Solana Price Prediction: SOL to retest $125

- Solana price continues to consolidate and approaches key breakdown levels.

- Overbought levels in the Relative Strength Index act as consistent resistance to higher prices.

- Failure of support could trigger a flash crash.

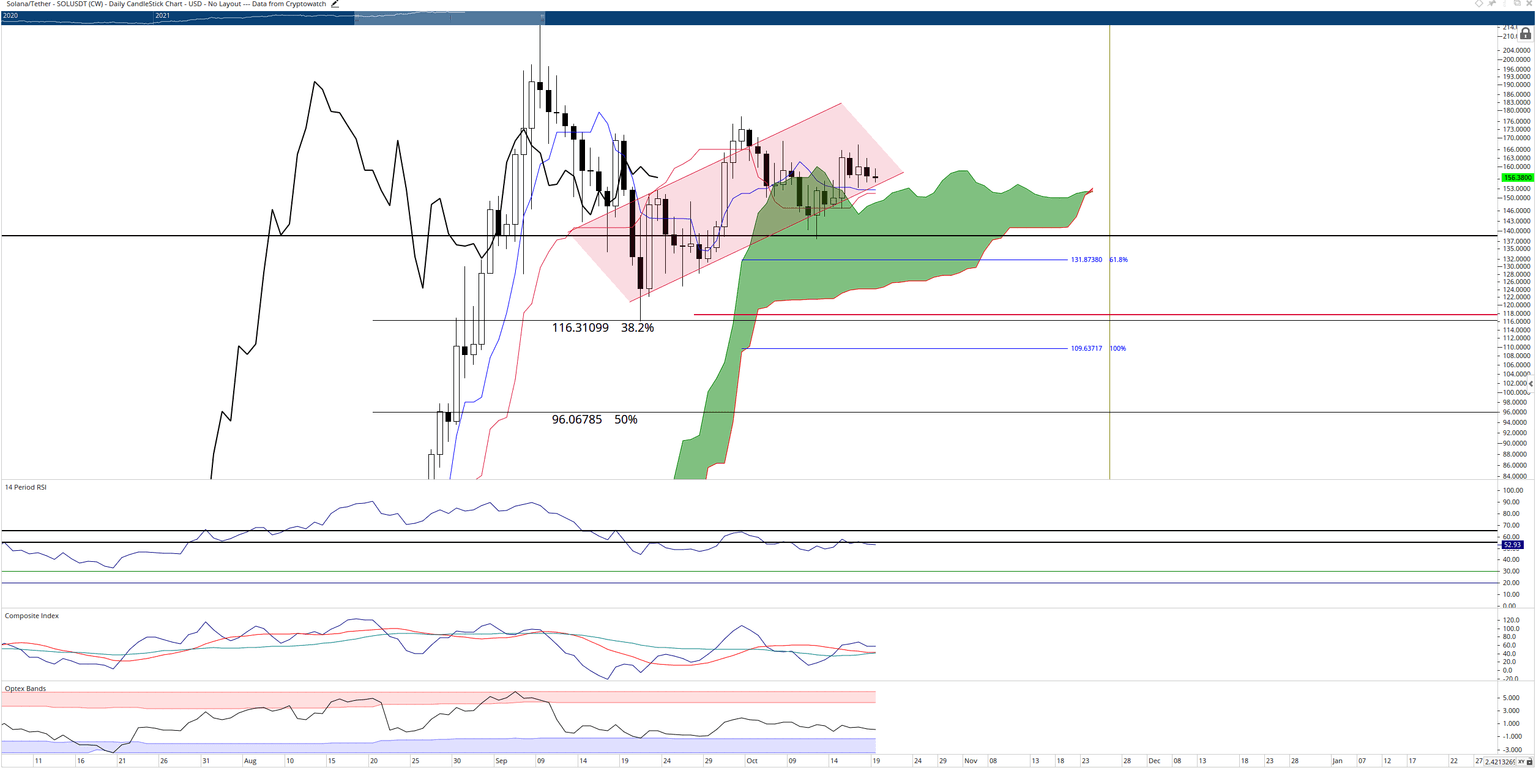

Solana price maintains an overwhelmingly bullish bias on the daily Ichimoku chart. The Chikou Span remains above the candlesticks, and the close is above the Tenkan-Sen, Kijun-Sen and the Cloud. But the current close is positioned to trigger bearish price action.

Solana price must hold near-term support, threats of downside pressure increase

Solana price has some important price levels to watch out for to prevent bears from taking over. Between $149 and $154, four primary support levels exist: the bottom of the current bear flag, the Tenkan-Sen, the Kijun-Sen and the top of the Cloud (Senkou Span A). Below $149, there is no support for Solana within the Ichimoku system until Senkou Span B at $125. But it could move lower.

Below $125 Solana price runs into a very thin 2021 Volume Profile. It is very possible that any break of $125 could drag Solana lower towards the weekly Kijun-Sen and 38.2% Fibonacci retracement at $116. However, a move that low from the present value area is likely to occur only if there is a broader sell-off within the whole cryptocurrency market.

SOL/USDT Daily Ichimoku Chart

However, Solana bears shouldn’t be overly confident about an impending sell-off. Solana will benefit from any bullish sentiment if Bitcoin has substantial bullish support after its futures ETF listing. Any near-term bearish bias will be invalidated if Solana price closes at or above $173. From there, Solana is on the road to pushing beyond its all-time highs and into the $300 value areas.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.