Uniswap Price Forecast: UNI technicals and on-chain metrics spell trouble

- Uniswap price hints at pullback as the TD Sequential indicator flashed a sell signal on the weekly chart.

- UNI network saw a reduction in new users joining the network, further supporting the bearish thesis.

- The reversal in Uniswap’s momentum could extend if the support barrier at $20 is breached.

Uniswap price witnessed a remarkable 580% upswing in roughly 46 days. However, this parabolic rally could be reversing soon due to multiple sell signals being flashed on both the technical and the on-chain metrics.

Uniswap price primed for a downswing

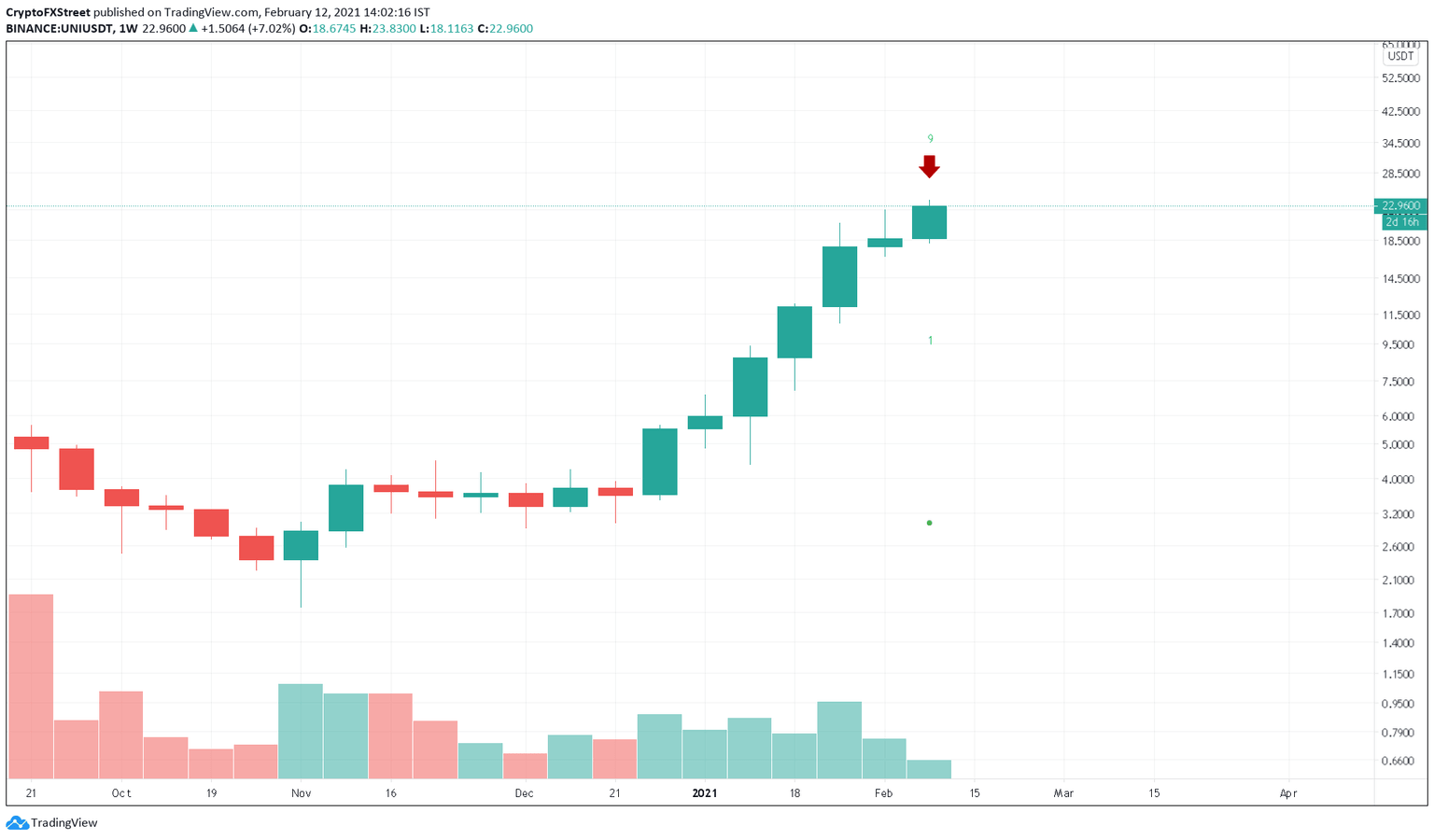

Uniswap price shows almost every weekly candlestick closed at least 30% higher than its open since December 28. However, the previous weekly candlestick noted only a 5.7% upswing, which suggested a slowdown in UNI’s momentum.

Rightfully so, what followed next is the sell-signal from the Tom Demark (TD) Sequential indicator in the form of a green nine candlestick. This technical setup forecasts a correction that ranges anywhere between one to four weekly candlesticks.

UNIUSDT weekly chart

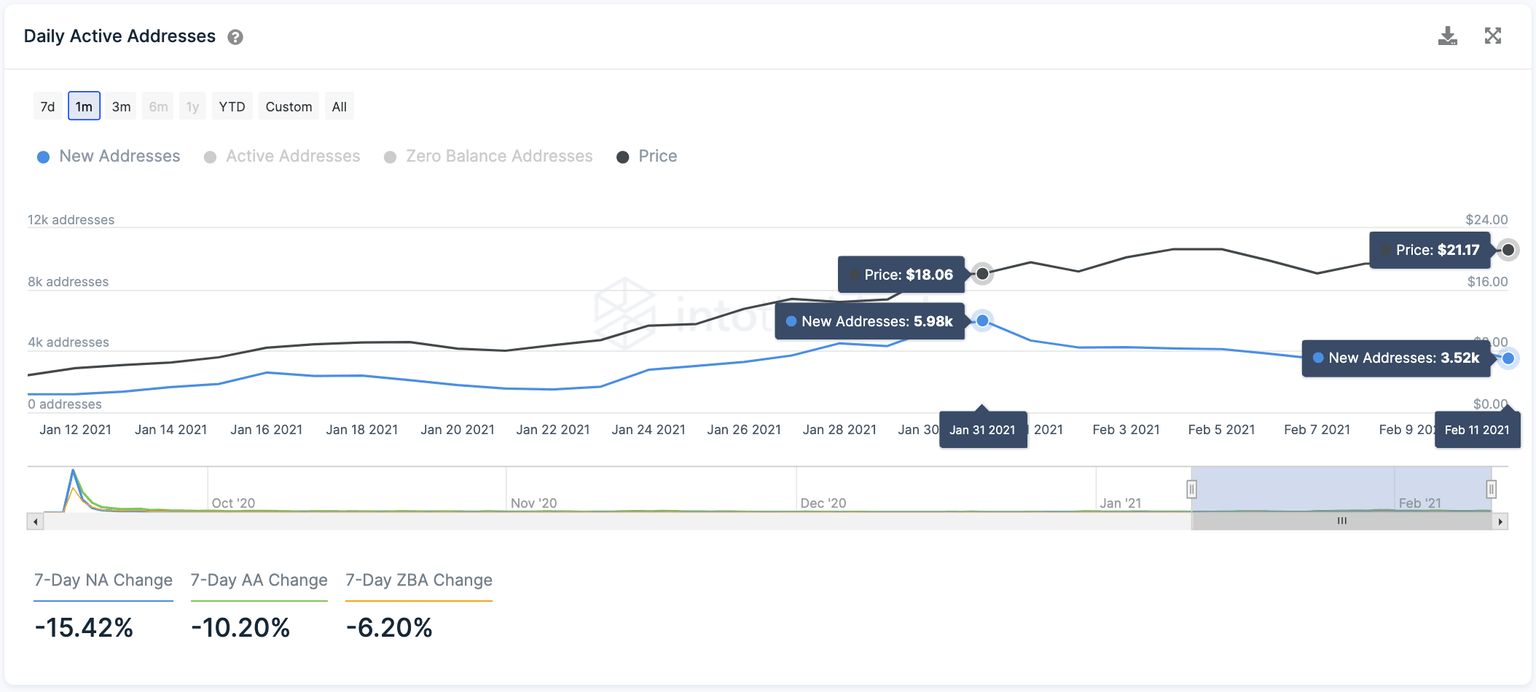

Adding to UNI’s bearish woes is the reduction in the number of new users joining the Uniswap network. This metric stands at 3,500 today, which is a 41% decline in new addresses since January 31.

The sudden drop in this on-chain metric indicates that market participants are not interested in purchasing UNI tokens at the current price levels.

Uniswap new addresses chart

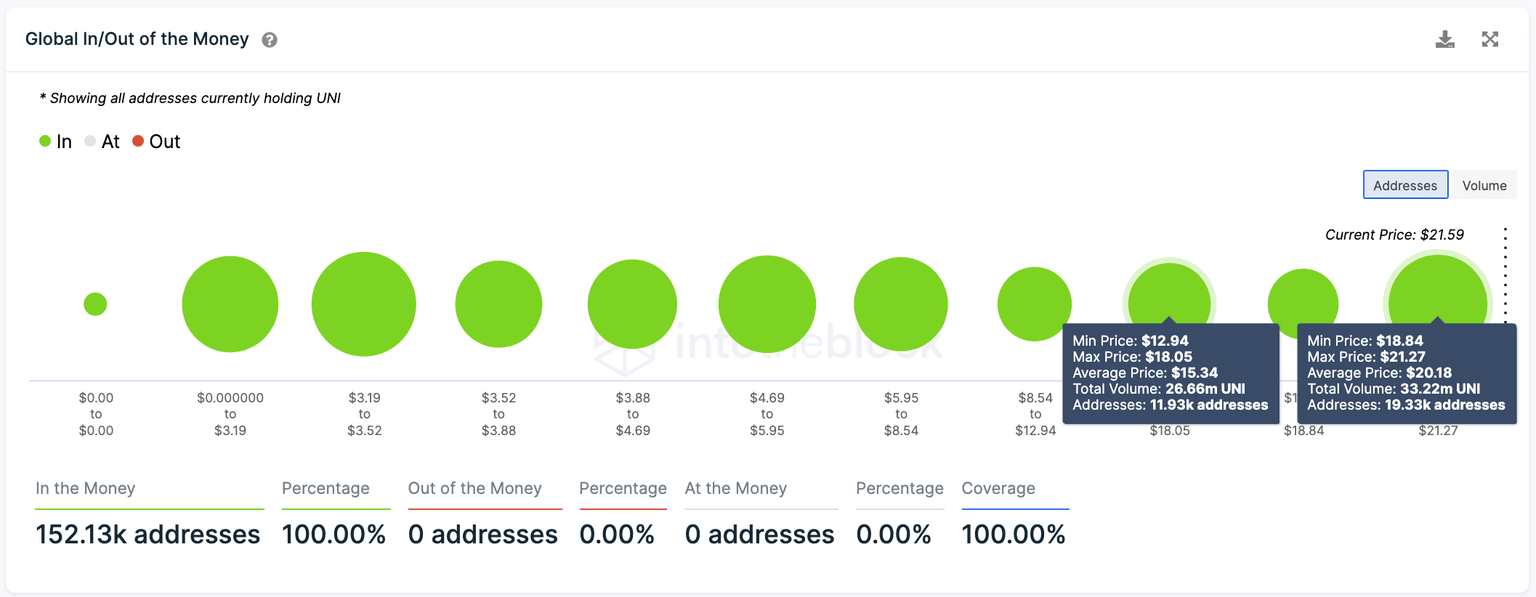

As per IntoTheBlock’s Global In/Out of the Money (GIOM) model, the support barrier at $20 is the only one holding Uniswap price from a steep crash. Here, roughly 19,300 addresses purchased nearly 33 million UNI.

In the event of a sharp sell-off leading to this support’s failure, Uniswap price will pullback to the next immediate support at $15, where approximately 12,000 addresses purchased about 26.5 million UNI.

Uniswap IOMAP chart

It is worth mentioning that if Uniswap price slices through the recent high of $23.80, the bearish outlook will be disregarded. Under such unique circumstances, UNI could rise towards the next interest areas at $30 and $37.50.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.