Ripple price underpinned as bulls target jump back above $0.50 as short-term target

- Ripple price sees bulls getting involved with the price action on Monday.

- XRP is primed for a leg higher as a bullish squeeze gets underway.

- Expect to see a jump above $0.50 with a possible 15% gain in the books.

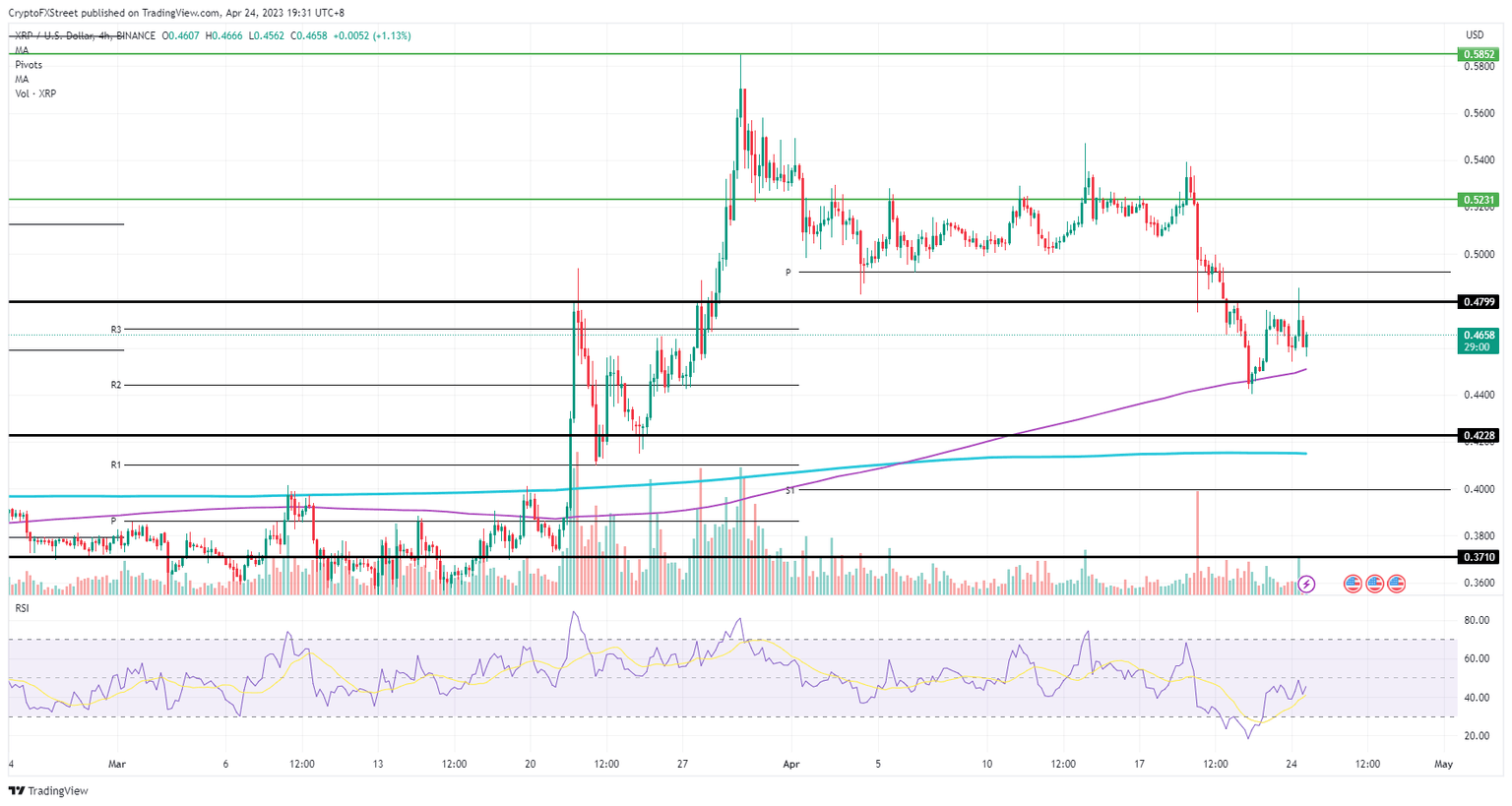

Ripple (XRP) price has bulls gearing up on Monday to outweigh the bears in the current price action. XRP has been showing that its price action is being underpinned by the 55-day Simple Moving Average (SMA) that is ascending, and higher lows confirm the bullish forces. Throw in that mix a Relative Strength Index (RSI) that is sub-50, and traders have the perfect setup for a 15% profitable trade.

Ripple price bound to head north

Ripple traders and bulls have had a rough patch since last week as XRP has dropped 20% in its performance. There is a silver lining though as price action gets underpinned with the 55-day SMA that has been halting the decline and then triggered a bounce higher. Additionally to that, the bullish forces can be shown with higher lows constantly since Saturday.

XRP is thus primed for a squeeze higher as bulls are taking over the control of the price action from the bears. Add in a favor to the bulls in the form of a subdued RSI with plenty of room to the upside, and it almost looks inevitable that price action will pop higher for Ripple. Once $0.48 gets broken to the upside, a quick jump toward $0.52 is the ideal scenario, bearing a near 15% gain alongside it.

XRP/USD 4H-chart

Never exclude a dead-cat-bounce out of the possibilities as some key levels to the upside need to be broken still. Already mentioned above is that $0.48 level that could prove to be too strong of a cap and push price action back to the lower ends of April. A 10% slide would be the result if the 55-day SMA breaks under pressure and the 200-day SMA needs to step up its game in order to catch the falling price action for Ripple.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.