Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC eyes $48,000 with Chinese Lunar New Year of the Dragon

- Bitcoin price could hit $48,000 this weekend if BTC decisively closes above $45,451 mean threshold.

- Ethereum price could reclaim $2,717 range high as ETH leads altcoin’s revival recourse.

- XRP could reclaim $0.5500 as Ripple price breaches midline of the descending parallel channel.

Bitcoin (BTC) price started moving after a prolonged consolidation, and with it Ethereum (ETH) and Ripple (XRP) prices. The general outlook is revival recourse, with markets flashing green as the Chinese Lunar Year of the Dragon sets in this weekend. It is a special year, representing strength.

“We’re happy to do the Year of the Dragon, because it’s a very powerful year and very auspicious,” said local board member of the Organization of Chinese Americans, Anna Wong, adding, “and everyone feels lucky when they’re in the Year of the Dragon.”

With this optimism, crypto markets could rally this weekend as Chinese investors feel lucky.

Also Read: Bitcoin price shows strength as US BTC ETF flow percentage beats AUM in most regions

Bitcoin price could make it to $48,000 this weekend

Bitcoin (BTC) price has forayed past the midline of the supply zone at $45,451. The supply zone extending from $44,235 to $46,715 is an order block characterized by aggressive selling. If BTC manages to close above its midline, it could extend the gains to $48,000 this weekend, or in a highly bullish case, extend the gains to $50,000. Such a move would denote a 5% climb above current levels.

The Relative Strength Index (RSI) is northbound, pointing to rising momentum. The Moving Average Convergence Divergence (MACD) is also in positive territory with histogram bars flashing green to show a strong bullish wave.

BTC/USDT 1-day chart

Conversely, with the RSI above 70, BTC is in overbought territory and a correction may be looming. Another threat to Bitcoin price upside potential is early profit-taking, which could see BTC fall back into the range between $40,650 and $43,750.

If selling pressure sends BTC all the way to $37,800, the cliff could see Bitcoin price roll over to $30,000, below which the bullish thesis would be invalidated.

Also Read: Bitcoin Weekly Forecast: BTC targets $52,000, will New Moon trigger a pullback first?

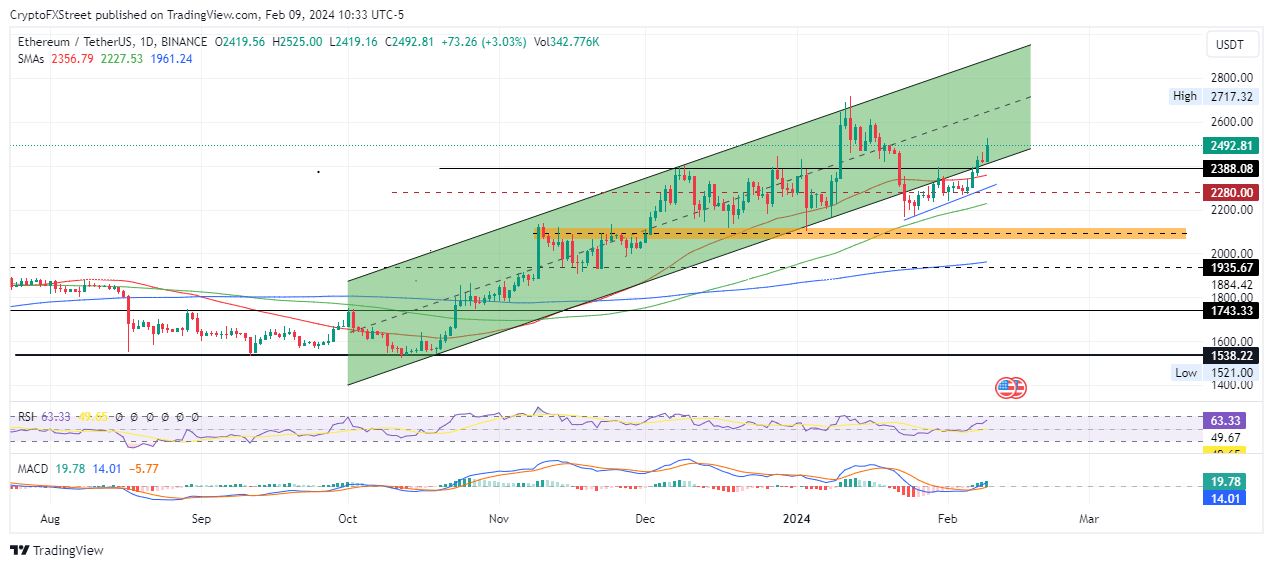

Ethereum price could reclaim its $2,717 range high

Ethereum (ETH) price is on a sustained uptrend, and could extend the climb past $2,600 to tag $2,717, levels last tested on January 12. This would constitute a 9% climb above current levels.

The RSI position at 63 shows there is more room in the north before ETH is overbought, with the inclination of the momentum indicator showing rising buying strength.

The MACD histogram bars are also green to show the strong presence of bulls in the market. Enhanced buyer momentum could see Ethereum price shatter past the range high to hit $2,800.

ETH/USDT 1-day chart

On the flip side, if traders start cashing in, Ethereum price could drop. While a break below $2,388 would harm ETH holders, the prevailing bullish outlook would only be invalidated if ETH crosses and closes below $2,280.

Also Read: Ethereum price tops $2,400 as 25% of ETH supply is staked and ETF applicants amend filings

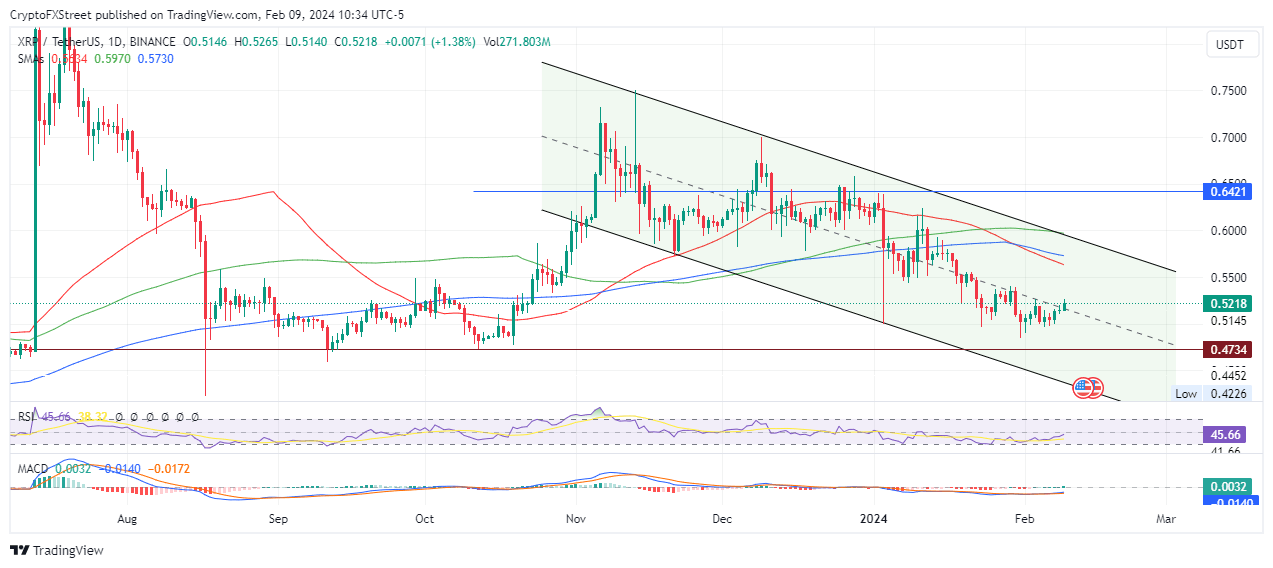

Ripple price could take back $0.5500

Ripple (XRP) price has broken above the midline of the descending parallel channel. With momentum rising, XRP price could extend the gains 5% to the $0.5500 level. In a highly bullish case, the price could extend the climb, shattering the 50, 200 and 100-day Simple Moving Averages (SMA) at $0.5633, $0.5730 and $0.5970, respectively. This could lay the path for XRP to hit the $0.6000 psychological level.

XRP/USDT 1-day chart

On the flipside, if the bears have their way, Ripple price could dwindle, potentially retesting the $0.4734 support.

Also Read: XRP Price faces threat of fall below $0.50 as XRPLedger AMM amendment is uncertain

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.