Ethereum Classic price coils up for a breakout with $30 in the cards for ETC

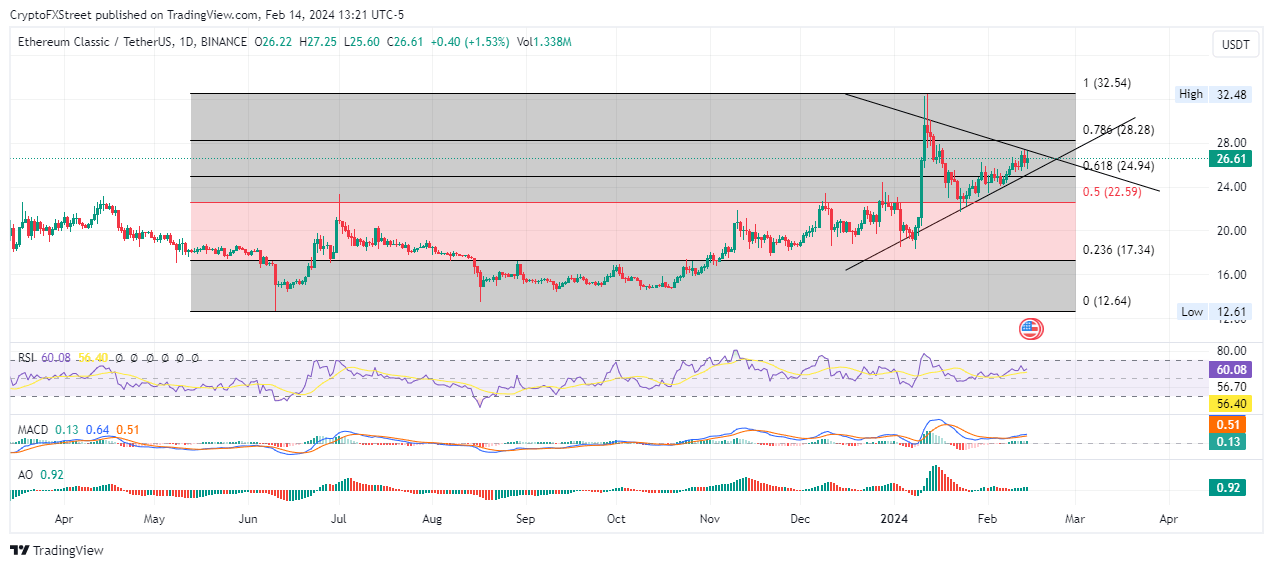

- Ethereum Classic price is filling up a triangle amid consolidation between the 78.6% and 61.8% Fibonacci levels.

- ETC could make a 12% climb at breakout to test the $30.00 psychological level.

- The bullish thesis will be invalidated if the altcoin breaks and closes below the $22.59 support level.

Ethereum Classic (ETC) price is trading with a bullish bias, but this directionality could be at a crossroads soon as the altcoin fills up a triangle.

Also Read: Ethereum Classic price tops out with a 15% correction likely underway for ETC

Ethereum Classic could rally 12% at breakout

Ethereum Classic (ETC) price is filling up a triangle, which means the next directional bias remains pending until the point when the breakout happens. The price is currently moving with a fixed market range between the 61.8% and 78.6% Fibonacci levels of $24.94 and $28.28, respectively.

For now, the odds lean in favor of the upside with the Relative Strength Index (RSI) tipping north while it holds above the 50 level. The position of the RSI at 60 also shows there is still more ground north before ETC can be considered overbought.

The Moving Average Convergence Divergence (MACD) is also in positive territory above its signal line (orange band). Furthermore, the histogram bars of both the MACD and the Awesome Oscillator are green-toned, showing that bulls maintain a strong presence in the ETC market.

With these features supporting the upside, increased buying pressure above current levels could see Ethereum Classic price shatter the upper boundary of the triangle to confront the 78.6% Fibonacci level at $28.28. A break above this blockade would clear the path for ETC to hit the $30.00 psychological level, nearly 12% above current levels.

In a highly bullish case, the Ethereum Classic price could extend the climb to reclaim the range high at $32.48.

ETC/USDT 1-day chart

On the flipside, a break below the lower boundary of the triangle could see Ethereum Classic price test the 61.8% Fibonacci level at $24.94. In a dire case, the altcoin could extend a leg down to the 50% Fibonacci level of $22.59.

A break and close below the aforementioned supplier congestion level would invalidate the bullish thesis, potentially sending ETC all the way to the 23.6% Fibonacci at $17.34. Such a move would constitute a 35% drop below current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.