Solana revenue hits multi-month lows as Pump.fun competition, Ethervista, launch on Ethereum

- Solana has experienced declines in its revenue, potentially fueled by Pump.fun’s competitors Ethervista and SunPump.

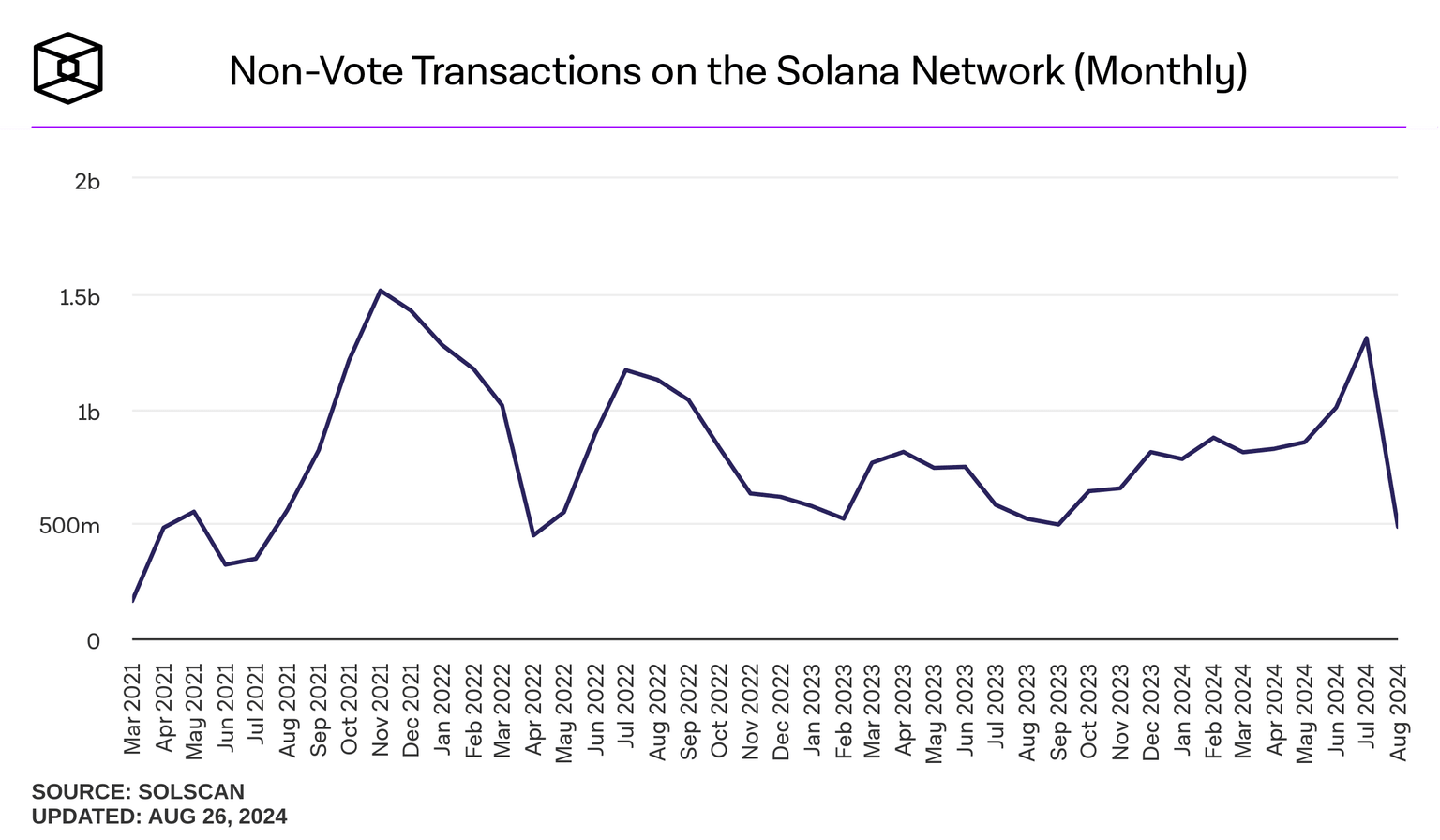

- Solana's non-vote transaction volume also dropped to lows last seen in September 2023.

- Recently launched Ethervista poised to challenge Pump.fun.

Solana's (SOL) daily revenue hit a six-month low on Monday, accompanied by a drop in its daily transaction volume. The rapid decline reflects a drop in trader interest following the launch of Pump.fun competitors Ethervista on Ethereum and SunPump on the Tron blockchain.

Solana risks further revenue decline following launch of Ethervista

According to data from DefiLlama, Solana's daily revenue reached a six-month low of $190.7K on September 1. This is a 92% decline from its revenue peak of $2.47 million on March 18.

Data from Kaito AI further notes that Solana's sentiment has flipped bearish, hitting the red zone since August 26. This negative sentiment is also reflected in Solana's non-vote transactions, declining by 63% from a peak of 1.31 billion in July to 485.61 million in August, per The Blocks Data Dashboard. The last time Solana non-vote transactions were at this level was in September 2023.

Solana Non-vote Transactions

Notably, some crypto community members speculate that a major cause of Solana's on-chain activity decline may have stemmed from a reduced interest in its meme coin generation platform, Pump.fun. Since the launch of its competition, SunPump, on the Tron blockchain, Pump.fun's revenue has been on a downtrend, per DefiLlama data.

Additionally, Lookonchain data suggests that the Pump.fun fee account sold 254,074 SOL on September 1 at an average price of $158. The account ejected another 10,300 SOL earlier today, bringing the total sold tokens to $41.64 million. This suggests profit-taking from the platform amid its declining interest.

To add salt to injury, a decentralized exchange, Ethervista, that allows the easy launch of meme coins on the Ethereum Mainnet went live in the past few days. Ethervista claims to introduce a fresh approach to token launches on the Ethereum network. Among its most prominent features is the 5-day liquidity lock for creators.

The approach counters dump events that often followed several newer meme coins on competitive platforms like Pump.fun.

As a result, several crypto community members have speculated that Ethervista could see Ethereum's on-chain activity peak again to the detriment of Solana.

SOL is down nearly 4% in the past 24 hours, stretching its weekly losses to 13%.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi