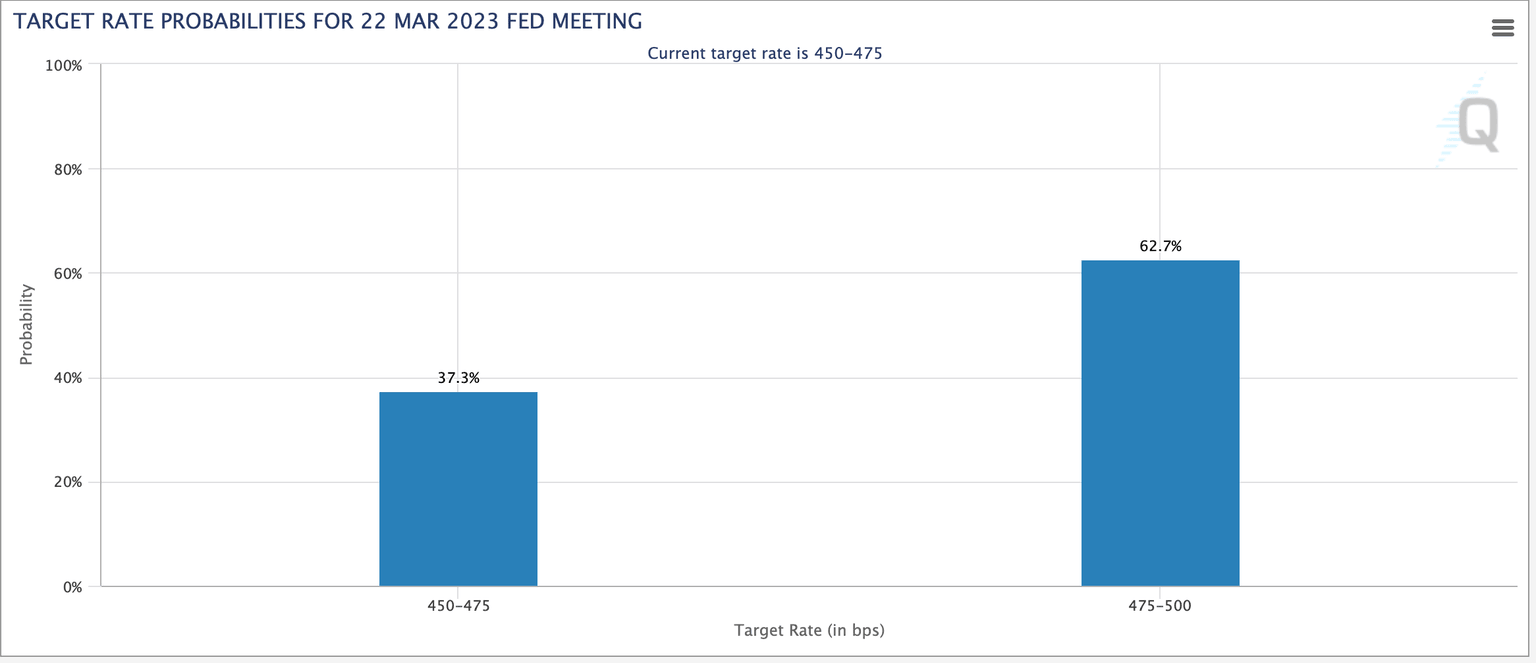

The Fed Watch Tool from CME forecasts a 37.3% probability of a pause in rate hikes, suggesting that the odds are skewed toward a 25 bps hike on March 22.

CME Fed Watch Tool

Recap of the journey so far

- The 2020 COVID pandemic caused a sudden halt to the global economy. To prevent a massive global collapse, the Fed printed money to encourage spending, and other central banks followed suit.

- As a result, Fed’s balance sheet increased egregiously, but so did inflation, which hit a peak of 9.1% in 2022.

- The Fed started rate hikes with 75bps but eventually tapered off to 50 and is currently at 25 bps. This was done to discourage spending, cut their balance sheet and reduce inflation.

- Due to the sudden nature of the Fed’s interest rate hikes and cuts, banks started experiencing pressure.

- The collapse of the Silicon Valley Bank triggered a massive panic response from the public, which led to bank runs on other financial institutions, kick-starting the banking crisis.

- The Fed stepped in to backstop these events and bail the institutions out, which is reminiscent of the 2008 financial crisis.

This brings us to the current day, where speculations of a pause in rate hikes are ongoing. This situation calls for a quote from Michael Feroli, the chief economist at JP Morgan,

There’s an old saying: Whenever the Fed hits the brakes, someone goes through the windshield. You just never know who it’s going to be.

Current situation

The Fed is currently faced with two conflicting ideas - raise the interest rates to curb inflation and print money/bail out banks to prevent an economic collapse. Doing one would negatively impact the other.

Hence, the March 22 interest rate will be crucial to see the direction in which the Fed will pivot. To be more precise, the FOMC press conference scheduled to take place 30 mins after the interest rate decision is key. Fed Chairman Jerome Powell’s responses will be pivotal in determining how the markets will react.

Factoring crypto into this situation

Last week, Bitcoin price seems to have shattered the negative correlation with the US Dollar as investors panic bought BTC due to the stablecoin depegs. This move continued the bull rally that began in January 2023, pushing the pioneer crypto to tag $28,000.

So far, BTC seems to be moving independently, bringing back its safe haven, inflation hedge and uncorrelated asset narratives.

The question that investors need to ask themselves going into this week is, “will this decorelatedness last?”

If the answer is a resounding ‘yes,’ then they need to focus on where BTC will head next. For any other assets, market participants need to explore the possibility of a pullback, if not a reversal.

Moreover, the high-impact macroeconomic developments taking place this week could trigger a knee-jerk reaction and reinstate the correlation with the US Dollar. Adding credence to a potential pullback is the decline in Bitcoin’s bullish momentum that has set up a bearish divergence.

Read more: Bitcoin price to take a breather as midsize US banks request Fed to insure deposits for two years

Narrative this week

Due to the gaming conference set to take place between March 20 and 24, the gaming crypto tokens have begun their pump. Here’s what we are reading:

Altcoin narrative for next week as Bitcoin price shows exhaustion signs

Three gaming tokens to buy next week: Immutable (IMX), Magic (MAGIC) and STEPN (GMT)

Important reads

Bitcoin price to take a breather as midsize US banks request Fed to insure deposits for two years

What Ripple holders can expect next week as XRP price coils up for explosive move to this level

Why Tether (USDT) and TrueUSD (TUSD) whales are key for crypto bull rally?

Is Dogecoin price preparing for a 25% rally?

Assessing chances of Ethereum price rally to $2,400

Why Ethereum will emerge victorious in the ongoing bull rally as Tether mints $2 billion USDT

Is this Bitcoin price rally sustainable? Will BTC hit $30,000?

Week Ahead: Crypto markets reel from the banking crisis as investors prepare for US CPI

Coinbase assures recovery of customer funds, as Circle mints $407 million USDC

Ocean Protocol Price Prediction: OCEAN kickstarts a 61% crash

Ethereum holders could be in trouble if Voyager sells $151 million ETH in its holdings

Cryptocurrency exchanges reassure saftey after Silvergate bank shuts down

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.