Ocean Protocol Price Prediction: OCEAN kickstarts a 61% crash

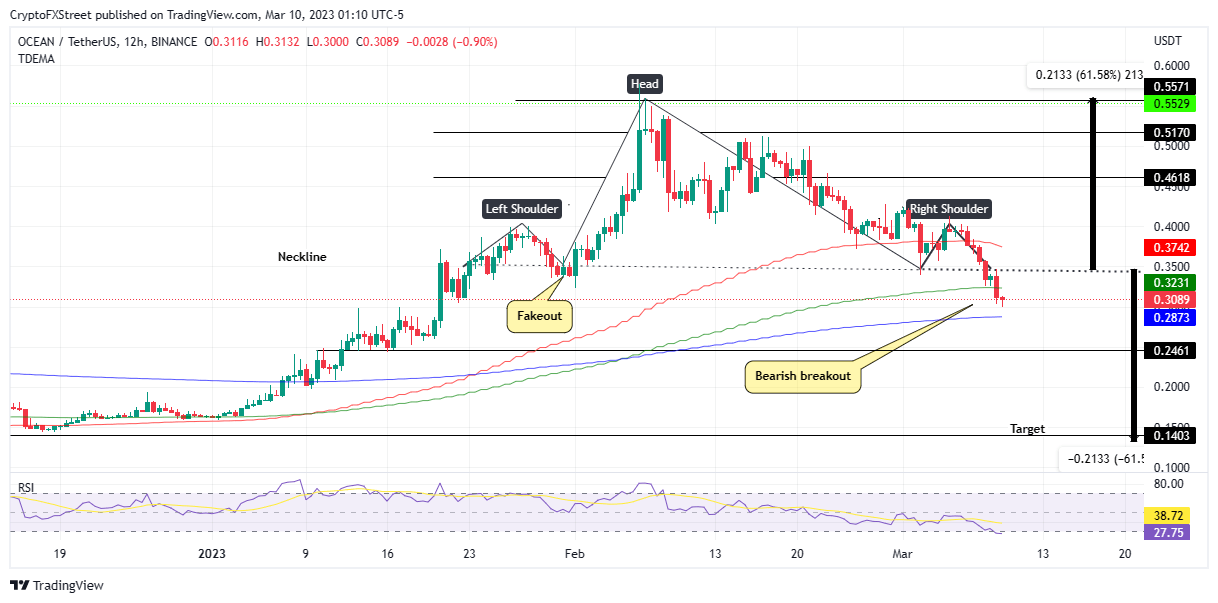

- Ocean Protocol price breaks out of a head-and-shoulder pattern, hinting at a 61% crash to $0.143

- OCEAN could slide to $0.246 if sellers push past the 200-day EMA support at $0.287.

- A daily candlestick close above the neckline at $0.350 will invalidate the bearish thesis.

Ocean Protocol (OCEAN) price took to an uptrend in early February, rising significantly during the first week before profit-takers interrupted the rally. The token then started a downtrend, losing all the ground covered in that month by early March. A bullish attempt to raise OCEAN’s market value has been impeded by dark clouds hanging above altcoins.

Also read: Mapping out Bitcoin's HTF levels and trade setups for March 2023 [Video]

Ocean Protocol price could drop to December 2022 lows

Ocean Protocol price blasted below the 50-day Exponential Moving Average (EMA) at $0.374 on March 6, losing 17.05% to find support at the current price of $0.309. The token’s price action since late January has formed a head and shoulder chart pattern. This technical formation is a bearish pattern consisting of three tops with a higher high in the middle (head) and a line linking the two valleys known as the neckline.

Ocean Protocol price confirmed the pattern when it broke the neckline at $0.350 and produced a twelve-hour candlestick close below it on March 8 trading session. The bearish breakout paved the way for the target of the chart pattern at around $0.140, which is 61.58% below the current levels. Notably, the target is estimated by measuring the height between the neckline and the head, then projecting it downwards.

Before hitting the target, the Ocean Protocol price must overcome the support presented by the 200-day EMA at $0.287, followed by the $0.246 support level.

OCEAN/USDT 12-hour chart

On the other hand, conservative traders looking for additional confirmation could see this as an entry point to buy OCEAN at a fair market value of $0.3231?. A daily candlestick close above $0.350 will invalidate the head-and-shoulders bearish thesis.

Such a move would bounce the Ocean Protocol price to confront the immediate resistance presented by the 100-day EMA at $0.323. An increase in buying pressure from this level could send Ocean Protocol price past the neckline to fight the next roadblock offered by the 50-day EMA at $0.374.

Northward, OCEAN would need to break down the $0.461 and $0.517 resistance levels before regaining its $0.557 at the head of the governing chart pattern.

Nevertheless, given the overhead pressure due to the EMAs and the general bearish sentiment in the market, chances of a trend reversal remain slim for now.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.