- ETH/BTC has a colossal challenge at the price level of 0.035.

- BTC relaxes and gives prominence to ETH.

- The weekly close is critical and can hurt the long-term structure.

We come to the end of the week in which the Crypto market has resurfaced after quite a few long weeks of consolidation of the first bullish tranche that began in mid-December.

It seems that the market wants to make the underlying tone clear with new rises today. Ethereum and XRP take the initiative, while at least today, Bitcoin appears to accept a secondary role.

It is essential for the whole Crypto market that Ethereum keeps up the pace and takes over from Bitcoin at the right times, and this is one of those times.

The move we are seeing now is what was expected to happen within the planned scenario for which we use the ETH/BTC pair to perform analysis of the market as a whole. Ethereum definitively capitulated against Bitcoin in the past couple of days and now has the initiative to start a new general bullish stretch of the market. If so, we would be facing the third wave, so we should, at minimum, expect the development of equal magnitude to that seen between the lows of December and the relative highs left by Ethereum in early January.

ETH/BTC 240 Minute Chart

The ETH/BTC cross is currently trading at 0.0328 after reaching the price level of the first congestion resistance at 0.0338.

Above the current price, the first resistance level is at the 0.0338 mentioned earlier (price congestion resistance), the second resistance level at 0.0335 (upper parallel bullish trend line). The third resistance level for the ETH/BTC pair is at 0.035 (upper parallel trendline) and the "magic" level that would get the market into a bullish mode in the weekly range.

Below the current price, the first support level is at 0.0323 (lower parallel bullish trend line). Then, the second support level is 0.0316 (price congestion support). The third support level for the ETH/BTC pair is at 0.030 (lower parallel bullish trend line). At this point, the market would reach the minimum price level before large falls that would be disastrous in the medium term.

The MACD on the 4-hour chart shows a profile before a bullish cut in the averages. The current pattern is usually resolved upwards, but there are some details in the formation that detract from its bullish strength.

The DMI on the 4-hour chart shows bulls moving higher to reach the ADX line that they have not yet been able to overcome. The bears, on the other hand, retreat a little but keep control of the market.

Do you want to know more about my technical setup?

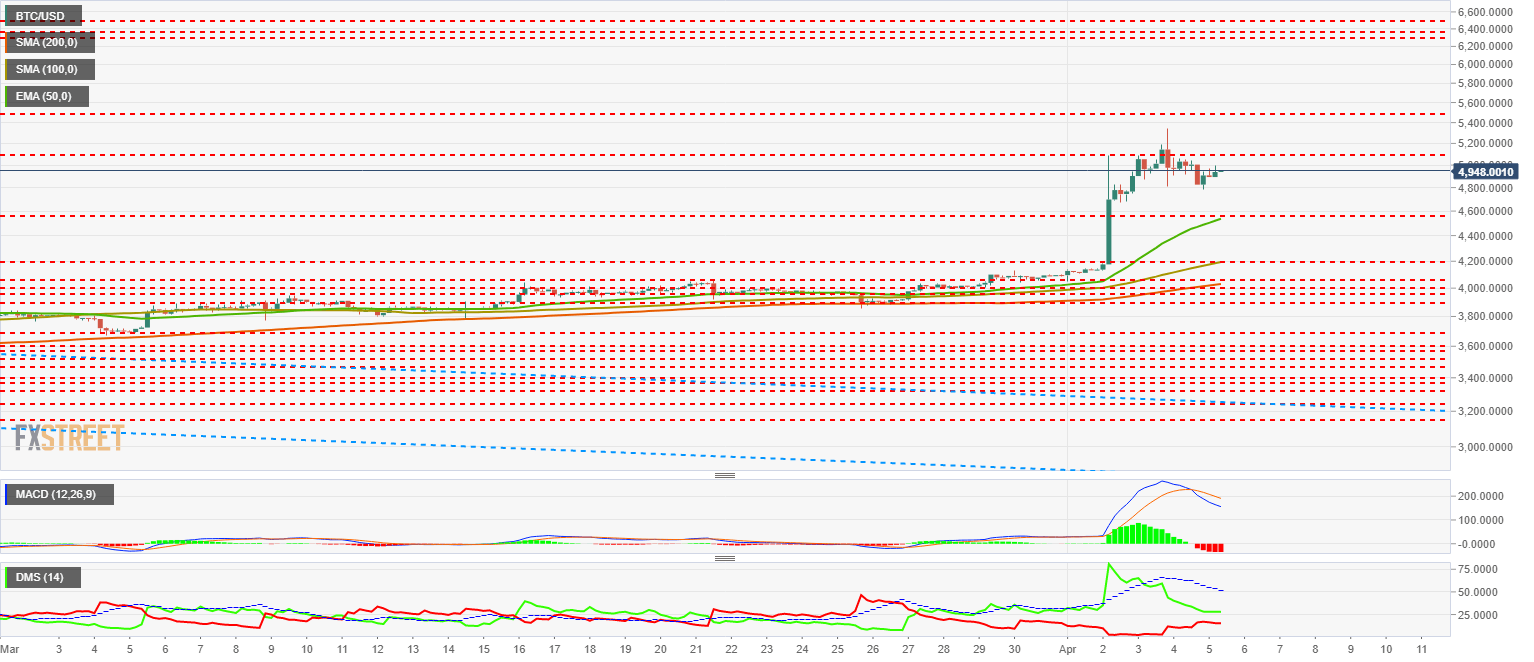

BTC/USD 240 Minute Chart

BTC/USD is currently trading at the $4,950 price level after marking $4.800 in the Asian session. Bitcoin is holding up very well in the high price range despite having entered consolidation mode, which shows that bullish interest is essential. The majority have not decided to sell before the first setbacks.

Above the current price, the first resistance level for BTC/USD is at $5,100 (price congestion resistance). The second resistance level is at $5,500 (price congestion resistance), so the third resistance level is at the vital confluence between $6,250 and $6,500 (price congestion resistance).

Below the current price, the first support level is at $4,600 (price congestion support and EMA50). The second level of support is at $4,200 (price congestion support and SMA100). The third level of support for the BTC/USD pair is at $4,050 (price congestion support and SMA200).

The MACD on the 4-hour chart shows bearish but slightly inclined cross averages. The development is ambiguous because it can both move up again and accelerate the bearish momentum.

The DMI on the 4-hour chart shows bulls controlling market momentum but with a tiny advantage over bears. The representatives of the bearish side increase their level of activity a little but are far from levels considered the current trend.

ETH/USD 240 Minute Chart

ETH/USD is currently trading at $165.85 and is once again moving higher after the first few minutes of the European session.

Above the current price, the first resistance level is at $180 (price congestion resistance). The second resistance level for the ETH/USD pair is at $200 (price congestion resistance), then the third resistance level is at $215 (price congestion resistance).

Below the current price, the first support level is at $150 (EMA50 and price congestion support). The second support level for the ETH/USD pair is at $141 (SMA100, SMA200 and price congestion support). The third level of support is at $131 (price congestion support).

The MACD on the 4-hour chart shows moving averages cut down but attempting to reconfigure upward. Doing so would initiate a bullish pattern that could lengthen the bullish leg for a few days.

The DMI on the 4-hour chart shows how bulls have outpaced bears but are blocked by the ADX line. If they get past it, the Ethereum price can fly higher. The bears, on the other hand, keep the tone and present resistance at even high levels.

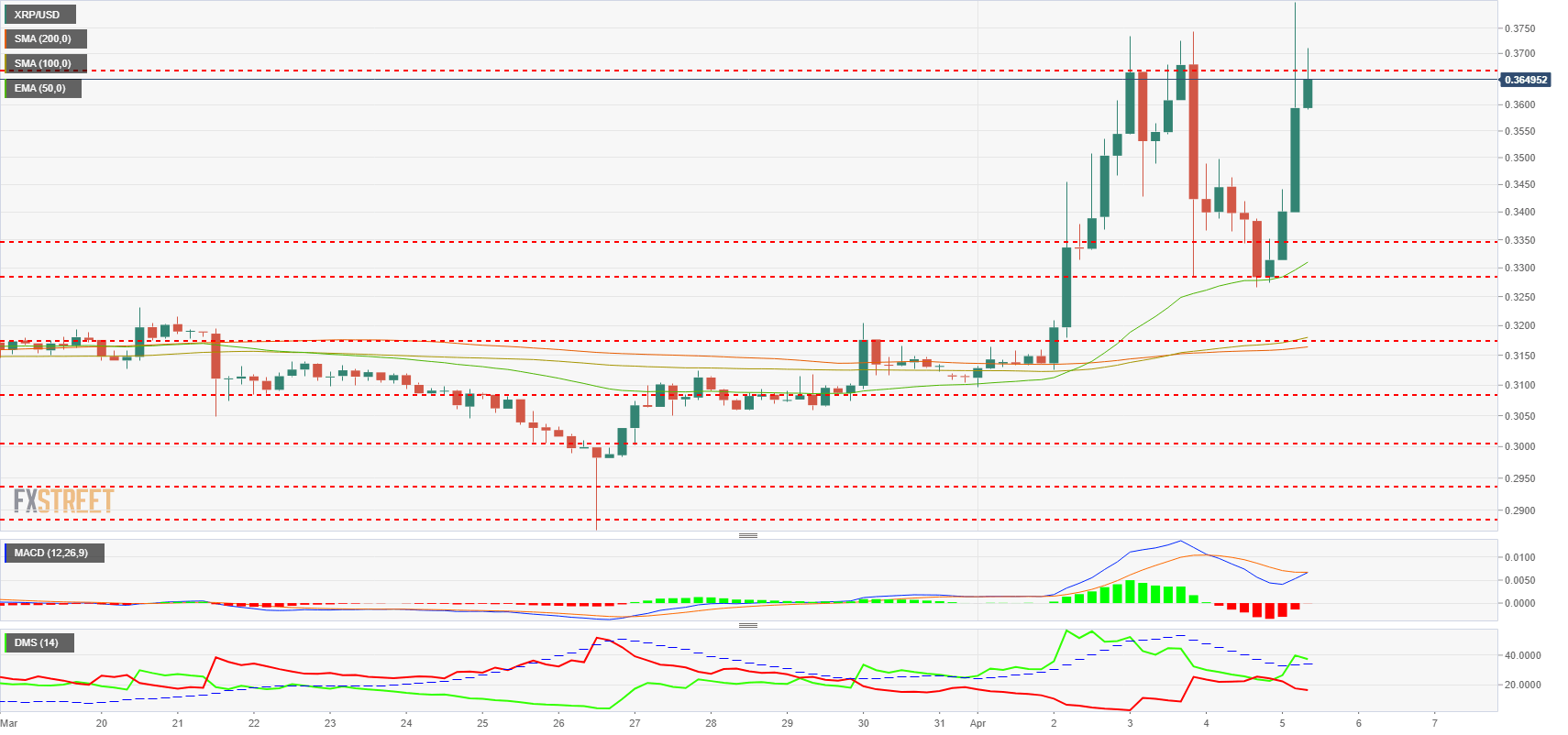

XRP/USD 240 Minute Chart

The XRP/USD is currently trading at the $0.367 price level and has been rising sharply since the start of the Asian session. The intraday high is $0.38.

Above the current price, the first resistance level is $0.39 (price congestion resistance). So, the second resistance level is at $0.438 (price congestion resistance), and the third resistance level for the XRP/USD pair is at $0.47 (price congestion resistance).

Below the current price, the first support level is $0.334 (price congestion support and EMA50). The second support level is $0.32 (SMA100, SMA200 and price congestion support), while the third support level for the XRP/USD pair is $0.308 (price congestion support).

The MACD on the 4-hour chart shows an unconfirmed bullish cross profile. If confirmed, the XRP may have one of its well-known glory days. Otherwise, the bears will be happy.

The DMI on the 4-hour chart shows how the bulls not only take control of the market but even outperform the ADX line, which increases the chances of seeing a sharp upward movement. The bulls retreat a little but remain at levels from which to dispute control of the bulls.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

-636900524831225957.png)

-636900526105612492.png)