Solana price needs to break $112 to mark the end of the downtrend

- Solana price has not yet retested the bearish invalidation level.

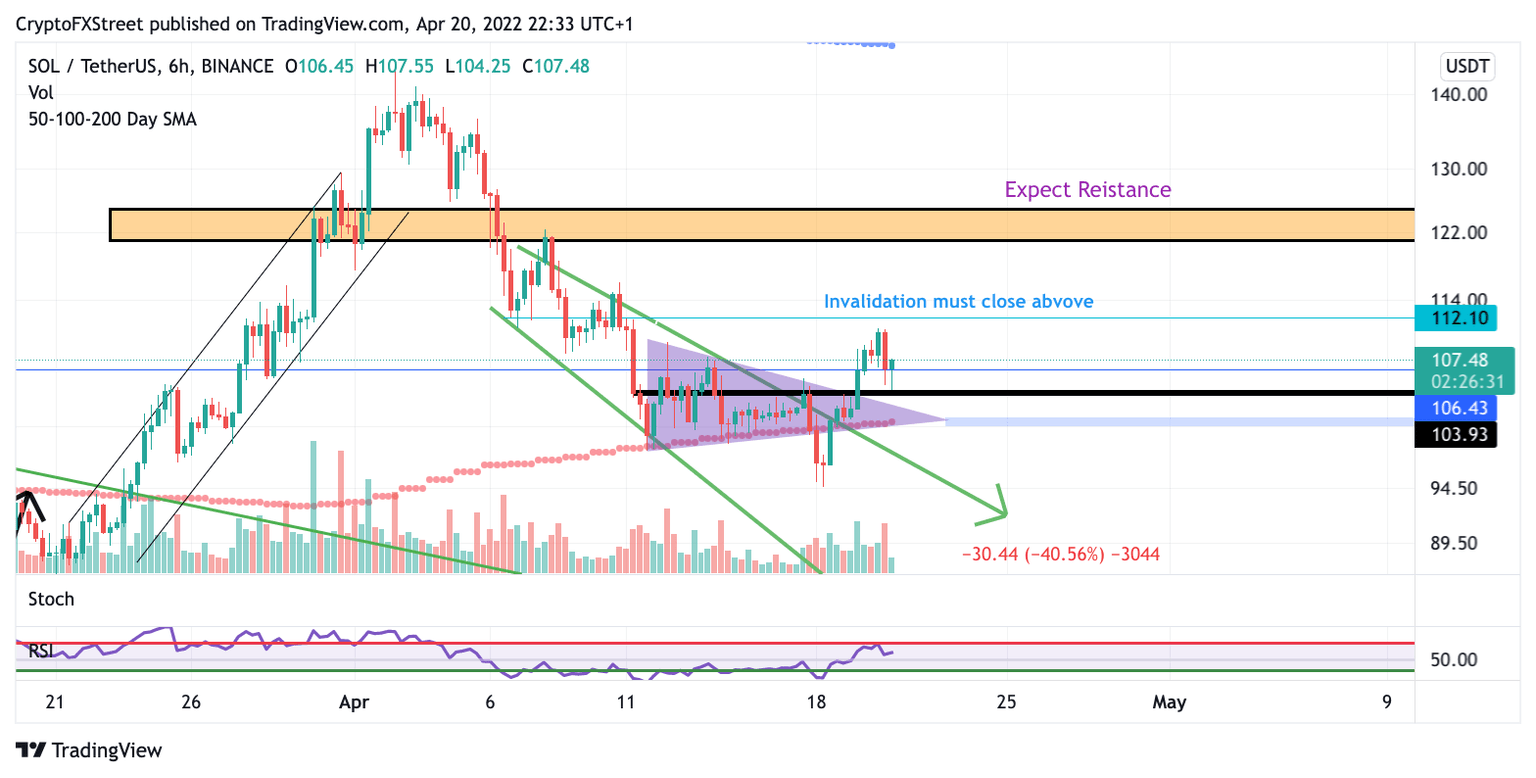

- SOL price is retesting a breached triangle pattern.

- Invalidation of the bearish thesis would be a break above $112.

Solana price is inching towards an end of correction confirmation. Risking money in SOL price is considered a high trade risk until the breach at $112 occurs.

Solana price says wait for confirmation

Solana price is seeing a significant resistance as the price failed to breach the $112 invalidation level of last week's bearish thesis. The counter-trend rally that occurred this week is certainly being considered while assessing the "Centralized Ethereum Killer" however, the best scenario for the uptrend has not yet occurred.

Solana price currently trades at $105 and is experiencing decent pressure from the bears.

The SOL price is likely to retest the triangle's apex in the days to come at $101. Solana enthusiasts could take a bite out of prices at this level, but the entry will be considered high risk. Solana price needs to break the previous $112 consolidation zone to confidently say the correction is over.

SOL/USDT 6-Hour Chart

If this bullish scenario occurs, the downward correction will be over. The SOL price could rally towards $120, followed by another pullback. Analysts will then look to join the future uptrend to ride the Solana price back to $150, resulting in a 40% increase from the current SOL price.

Author

FXStreet Team

FXStreet