Tezos price rebounds from key support, aiming to retest all-time highs

- Tezos embraces support at the ascending parallel channel lower boundary in preparation for an upsurge to $4.

- XTZ uptrend is likely to be reinforced by a golden cross pattern on the daily chart.

- The TD Sequential indicator may present a sell signal on the 12-hour chart, sabotaging the recovery.

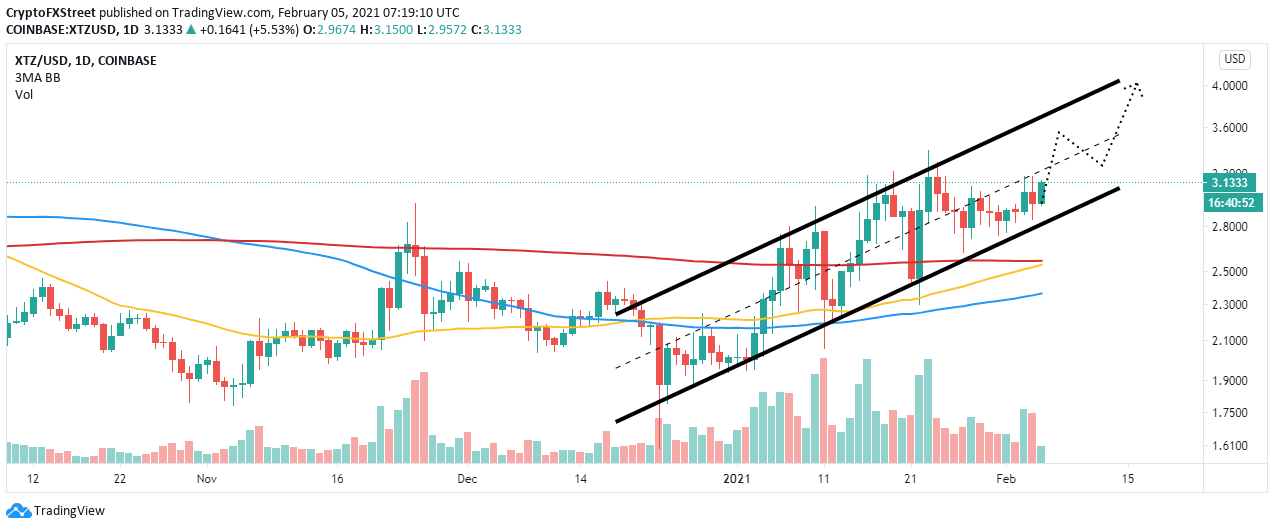

Tezos has recovered consistently from Decembers’ dip that saw it revisit $1.6. The uptrend has been taking place within the confines of an ascending parallel channel. A massive breakout is anticipated in the near term, likely to boost XTZ to its all-time highs.

Tezos technicals align in support of a bullish impulse

For more than six weeks XTZ’s price action has been limited by the ascending parallel channel. A recent rejection from the upper edge resulted in a breakdown, retesting the channel’s lower boundary support. At the time of writing, Tezos is trading at $3.1 after a bounce back from the crucial support.

A breakout is anticipated at the middle boundary of the channel, thus placing the $2.4 billion token on a trajectory toward the all-time highs, slightly above $4. Some resistance is also envisaged at $3.5, regardless, Tezos has the potential to continue with the uptrend.

It is worth noting that a golden cross pattern could form on the daily chart. The bullish outlook will manifest when the 50 Simple Moving Average crosses above the longer-term 200 SMA on the daily chart. In other words, the Tezos uptrend is set to get stronger amid the rising trading volume.

XTZ/USD daily chart

Looking at the other side of the fence

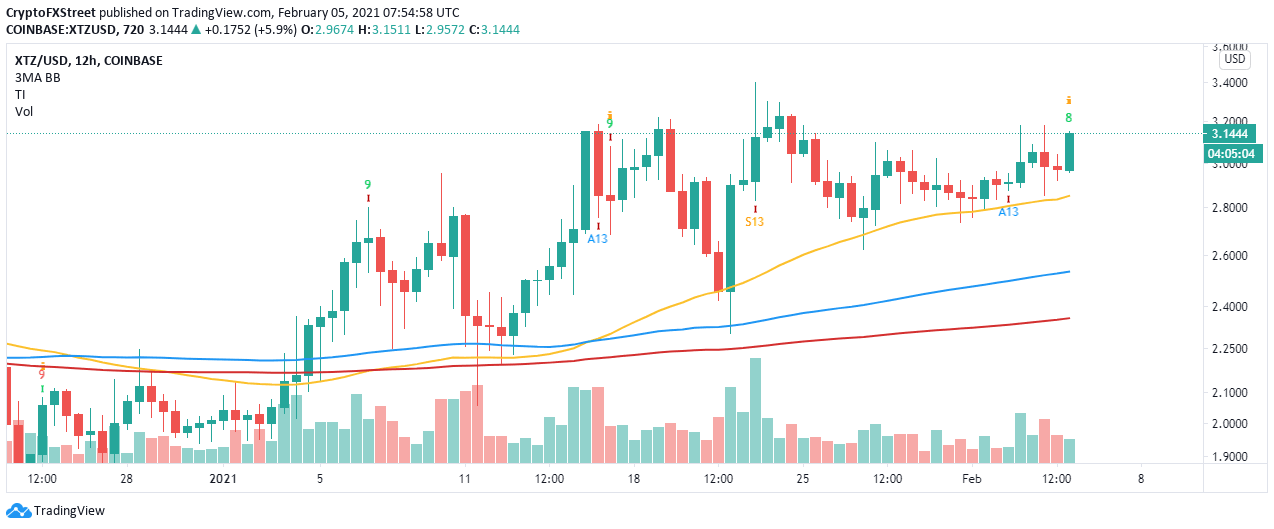

The TD Sequential indicator is likely to flash a sell signal on the 12-hour chart in a few hours. Traders utilize this indicator to identify the points where an uptrend or downtrend is exhausted, giving way to a reversal.

A nine green candlestick represents a sell signal and is validated when it closes higher than the 6 and 7 candlesticks. Therefore, a correction may engulf Tezos in the short-term which will sabotage the expected breakout to new all-time highs.

XTZ/USD 4-hour chart

The 12-hour chart highlights the 50 SMA as an initial contact point or immediate support. If declines overshoot this zone, we can expect the 100 SMA and the 200 SMA to come in handy.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren