This bullish setup anticipates massive gains for Cardano price

- Cardano price breaks sharply above the short-term downtrend.

- ADA price rallies at least 40% as buy-the-dip traders return to the scene.

- Expect to see a possible test at a technical cap if positive sentiment persists throughout the week.

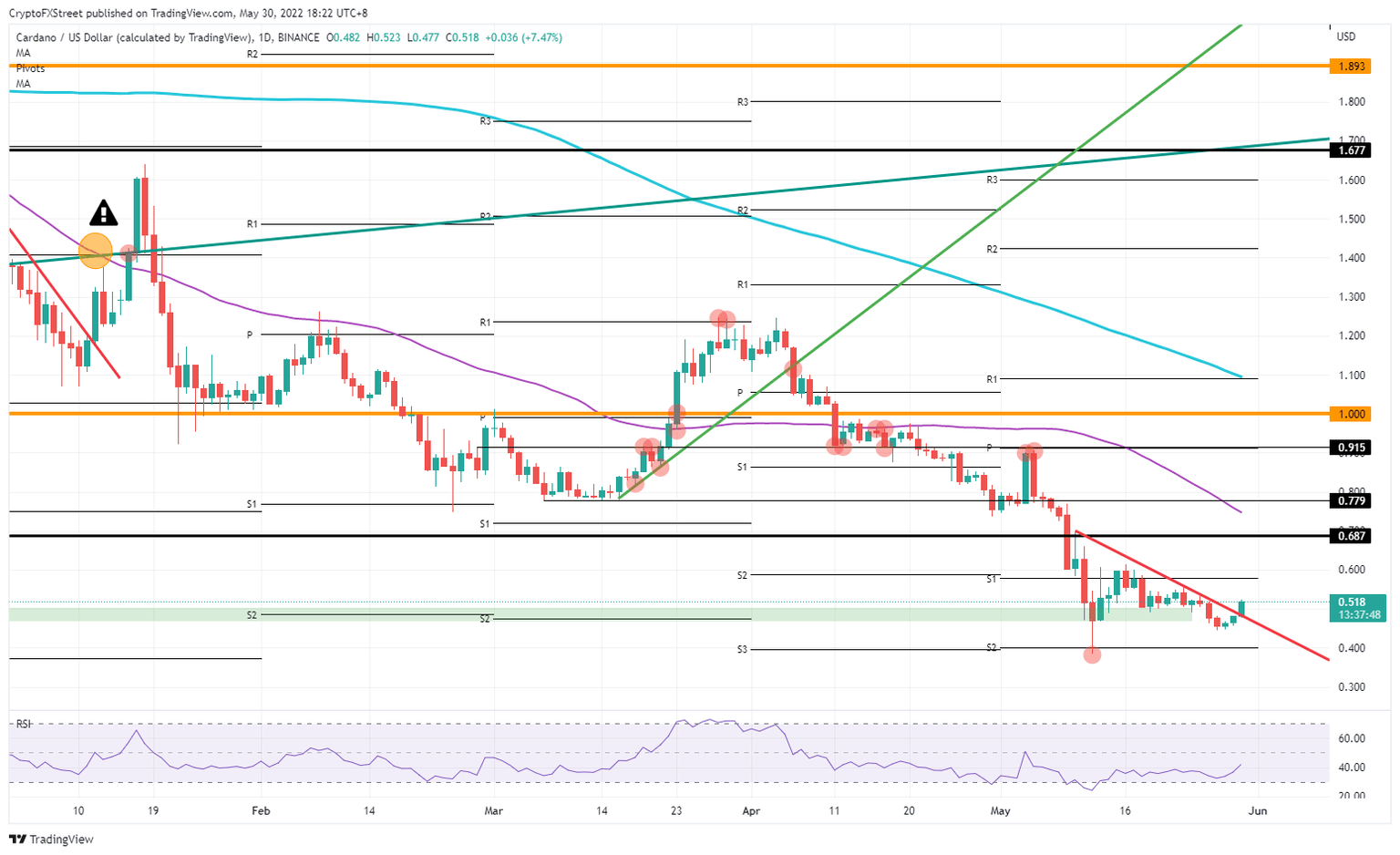

Cardano (ADA) price is set to jump 56% by the end of this week in a return of risk sentiment. With a big appetite, traders are buying every risk asset in sight as stock market futures worldwide are rallying higher. With this turnaround after the positive weekly close last week, all harmful elements have been priced in, and markets are at a tipping point to end the downtrend for 2022.

ADA price set to break the downtrend

Cardano price has shot through the short-term red descending trend line this morning as globally, risk appetite has returned. Bulls are feasting themselves on stocks and cryptocurrencies, making both asset classes rally higher. A tipping point has now been reached, and markets have finally factored in all moving parts from the geopolitical turmoil that has had risk assets in a choke hold since the beginning of 2022.

ADA price is thus set to book its best performing week for the year as a pop above the red descending trend line opens room towards $0.687, with both the dollar backing off and bulls buying into the price action. As those two factors are set to continue this week, expect to see a clear break and close above $0.687 and, by doing so, set the scene for a test of the 55-day Simple Moving Average (SMA) at $0.750. Although the bullish element looks strong, expect to see some profit-taking and a short fade to the downside by this week as ADA price will have rallied 56%, and the Relative Strength Index (RSI) will be nearing the overbought area a bit too quickly.

ADA/USD daily chart

Risk to the downside could come with a bull trap, as the US session has often been the outlier these past few trading weeks, where earlier gains got erased, and indices closed lower. In that case, it could be bears who are pulling price action back below the red descending trend line and squeezing out bulls in the process, paving the way for another drop towards $0.400. That would mean a drop of roughly 20% in a simple technical bull trap and squeeze.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.