Three gaming tokens to buy next week: Immutable (IMX), Magic (MAGIC) and STEPN (GMT)

- ImmutableX price hints at a 70% breakout rally as the ten-month consolidation pattern matures.

- Magic price could rally 45% in the coming week as momentum indicators flip bullish.

- STEPN price eyes a 50% climb after a double bottom formation on the daily chart.

The Banking Crisis that began in early March seems to be taking a firm standing and spreading roots. This development has triggered a panic buying of Bitcoin (BTC) price, which has pushed it to a nine-month high.

As BTC cools off during the weekend, a bearish divergence seems to be in development. This setup, combined with the banking crisis, will not only provide a perfect opportunity for sidelined buyers to accumulate BTC for the next leg up but also for altcoins to trigger a quick rally.

Read More: Bitcoin price takes a breather as midsize US banks request Fed to insure deposits for two years

Furthermore, the gaming category for cryptocurrencies has started to rally due to the Gaming Developer Conference (GDC) that is set to take place between March 20 and 24. So, this article takes a look at three altcoins that have taken the lead in March and are primed for more gains.

Read More: Altcoin narrative for next week as Bitcoin price shows exhaustion signs

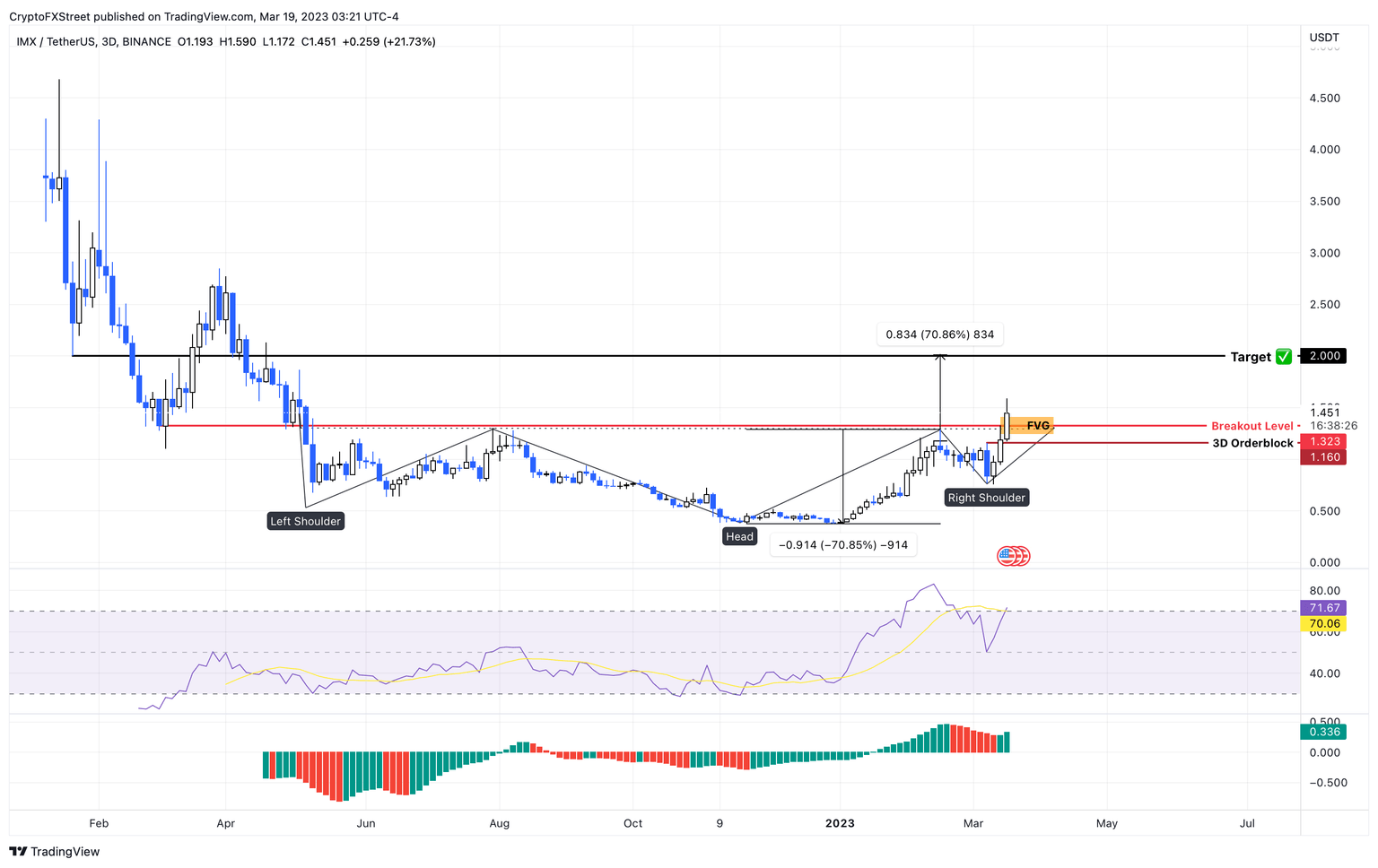

ImmutableX (IMX) price prepares for a 70% rally

ImmutableX price action for the last ten months has formed an inverse head-and-shoulders formation. This technical formation on the three-day chart forecasts a 70% upswing to $2, which is obtained by measuring the distance between the head’s highest and lowest points and adding it to the breakout point at $1.32.

A pullback into the Fair Value Gap, extending from $1.24 to $1.41

IMX/USDT 1-day chart

On the other hand, if ImmutableX price fails to breach the $1.32 hurdle, it would denote an exhaustion of buying pressure.

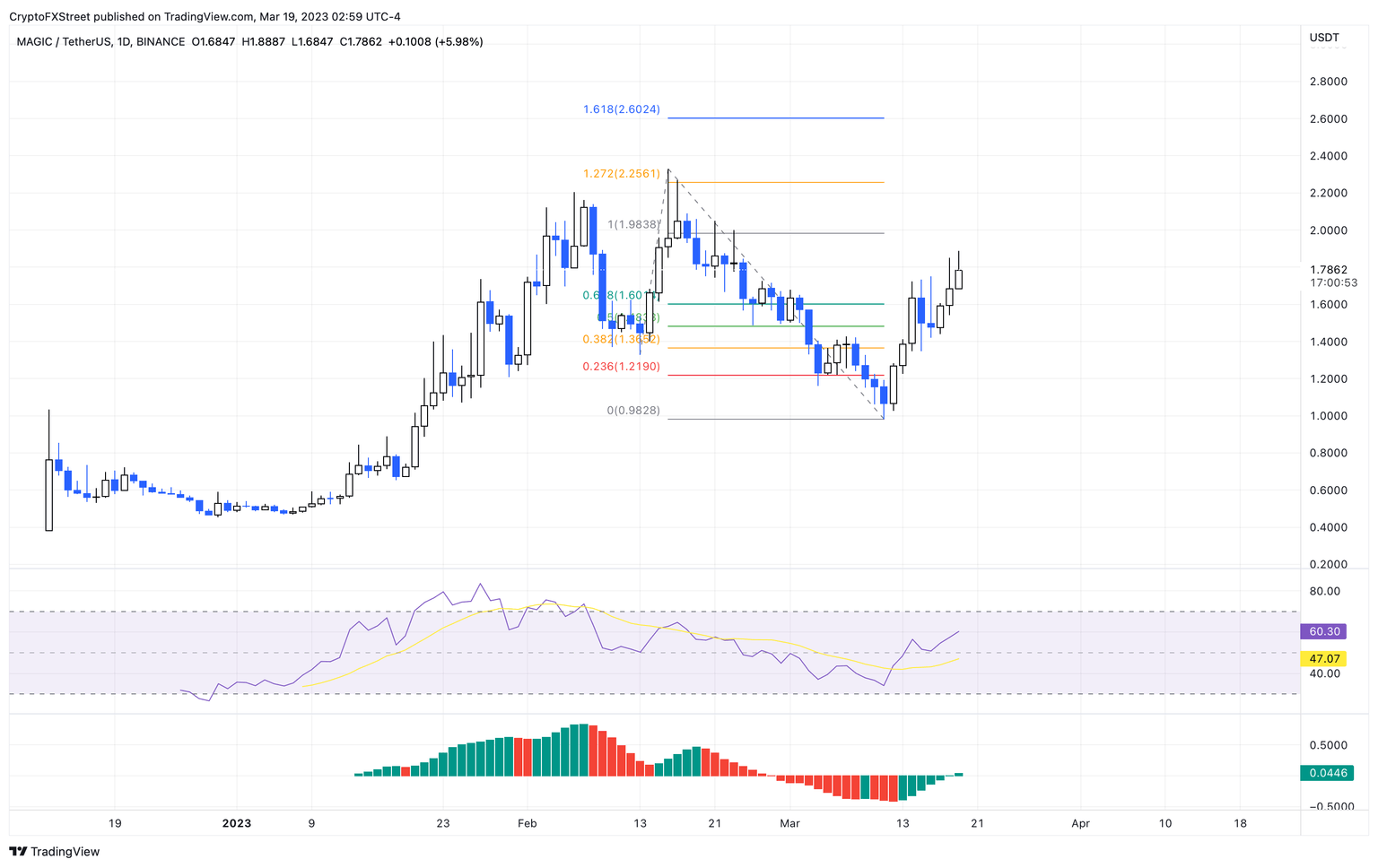

Magic (MAGIC) price looks bullish on the daily timeframe

Magic price currently trades at $1.77 after a 25% upswing in the last four days. This upswing is likely to witness a further spike in bullish momentum based on Relative Strength Index (RSI) and Awesome Oscillator (AO).

The RSI on the daily timeframe has clearly flipped the 50-level after spending two weeks below it. The recent move suggests that buyers are back and in control. Moreover, the AO indicator has recovered above the zero line after hovering three weeks below it. Both these moves indicate that sidelined buyers are stepping up, waiting for a further spike in MAGIC price.

Using the trend-based Fibonacci extension tool, one can see that the next targets for MAGIC price if it continues to trend higher include the 127.2% and 161.8% levels at $2.25 and $2.60, respectively.

In total, a 25% to 45% gain is likely for MAGIC token holders in the coming week.

MAGIC/USDT 1-day chart

The invalidation of this move will occur on the breakdown of the March 15 swing low at $1.35. Such a move would produce a lower low and potentially trigger a correction to $0.982.

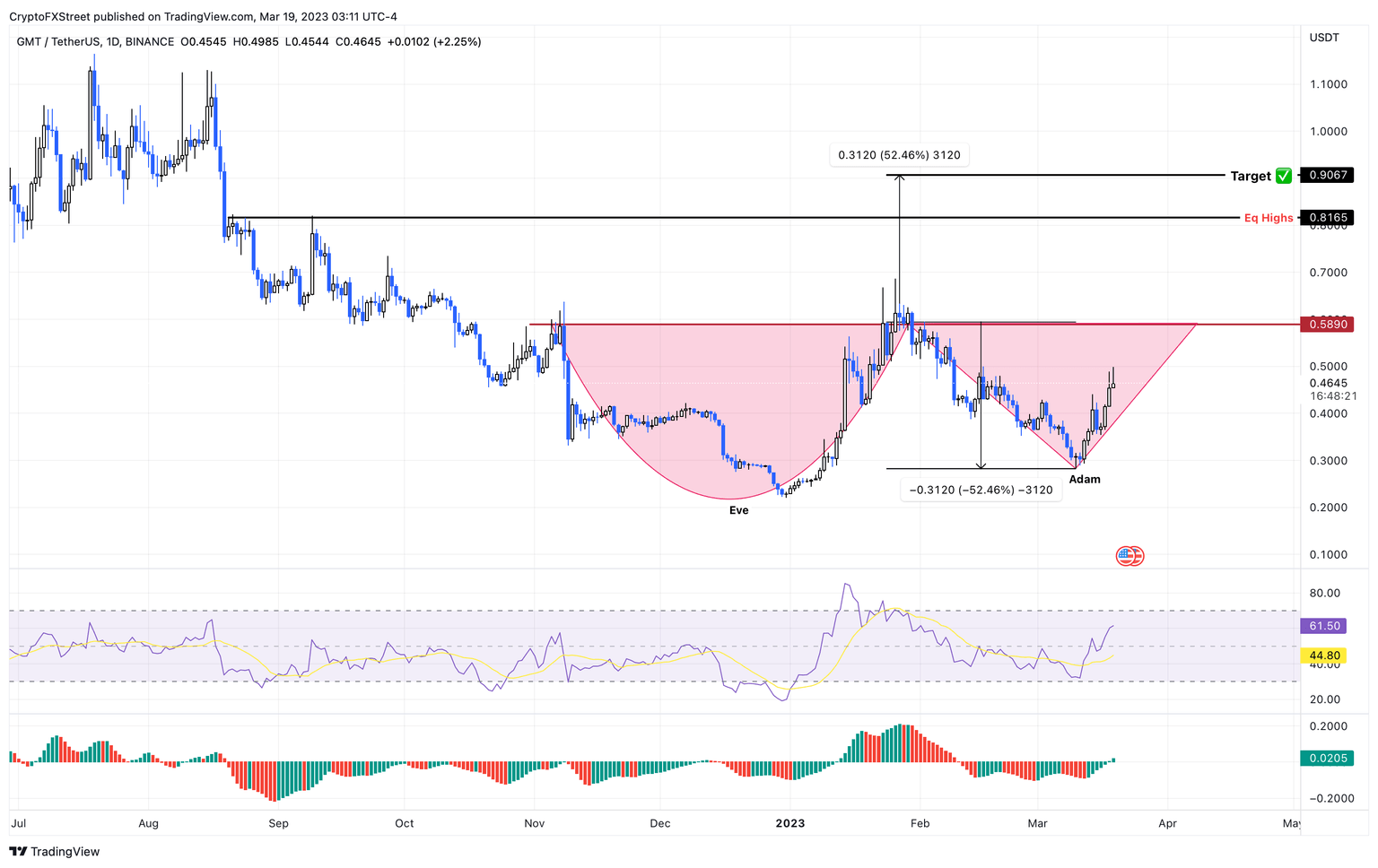

STEPN (GMT) hints at a 50% upswing

STEPN price shows a variation of Adam and Eve double bottom formation. In this case, Eve has formed first, which is a rounded bottom, and Adam is yet to form, which is usually a V-shaped bottom.

This setup forecasts a 52% upswing, obtained by measuring the Adam structure’s depth and adding it to the breakout point at $0.589, reveals the target of $0.906.

Further supporting the bullish outlook for GMT are the RSI and AO indicators’ positions. The RSI has revealed a fresh bounce off the midpoint, indicating a resurgence of bullish momentum. Additionally, the AO indicator has flipped above the zero-line, adding a tailwind to buyers’ thesis.

Investors should note that only a breakout above the $0.589 level will confirm the bullish move described above. If successful, market GMT holders need to pay attention to the $0.816 and $0.906 levels to book profits.

GMT/USDT 1-day chart

While the bullish outlook for STEPN price makes logical sense, investors need to pay attention to March 16 swing low at $0.354. A breakdown of this level will invalidate the bullish thesis for GMT.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.