Ripple price sees investors bracing for Powell late Wednesday with $0.44 in the cards

- Ripple price jumped over 1% again this morning after an upbeat trading day on Tuesday.

- XRP sees bulls hammering on the monthly S1 support to break it down.

- Expect to see bulls ramping up the rally towards $0.4228 with the Powell speech as a catalyst to break above it.

Ripple (XRP) price will see traders mainly focusing on the Powell speech later today at the Brookings Institution. With many questions being raised and Fed members contradicting one another, markets will be hanging on every word coming from Powell’s mouth to get a clearer view of what the path will be going forward. Any dovish indications will fire up markets, with equities and cryptocurrencies in tandem rallying substantially higher. Fasten your seatbelts!

XRP needs to know how to trade the Powell speech

Ripple price is on the cusp of making one of its biggest moves to the upside today as traders are looking forward to hearing from Fed chair Powell as he will be one of the last speakers before the blackout period begins in the wake of the Fed FOMC meeting on December 14. The best way to trade this event is to know how or what will happen, and that approach comes by monitoring some Twitter sources via a tweet deck or having a squawk setup that will shout out the headline news for you. The speech will be released in a few minutes or even at the moment Powell is taking the stage, which will move markets before he even has said one word.

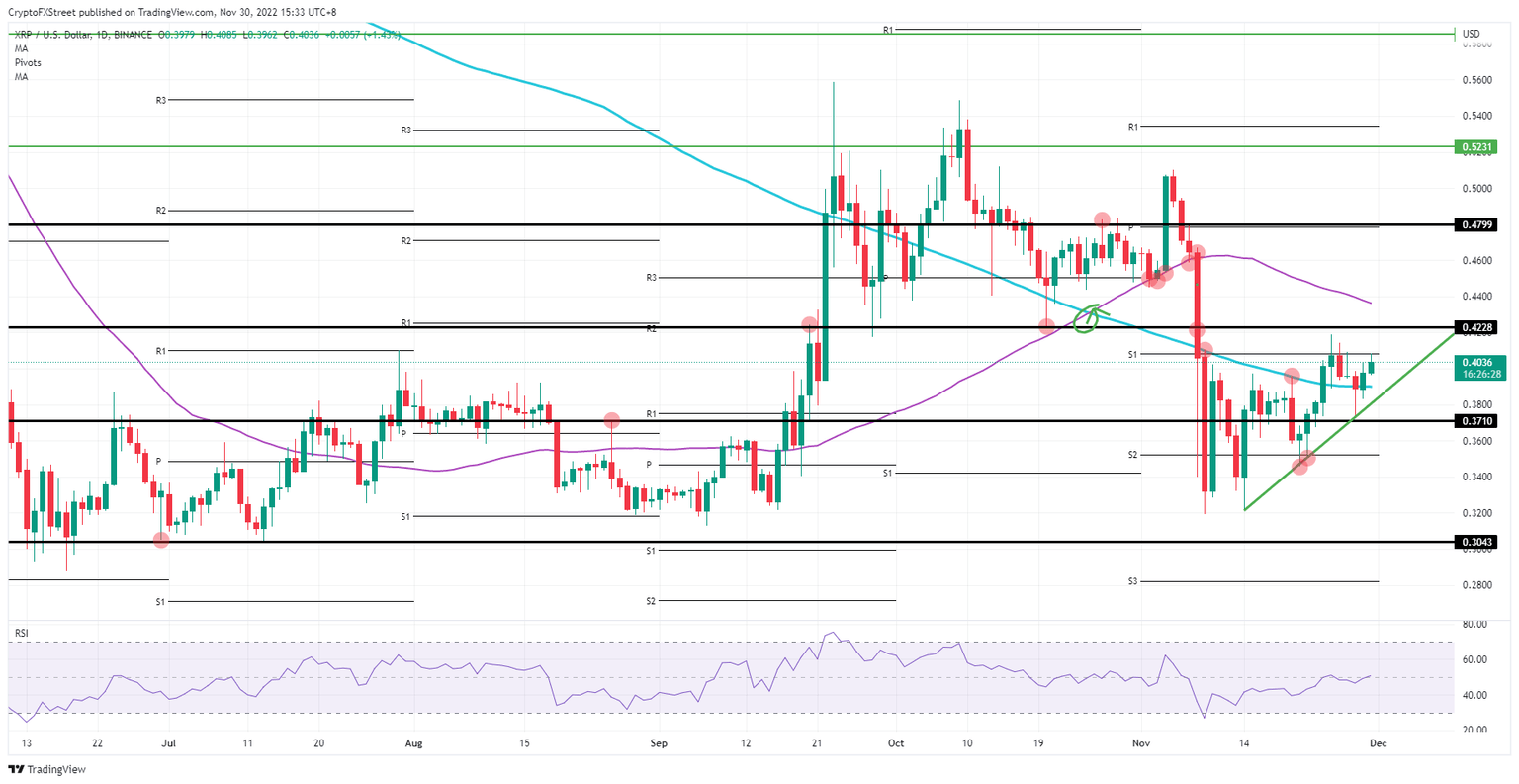

XRP thus will see inexperienced traders chasing the move, while experienced and prepared traders will be in the trade already. Expect to see the tension build up in the run-up, as bulls are already aiming for the monthly S1 support level as we speak and could hit $0.4228 near the US opening bell. The Powell speech will act as a catalyst, should some dovish undertone be retained from his speech, triggering an 8% rally toward $0.44 with the 55-day Simple Moving Average as the price cap.

XRP/USD daily chart

Risk to the downside comes with this buy-the-rumor-sell-the-fact trade setup. As several analysts will be heard on Bloomberg television and other channels, XRP will already be trading at elevated levels near the speech itself. Should the speech bear a hawkish surprise, an immediate unwinding would happen of all the long positions taken throughout the day. XRP would fall against the green supportive trend line and flirt with a break to the downside toward $0.37.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.