Solana price bears staggering 70% loss between high and low of November

- Solana is printing a fresh yearly low this Tuesday as crypto markets are rattled again.

- SOL slips below the $12 threshold and could flirt with single-number prices.

- At risk is another 40% decline toward the next important multi-year low.

Solana (SOL) price is imploding again as November is set up for its worst-performing month ever, as the FTX chapter could be the final chapter for SOL if this sell-off continues. Risk comes as two other cryptocurrency services signal near default as they run out of cash with failed attempts to raise it. Another corpse is falling out of the closet, which makes SOL a Lehman Brothers-type stock.

SOL: biggest victim in the crypto purge

Solana price action this week must give traders the feeling they are watching a scary movie. Take your pick between Halloween, Scream or The Purge. Traders and investors are backing away from cryptocurrencies as a violent storm is hovering in its asset class where several parties are looking to one another, afraid of cooperating as anyone could be the next victim and could not be there the next day as a massive cash exodus continues.

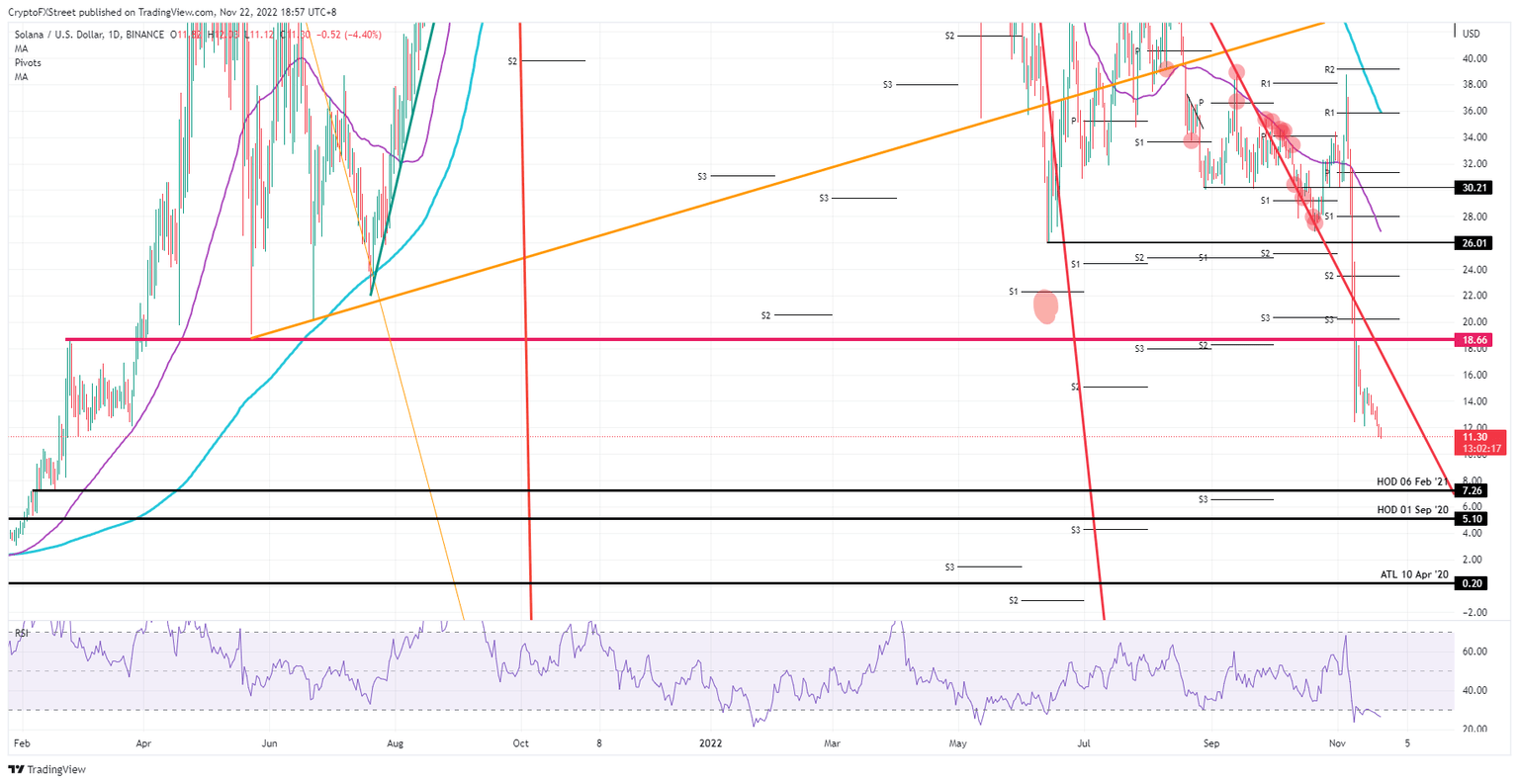

SOL's current performance for November comes with a whopping 70% loss, and the bottom has not arrived yet. As with Socrates, SOL will need to drink up the poison cup and see its value trade around $8, near the low of February 6, 2021. That means roughly another 40% decline, totaling an 80% decapitation in just 17 trading days.

SOL/USD daily chart

A big catalyst, or white knight in shiny armor for that matter, is the only element that could create a tight turnaround in this string of developments. Should a consortium of banks step in and incorporate a few cryptocurrency holdings, place them under due diligence and necessary financial restrictions known in equities and other asset classes, that would bring some stability and return of confidence in the much-battered asset class. SOL would quickly pop back above $18.66 and next reach $26.01, erasing a large chunk of the incurred losses for this month.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.