Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Altcoins follow as BTC shows no signs of stopping

- Bitcoin price could extend gains by 5% to $55,000 as BTC bulls hold their breath.

- Ethereum price could leap 7% to $3,000 if ETH bulls keep their profit appetite in check.

- Ripple price garners strength for an 11% move to $0.6000, levels last tested on January 12.

Bitcoin (BTC) price is pumping hard, with altcoins such as Ethereum (ETH) and Ripple (XRP) following in line. The apex cryptocurrency continues to recover some of the ground lost during the past years.

Bitcoin eyes $55,000

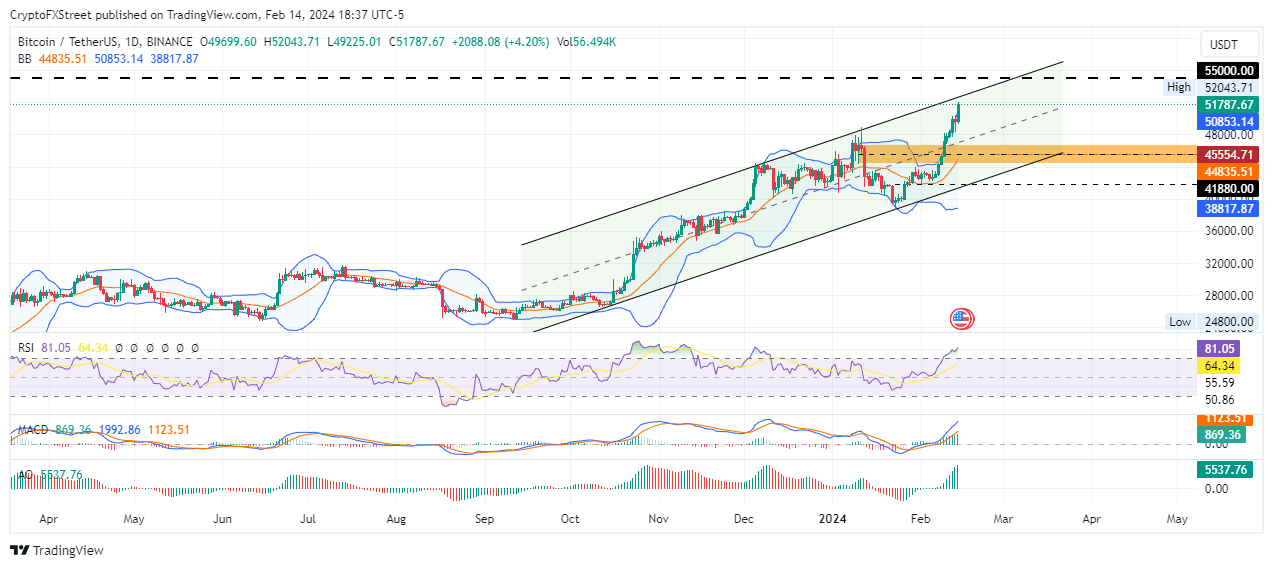

Bitcoin (BTC) price could take $55,000 soon, a 5% climb above current levels that does not seem so far right now. With strong technical indicators behind it, BTC is confronting resistance at the upper boundary of the ascending channel.

The Relative Strength Index (RSI) remains northbound despite BTC being overbought, suggesting rising momentum that could send Bitcoin price higher. The histogram bars of the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD) are also flashing green with large volumes in positive territory, showing a strong bullish presence in the BTC market. This is accentuated by the MACD moving higher above its signal line (orange band).

BTC/USDT 1-day chart

Conversely, considering BTC is overbought, investors should not be surprised if a pullback happens, which could send Bitcoin price below the midline of the channel and into the supply zone (turned bullish breaker) between $44,300 and $46,760. A break and close below the $45,554 midline would confirm a continuation of the fall.

Ethereum price could leap to $3,000

Ethereum (ETH) price’s $3,000 target is now within reach as ETH bulls keep their profit appetite in check. The Proof-of-Stake (PoS) token has breached resistance due to the midline of the channel with the potential for a 7% climb to the forecasted target.

The MACD and AO both show a strong bullish grip, while the RSI hints at rising momentum, which could ferry Ethereum price to the psychological level, last tested on April 26, 2022.

ETH/USDT 1-day chart

Like BTC, however, ETH is also overbought, with the RSI above 70. With this, a correction is likely, with Ethereum price likely to descend 6.5% to $2,600 or in a dire case, revisit the $2,500 level. Such a move would denote a 10% drop below current levels.

Also Read: Ethereum Classic price coils up for a breakout with $30 in the cards for ETC

XRP bulls are back in the game

Ripple (XRP) price has sustained a recovery since early February, showing that XRP bulls are back in the game. With Bitcoin showing directional bias, altcoins are following and the remittance token is not far behind.

With the RSI above 50, coupled with a bullish effort seen in the green histogram bars of both the MACD and AO, Ripple price could extend the gains 11% to retake the $0.6000 psychological level.

Ripple price is sitting in the upper half of the Bollinger Bands, between the centerline and the upper band at $0.5196 and $0.5428, respectively. This accentuates the bullish thesis.

XRP/USDT 1-day chart

Conversely, early profit booking could cut the rally short, sending XRP price below the midline of the channel. In a dire case, the altcoin could descend to the $0.4734 support floor, levels last seen on October 12.

Also Read: Ripple unveils plans for crypto custody while XRP price trades sideways

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.