Uniswap Price Forecast: UNI prepares for a 25% spike, eyeing new record highs

- Uniswap is getting ready to move to new all-time highs around $28.

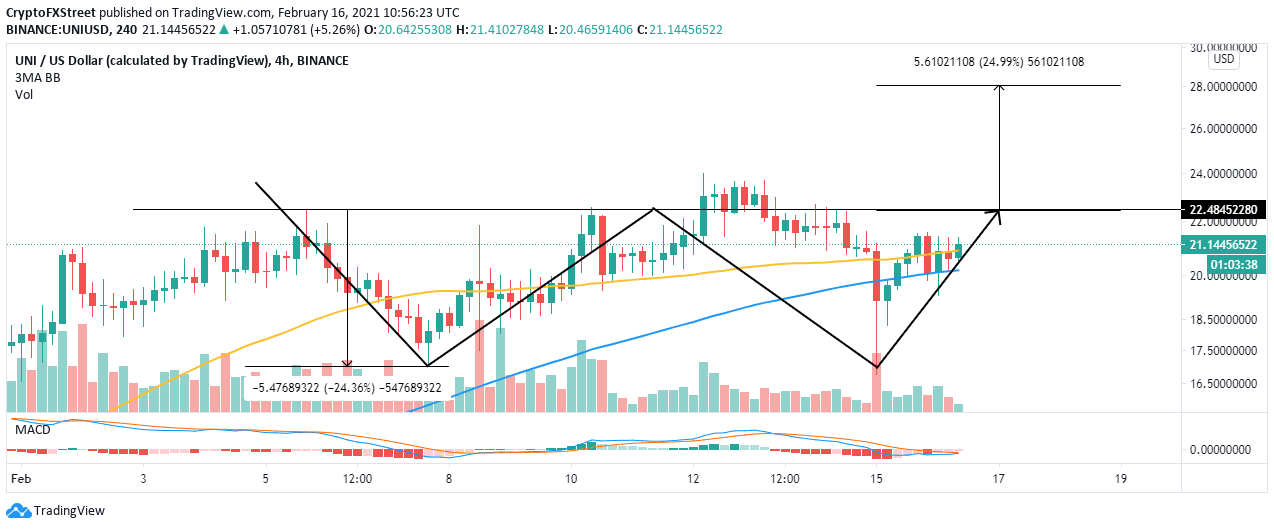

- A double-bottom pattern suggests that UNI is drawing closer to a breakout point.

- The IOMAP shows the difficulty in the upswing, bringing to light the possibility of consolidation.

Uniswap has recovered from the most recent dip to $17. The losses came into the picture after the decentralized finance token (DeFi) hit an all-time high of $24. Resistance intensified, making it difficult for the bulls to rally above $25. Meanwhile, a critical technical pattern suggests that UNI is on the verge of lifting off to new all-time highs around $28.

Uniswap nurtures the ultimate technical breakout

Uniswap is trading at $21 at the time of writing. The cryptocurrency has also stepped above the 50 Simple Moving Average (SMA) on the 4-hour chart, validating the current uptrend.

The Moving Average Convergence Divergence (MACD) hints at the trend is flipping bullish in the same timeframe. The indicator has settled above the midline. In addition to that, the MACD line (blue) almost crosses above the signal line.

A comprehensive look at the chart brings to light the formation of a double bottom. The pattern is regarded as a trend reversal in technical analysis that is shaped following extended downtrends when two “bottoms’ appear on the chart.

As the price nears the second bottom, selling pressure starts to diminish, leading to a bullish impulse. After the price breaks the neckline (horizontal trendline), a significant move follows. In the same way, if Uniswap slices through the neckline, we can expect the price to make a 25% move to new record highs around $28.

UNI/USD 4-hour chart

The expected uptrend could materialize due to increased buying volume since whales appear to be on a buying spree. According to Santiment, holders with 1 million to 10 million UNI have grown significantly over the last 30 days from 57 to 65.

The improvement in these large holders is a positive impact on the price of the token because of the volume they move. Therefore, if buying pressure continues to soar, Uniswap could soon hit a new high.

Uniswap holder distribution

Looking at the other side of the picture

The IOMAP model by IntoTheBlock suggests that Uniswap is likely to consolidate at the current price level before a breakout comes into the picture. A robust seller congestion zone runs from $21.3 to $21.7. Here, roughly 2,300 addresses had previously bought approximately 9.1 million UNI.

Uniswap IOMAP chart

On the flip side, immense support has been put in place to ensure that declines are avoided. For now, the most substantial support runs from $20.3 to $20.8. Here, about 2,800 addresses are profiting from the roughly 13.2 million UNI. It is doubtful that losses will slice through this area, thus validating the consolidation.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B14.08.06%2C%252016%2520Feb%2C%25202021%5D-637490714874690311.png&w=1536&q=95)

-637490716201493974.png&w=1536&q=95)