Solana price to be burned by 10% drop as SOL bulls play with fire

- Solana price has been trending downwards since Wednesday.

- SOL bears to break back below the red descending trend line, take out the monthly pivot along with it.

- The big risk for a 10% drop, sub $19, with the risk of more downside to come.

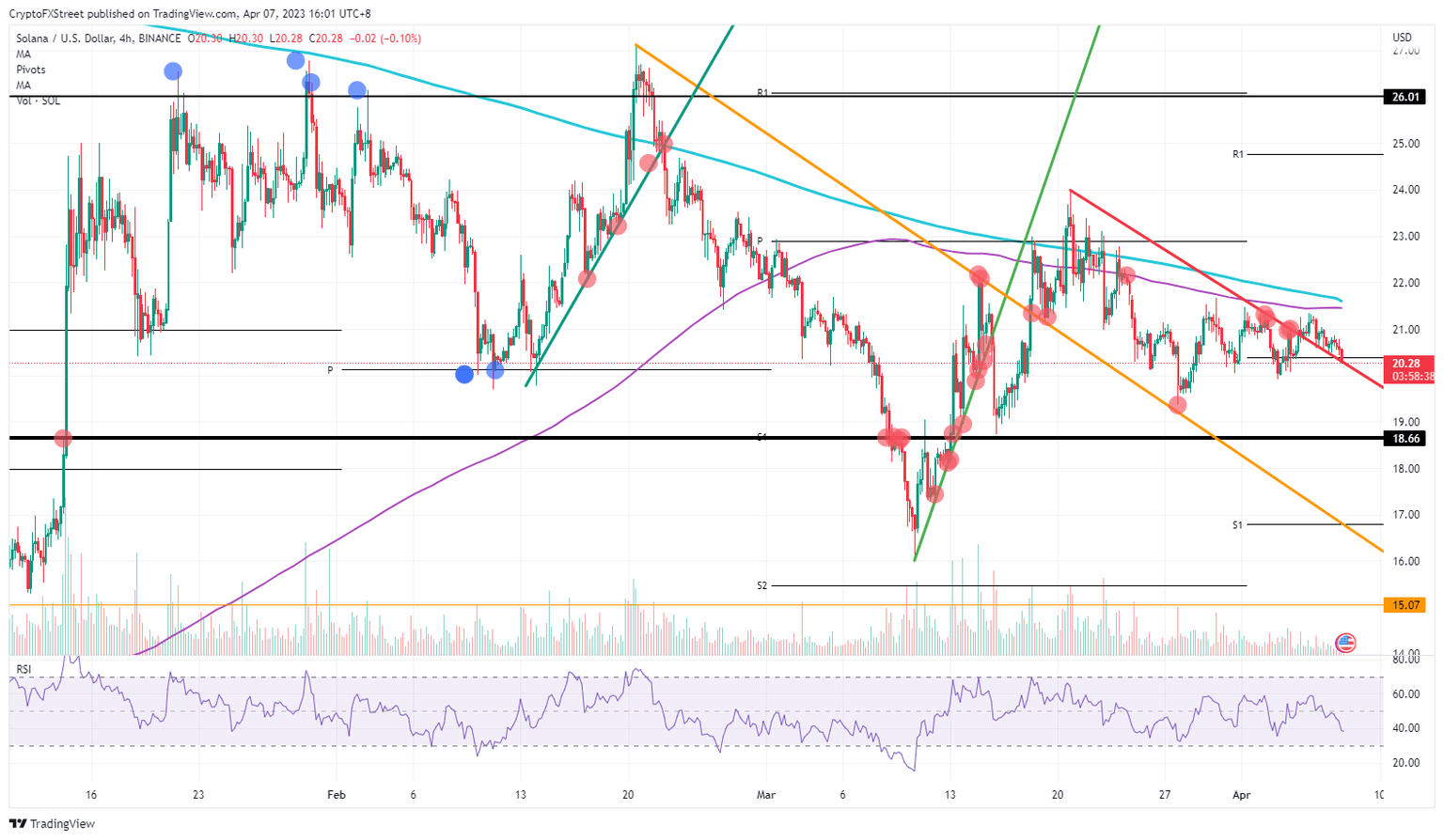

Solana (SOL) price is trending lower as the red descending trend line (see chart below) at the time of writing still offered some support. It is worrying though that the monthly pivot at $20.40 has been taken out, as SOL bulls are now being squashed against that descending trend line by the bears.

The big risk is that, if bears succeed in pushing price action below it, more short-sellers will come in, and SOL could drop quite quickly toward $18.66 with 10% losses at hand.

Solana price downtrend means issues for bulls

Solana price has bulls playing a dangerous game here as SOL price action trends lower for a third consecutive day in a row. Since Wednesday, the decline has started, and with constant lower lows and lower highs, bulls are starting to feel the pressure. Many of them will start to see that negative results grow bigger by the candle. Once bears are able to push SOL back below the red descending trend line, expect plenty of bulls to start selling their stake as well.

SOL will see a wave of selloffs quickly flooding the price action. That means a breakdown in the equilibrium between supply and demand, and price action will come down to attract new buyers. Expect that level to be around $18.66 as a pivotal level, although a break of that level could mean a 20% decline toward $17.

SOL/USD 4H-chart

A false break below could be used as a bear trap for bulls to squeeze out their positions. It would act as fuel for a push higher, with possibly a break above $22 and taking out both the 55-day and the 200-day Simple Moving Average (SMA) along the way. Although still quite far off, but a rally higher towards $26 could be possible for this month.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.