Is Dogecoin price preparing for a 25% rally?

- Dogecoin price has swept below the range low at $0.0705 and recovered above it, denoting a recovery rally could be brewing.

- Investors can expect DOGE to trigger a 23% upswing to retest the range high at $0.0946.

- Invalidation of the bullish thesis will occur below the $0.0705 support level.

Dogecoin price has been in a tight range for the past few months. The recent sweep of the range low was a buy signal for those paying attention, as DOGE recovered the recent losses. Now, the meme coin is coiling up to continue this trend to move higher.

Dogecoin price attempts a bullish move

Dogecoin price has been stuck between buying climax at $0.0946 and selling climax at $0.0705 for the past four months. In early March, DOGE slipped below the lower limit but recovered above the said level in the next week, denoting a presence of buyers.

A sustained bullish narrative from Bitcoin’s end could fuel the rally for Dogecoin price, triggering a move to retest the buying climax at $0.0946. This move would constitute a 23% gain for DOGE holders.

In a highly bullish case, Dogecoin price could attempt an extension of this move and tag the $0.106 hurdle, bringing the total gain to 40%.

DOGE/USDT 1-day chart

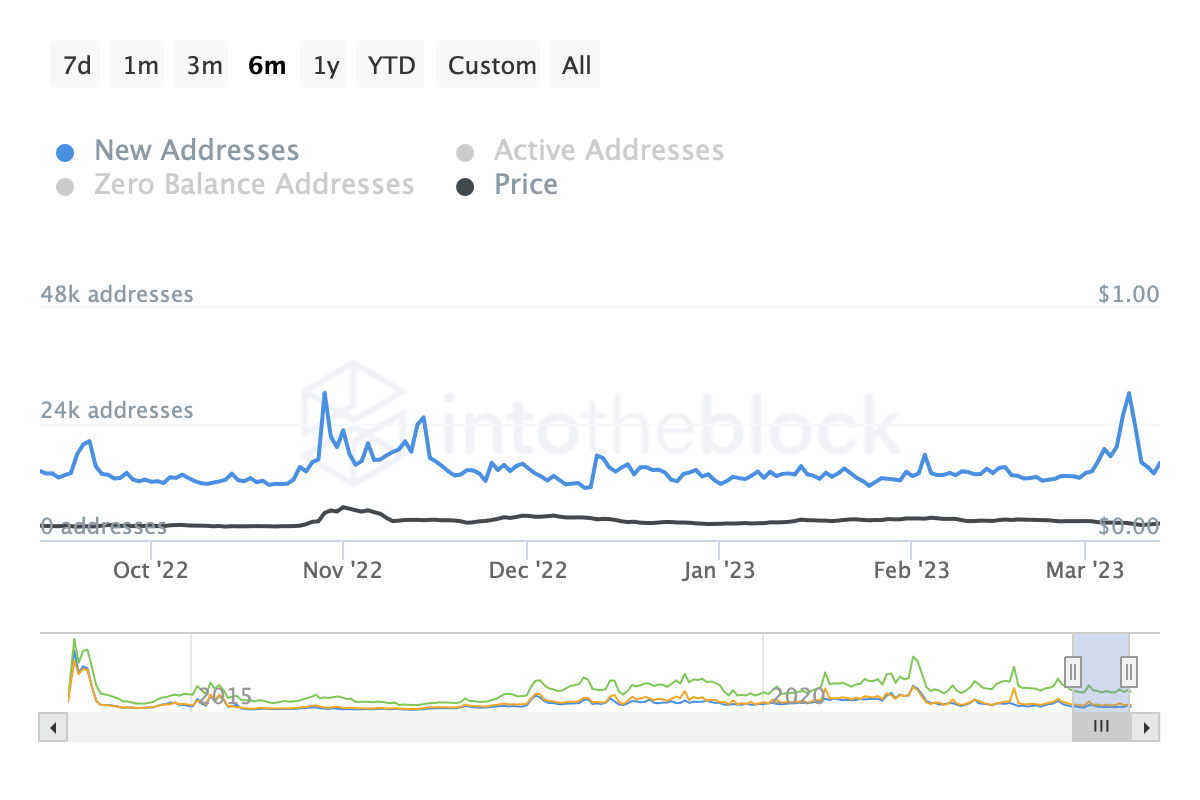

Moreover, the number of new addresses joining the Dogecoin network has doubled from 15,000 to 30,000 between March 1 and March 8. This spike adds credence to the bullish thesis. But these addresses have since dropped down to 16,000.

DOGE new addresses

While things are looking optimistic for Dogecoin price, a breakdown of the selling climax at $0.0705, flipping it into a resistance level would invalidate the bullish thesis.

In such a case, Dogecoin price could slide lower and retest the $0.0645 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.