Solana launches the Mesh program for DAOs as SOL price foreshadows a 12% climb

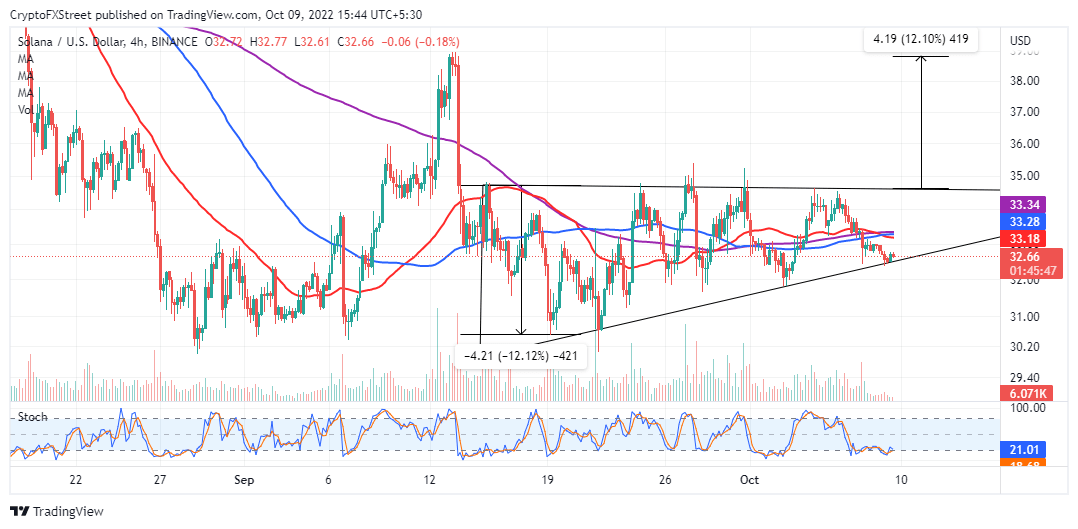

- Solana price needs to close the distance to $33.34 ahead of a potential rising triangle breakout.

- Solana announces Mesh; a new program specifically built for DAOs and institutions.

Solana price is assessing the possibility of a bullish breakout to usher in the new week. The competitive smart contracts token has continued to trend north of its support at $30.00, but recently it has been challenging for bulls to clear the seller congestion at $35.00. If the rising triangle pattern confirms a breakout in the next few days, SOL price might rally 12% to tag $39.00.

Solana launches its Mesh program for DAOs and institutions

Solana announced the release of Mesh – a new program tailor-made for DAOs (decentralized autonomous organizations) and institutions. The idea was to make it part of the Squads Multisig Program Library.

The Mesh allows organizations to develop hierarchies or several interdependent structures with multiple multisigs. According to Solana, "multisigs deployed through Mesh require external authority approval to change threshold or alter membership." Another multisig or governance token could host the said authority.

Furthermore, organizations looking to trade on-chain or manage programs and/or protocols can employ the Mesh to deliberate on their internal structures by putting up an equivalent of a "management multisig" to hold the authority of various "employee multisigs."

Solana price is moving toward a major bullish move

Solana price is doddering at $32.85 at the time of writing while buyers battle selling pressure at $33.00. The 50-day SMA (Simple Moving Average), red and the 100-day SMA, blue, are in line to prevent further upward movement at $33.20 and $33.31, respectively.

However, the Stochastic oscillator affirms that SOL is in the bulls' hands. Besides, the index is making a positive divergence from the price; it has lifted from the oversold region and heading toward the midline.

SOL/USD four-hour chart

The ascending trend line cements the bulls' presence in the market, but the x-axis represents the dominant selling pressure around $35.00. Traders must hold on for SOL price to crack this resistance before activating their long positions. For those who prefer to lock in early profits, $35.00, $37.00, and $39.00 are potential exit positions.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren