Is this Bitcoin price rally sustainable? Will BTC hit $30,000?

- Bitcoin price shows a strong surge in buying pressure that has triggered a 22% upswing in the last three days.

- This uptick is now facing a question, retrace and rebuild momentum or continue the ascent and tag $30,000.

- Investors need to watch out for signs emerging on a lower timeframe to determine where BTC is headed next.

Bitcoin (BTC) price has recovered the losses it experienced by the end of last week. The sell-off was caused mainly due to failing banks in the United States which in turn triggered a depeg in major US-based stablecoins. However, by the end of the week, there were assurances that the Federal Reserve would make affected investors whole, which instilled confidence and catalyzed this recovery rally.

Also read: USDC mayhem catalyzes recovery rally in Uniswap and Curve DAO

Bitcoin price at an inflection point

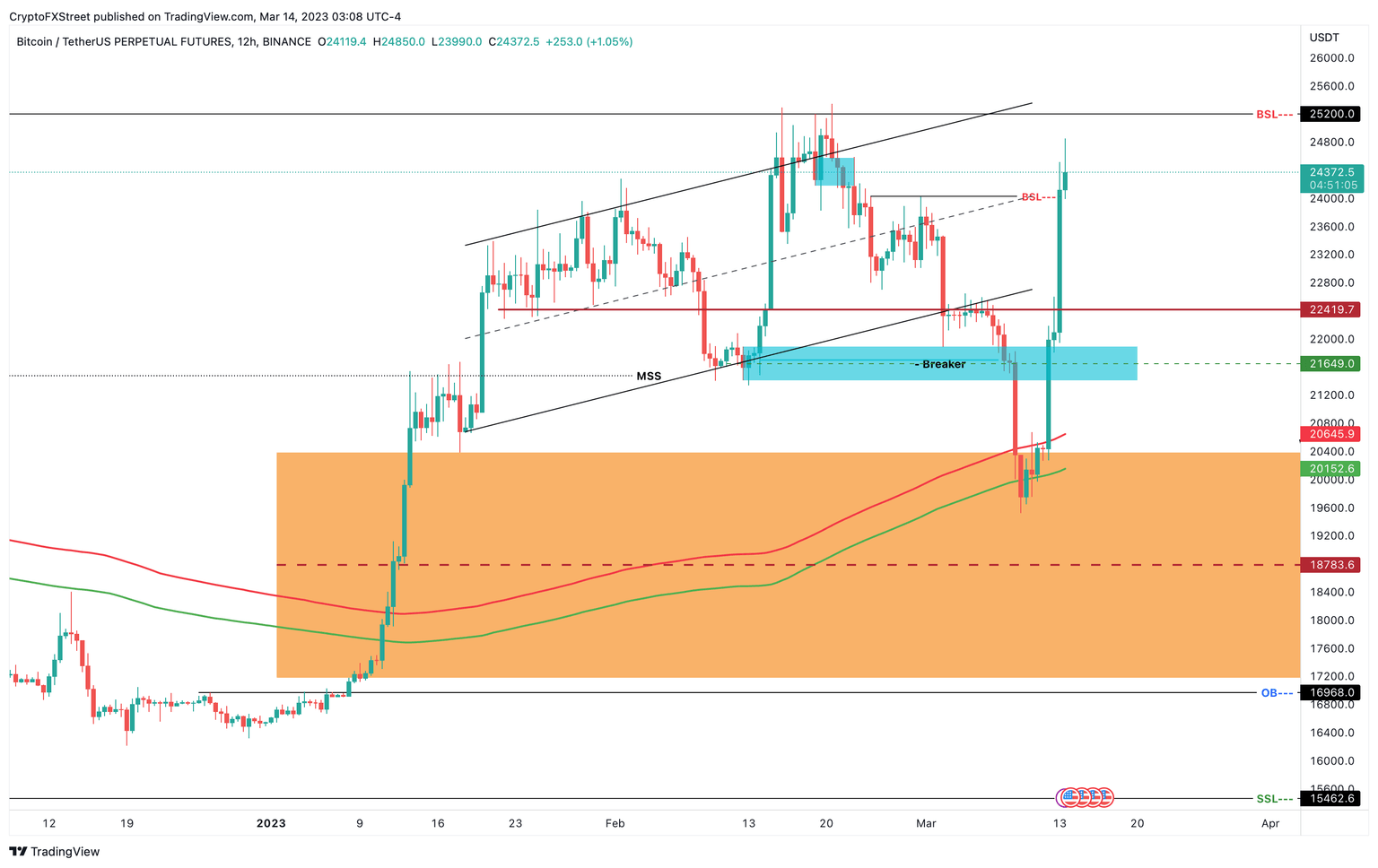

Bitcoin price slipped below its ascending parallel channel on March 2 and what followed next was four long days of tight consolidation. The sell-off that began in the 2nd week of March accelerated, leading to 10% losses by March 9.

As the US banks started collapsing consecutively, the stablecoin de-peg caused panic in the markets, pushing holders to swap their affected stables into other safer alternatives like unaffected stablecoins, including USDT, BUSD and TUSD. Others had a more creative approach and swapped their USDC to BTC. Some market participants purchased USDC at a discount, hoping that USDC would go back to the peg.

Additionally, assurances from the concerned authorities were the key that initiated the rally. Following this was Biannce CEO openly stating that he would convert the $1 billion of the Industry Recovery Fund into Bitcoin (BTC), Ether (ETH) and Binance coin (BNB)

So far, Bitcoin price has managed to overcome the $23,000 hurdle and is currently hovering around $24,290 after collecting the buy-stop liquidity (BSL) resting above $24,000. There is another set of BSL above the $25,000 psychological level.

If Bitcoin price manages to flip this resistance barrier into a support floor, it would trigger a rally to the next major hurdle at $28,000 and the next psychological level at $30,000.

BTC/USDT 12-hour chart

Exploring BTC’s bearish case and factoring in US CPI

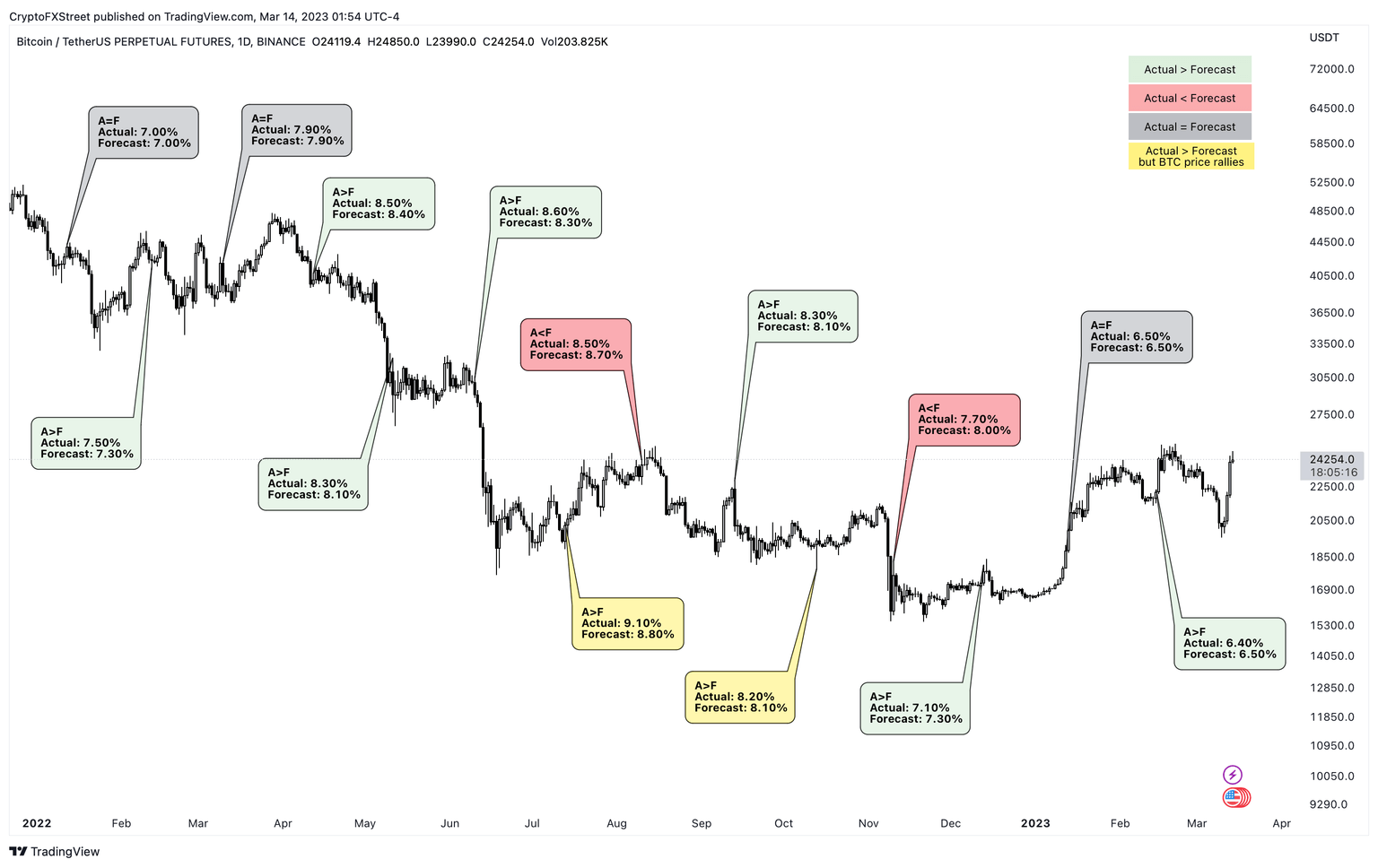

While the bullish outlook for Bitcoin price is mainly driven due to panic and frenzy, investors need to be cautious of jumping on the bull train at the wrong time. The upcoming US Consumer Price Index (CPI) announcement on March 14 at 12:30 GMT is a key event that will potentially turn the tide.

Typically, a higher-than-anticipated CPI number would be bad news for investors since it would warrant tighter interest rates from the Fed. A tighter interest rate, especially a 50 basis point (BPS) hike in the decision, will be better for the US Dollar and not so much for the risk-on assets like cryptos or the stock market.

To summarize, a higher CPI would be bearish for Bitcoin price in the short-term, i.e., BTC could plummet in the short-term, causing bulls that hopped on the long-only trade late to likely get liquidated.

However, the chart attached below shows a different outlook, an opposing one over longer durations. Specifically, Bitcoin price shows a steady decline over the course of when CPI comes in hotter-than-expected

There were two non-events where BTC rallied instead of dropping when the CPI number came in higher than the consensus.

BTC/USDT 1-day chart vs. CPI reaction

So, all-in-all, investors who are confident in their bullish positions need to rethink their stance as CPI is more than likely going to come in hotter. The reason for this can be found in Fed Chair Jerome Powell’s testimony on March 8, where he described that the inflation was growing and their efforts so far were not enough. This hawkish stance suggests the possibility of the CPI coming in hotter-than-anticipated, which could cause the markets to drop, catching the bulls off-guard.

A daily candlestick close below the $22,419 level will invalidate the bullish thesis for Bitcoin price. A breakdown of a critical support floor could potentially plunge BTC into the weekly Fair Value Gap’s (FVG) midpoint at $18,783.

More crypto news

- Fed Chair Powell targets bringing inflation back to 2%, Bitcoin price stays around $22,000

- Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bullish momentum fades for BTC and ETH, XRP suffers SVB woes

- US Department of Justice investigating the collapse of Terra stablecoin: Report

- Is Bitcoin's safe haven narrative back as US banks start to go belly-up?

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.