Tezos Price Prediction: XTZ could see a massive jump to $4 after defending critical level

- Tezos price has defended an important support trendline which is part of an ascending parallel channel.

- The digital asset remains inside a long-term uptrend and aims for $4 in the short-term.

- Bears aim to crack the same crucial support level to push XTZ by more than 35%.

Tezos has been trading inside a long-term uptrend since December 23, 2020, climbing from a low of $1.5 to a high of $3.39 on January 23. The digital asset has been underperforming in the past week despite the DeFi market exploding and Ethereum seeing new all-time highs alongside many altcoins.

Tezos price can quickly rise to $4 if bullish momentum continues

On the 12-hour chart, Tezos has created an ascending parallel channel since December 2020. The digital asset has been trading just above the lower trendline support for the past week, defending this level on several occasions.

XTZ/USD 12-hour chart

Tezos price is ready for a big rebound after successfully defending $2.9. XTZ bulls also managed to hold the 50-SMA as a support level since the beginning of 2021. The top trendline of the parallel channel is located at $4 which is the bullish price target for Tezos.

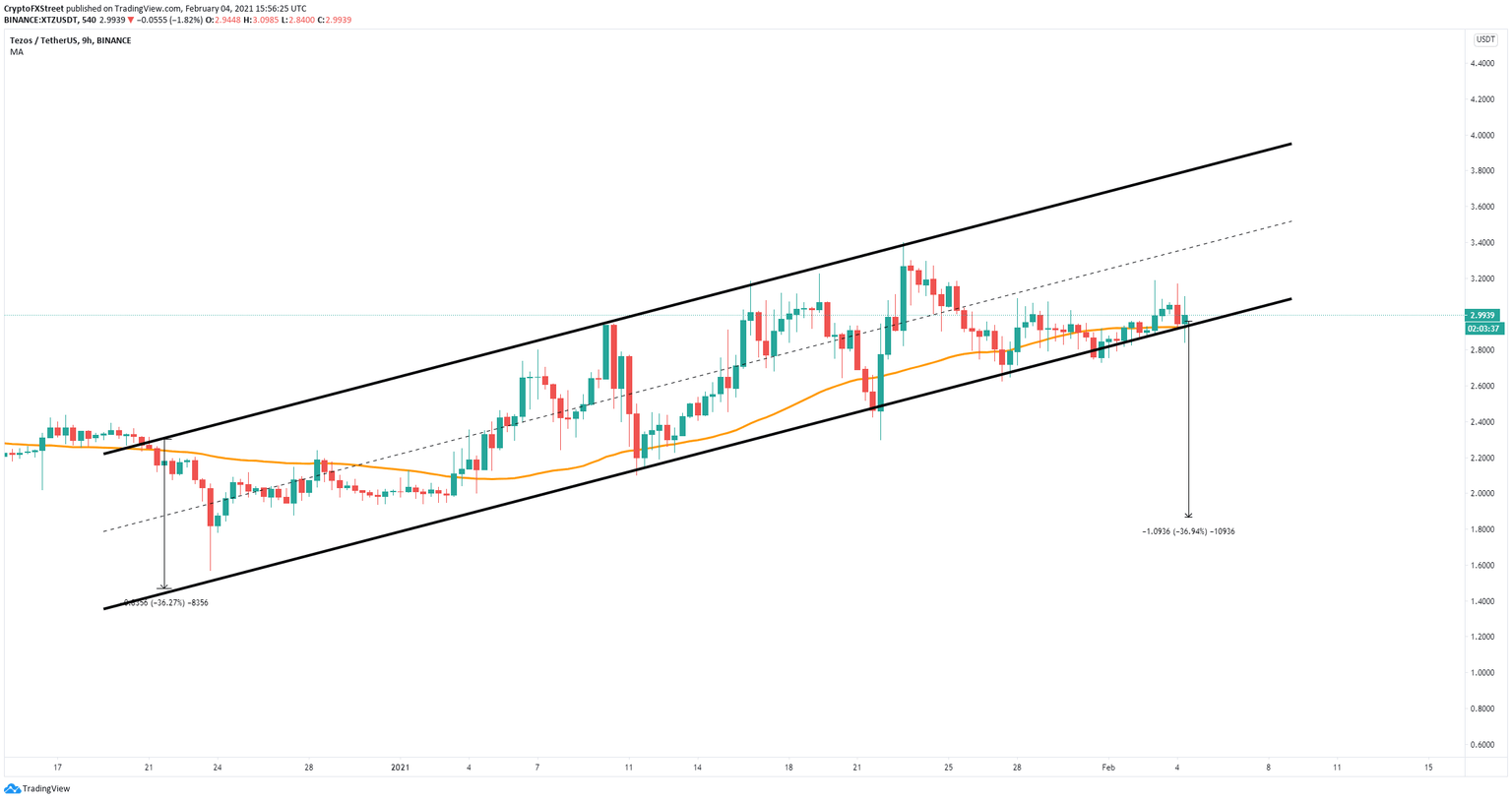

XTZ/USD 9-hour chart

However, the TD Sequential indicator has just presented a sell signal on the 9-hour chart. If XTZ bears can push the digital asset below the 50-SMA at $2.9 which coincides with the critical support level of the parallel channel, Tezos price can quickly fall towards $1.8, a 36% move calculated using the height of the parallel channel.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.