Solana readies for blastoff to $265

- Solana price consistently displayed the potential for a sell-off over the past few weeks.

- Buyers step in to support price and look to continue one of the biggest cryptocurrency rallies of 2021.

- Ideal breakout conditions ahead.

Solana price remains inside the Ichimoku Cloud but continues to press against near-term resistance. Sellers have been unable to push Solana lower. It’s as if Solana is magnetized to the top of the Cloud. Almost zero time is spent with any meaningful distance between the close and the daily Senkou Span A.

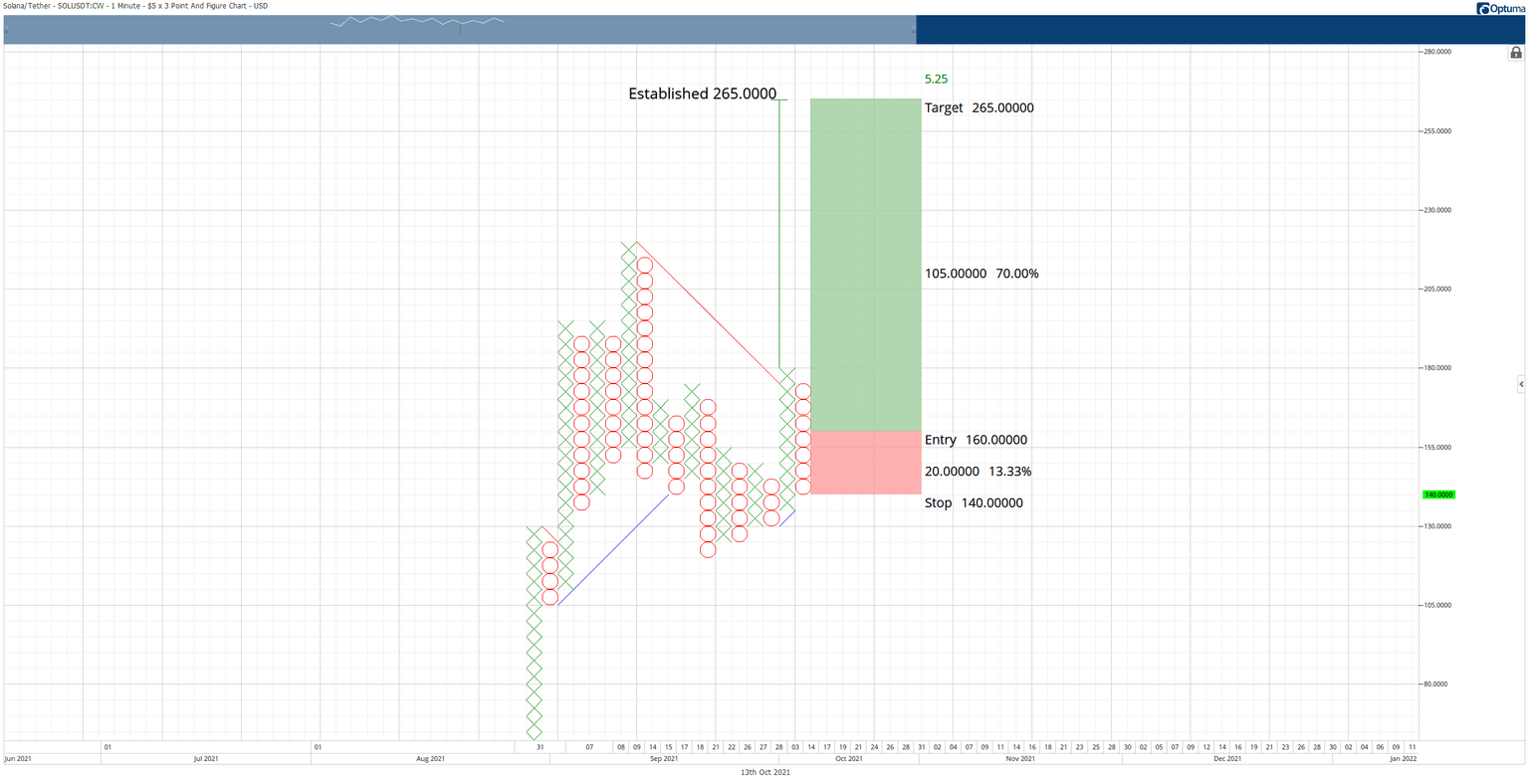

Solana price awaits a $160 entry before jumping to $265

Solana price action on the Point and Figure chart image below may look bearish at first glance. However, it’s technically in a bullish continuation pattern known as a Pole Pattern. The Pole Pattern entry off the current O-column is at $160. The entry is vital because it is the first re-entry since the prior X-column broke above the dominant uptrend angle. The first bullish entry after the first pullback is often intense and can be sustained for quite some time.

As buyers begin to take over, sellers will continue to look for short opportunities. Bears will want to observe the initial entry at $160 and any weakness from the initial entry. The black trendline on the Point and Figure chart shows where bears could easily take over and create a very probably flash crash even after catching so many buyers in a bull trap.

While momentum currently favors buyers, bulls should not be complacent. The price structure on the Solana price Point and Figure chart is one where any complacency could trigger a massive sell-off. Watch specifically if there is any close below the $125 level as it could accelerate losses.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.