Terra Price Analysis: LUNA aims for a $2 billion market capitalization with no barriers ahead

- Terra is a Blockchain similar to Ethereum with several functional protocols built on top of it.

- The digital asset has performed extremely well in 2021 gaining $700 million in market capitalization.

- The project has a lot of plans for the future and the short-term that can drive LUNA price even higher.

Terra is a Blockchain platform that supports smart contracts and allows developers to use Terra stablecoins, on-chain swaps, run on multiple chains, and more. The digital asset behind Terra is called LUNA and it’s currently trading at $2.08 with $1 billion in market capitalization.

The fundamental forces behind Terra

There are several projects already built on top of Terra. The first is ZenGo, a fully functional wallet and card powered by Visa that can be used anywhere. Mirror Protocol is the most successful project so far, reaching a market capitalization of $156 million.

Mirror creates assets reflected on the Blockchain, which means that users can trade stocks like Tesla, or Microsoft, as well as indices like the QQQ trust index on the Blockchain. One of the main benefits of Terra’s blockchain is the speed and the cost of $0.001 per transaction, which is extremely lower than Ethereum’s gas fees.

On January 26, 2021, Terraform Labs raised $25 million from Galaxy Digital, Coinbase Ventures, and others to continue building new and exciting projects. The next upcoming project built on Terra will be ANCHOR, a savings protocol with a ton of innovative features like principal protection or a stable interest rate.

Terra price has hit an all-time high of $2.5 but could rise higher

On February 3, 2021, LUNA touched $2.5 for the first time ever but saw a significant pullback down to $2.04. The digital asset could continue to climb higher as it faces very little resistance on the way up.

LUNA social volume

In the past week, a peak in social volume has accurately predicted local tops for LUNA. However, we now see almost no activity in social media which indicates that Terra price can continue surging higher without the risk of a pullback.

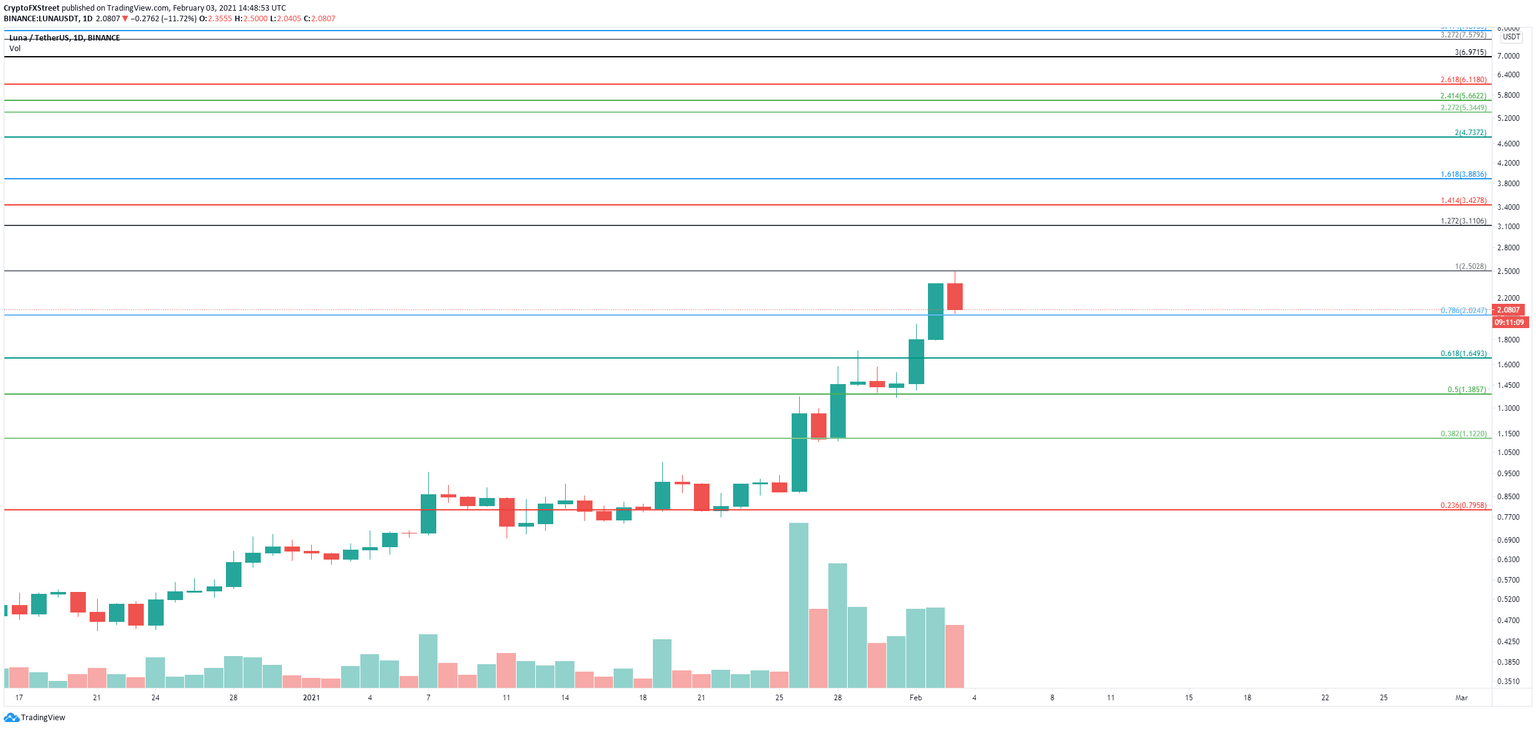

LUNA/USD daily chart

Using the Fibonacci Retracement tool on the daily chart we can see the next price target for the bulls is located at $3.11 which is the 127.2% Fib level. A breakout above that point can push Terra price towards $3.42 and $3.88 which would put the digital asset at a $2 billion market capitalization.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.47.23%2C%252003%2520Feb%2C%25202021%5D-637479606334079027.png&w=1536&q=95)