Terra Price Prediction: LUNA could skyrocket 40% after a minor correction

- LUNA price has been on a tear as it saw a 200% bull rally in two weeks.

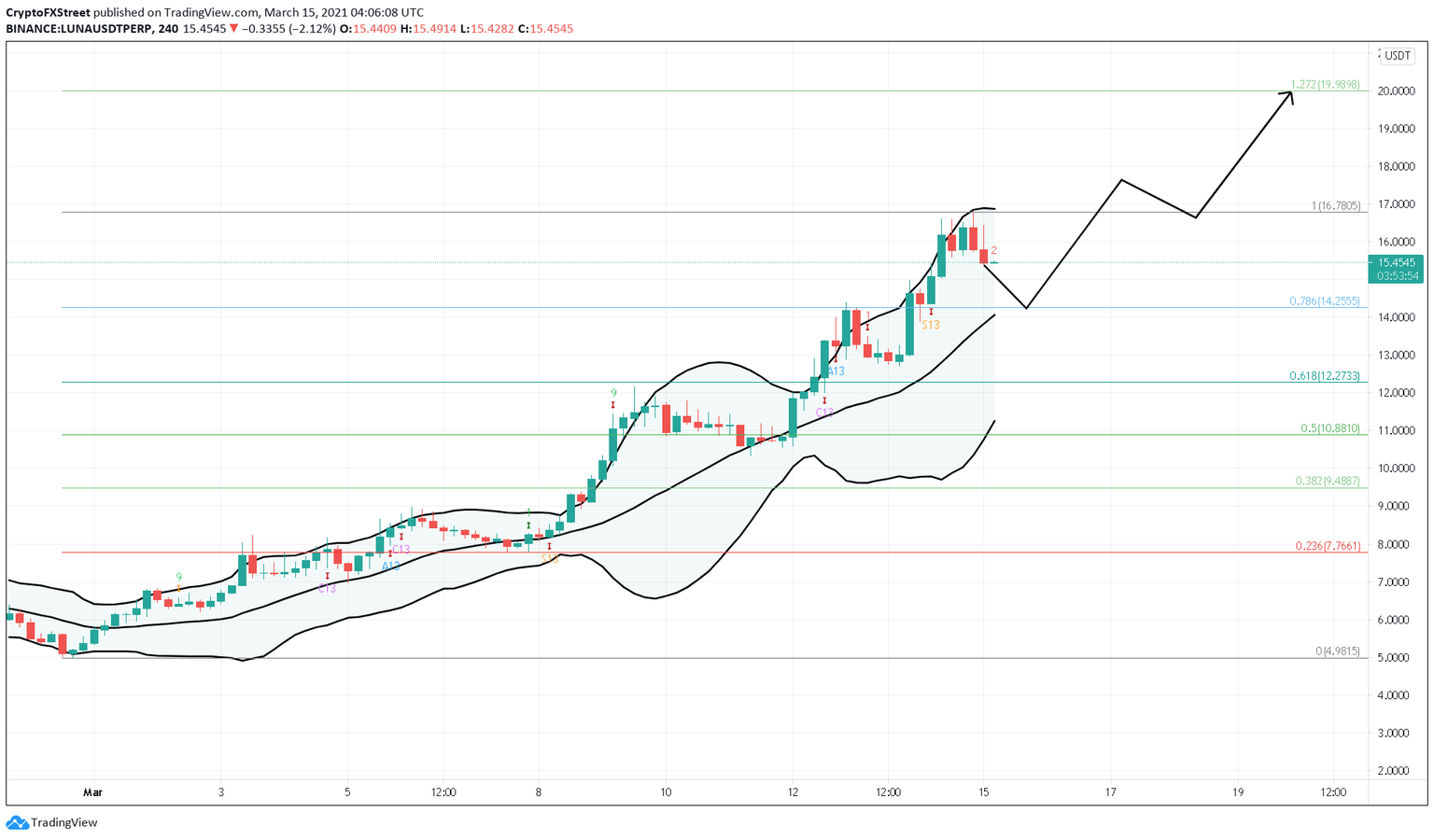

- A 40% upswing to $19.98 seems likely after a slight correction to a confluence of support.

- Invalidation of the bullish thesis will occur if Terra slices through the $14.22.

LUNA price saw a massive upswing in the last two weeks. The uptrend seems to be intact and could continue after a slight correction.

LUNA price on the verge of another run-up

LUNA price has seen a strong uptrend which has pushed it from $5 to almost $17, which is an impressive 3x returns in less than two weeks. Now, Terra price could correct to a crucial support barrier at 78.6% Fibonacci retracement level at $14.22 before going on another leg-up.

Bollinger Bands indicator shows an interesting relationship with LUNA’s corrective phases. Since February 28, almost every corrective wave has seen a prompt pullback to the Bollinger Bands’ middle line. If something similar were to happen, then Terra could drop to $14.22, a level that coincides with the 78.6% Fibonacci retracement extension, further adding credence to this thesis.

Naturally, a bounce from this point suggests that a retest of the all-time high at $16.78 is likely. A spike in buying pressure around this level could propel LUNA price to the 127.2% Fibonacci retracement level at $19.98, which is a 40% upswing from $14.22.

LUNA/USDT 4-hour chart

On the other hand, investors should note that the 40% upswing depends on buyers scooping up LUNA for a discount at the 78.6% Fibonacci retracement level. If market participants decide to book profits here, it could lead to a breakdown of the support barrier resulting in a 13% downswing to $12.27, which coincides with the 61.8% Fibonacci retracement level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.