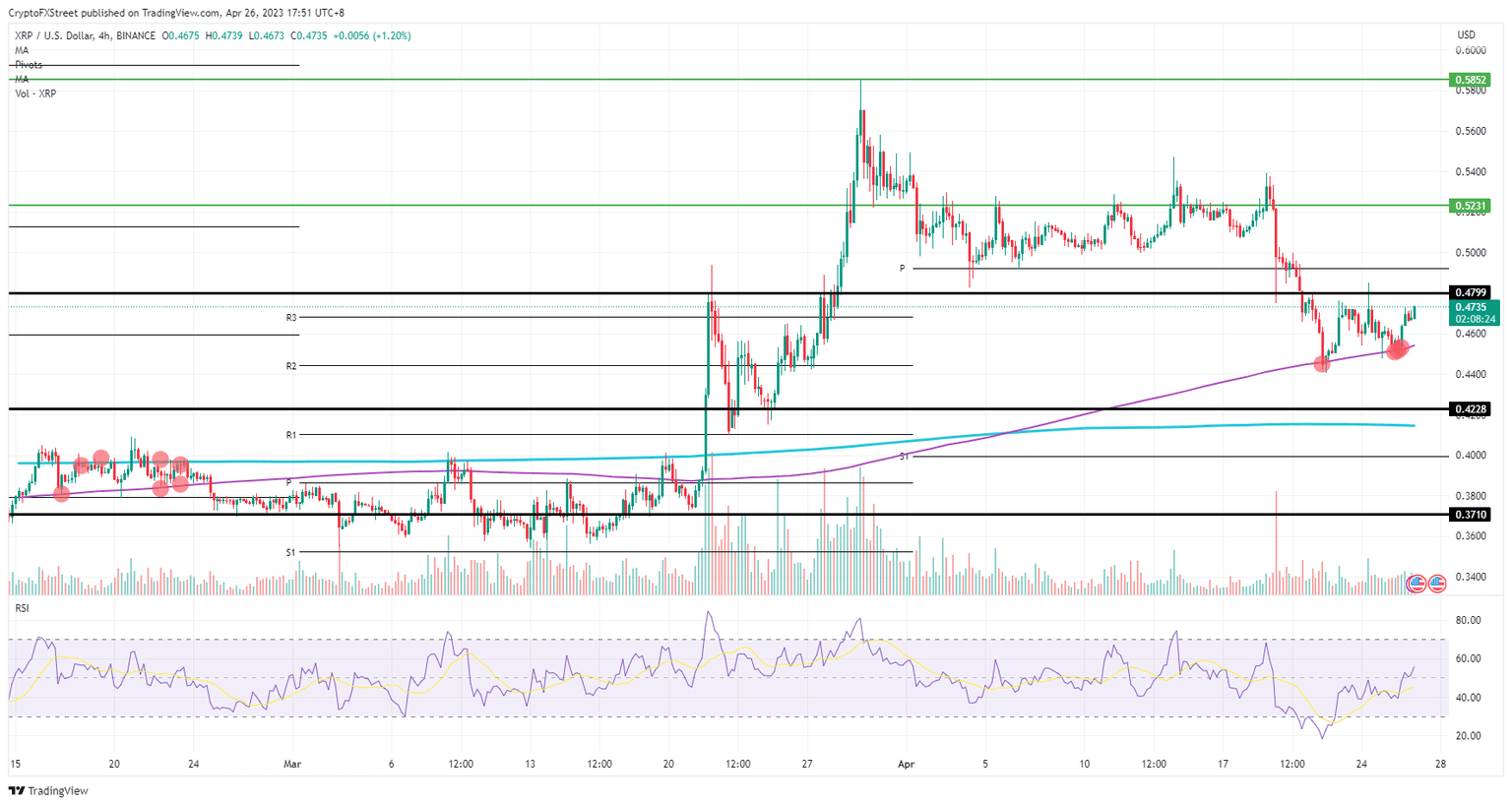

Ripple price reveals a line in the sand as the only way is up for XRP with a 25% appreciation

- Ripple price has bears breaking their teeth on an important moving average.

- XRP sees bulls overpowering bears as a squeeze is underway.

- Expect once bulls pop back above $0.48, the road is paved for $0.58 on the topside.

Ripple (XRP) price saw bears attempting to stage a coup on the price action as they tried to run price action below the 55-day Simple Moving Average (SMA). Expect a few false breaks; bulls kept their act together and did not hand bears the room to head towards $0.42. With some shifts in tailwinds coming from tech stocks, cryptocurrencies are on the front foot, and XRP signals an imminent bullish breakout that values Ripple price 25% higher.

Ripple price to pop massively

Ripple price was under pressure from the bears as price action was heading lower over the weekend with a price target projected to near $0.42. Instead, bears crashed each time into a massive wall of buying orders as bulls were defending the 55-day SMA all over the weekend and at the start of this week. With bulls having enlarged their stake massively in the price action, XRP is primed for a massive breakout.

XRP bears must be looking a quite some substantial losses as even a few false breaks got triggered, which is opening up room now for a beartrap. Expect those bears to switch sides soon and be forced to buy XRP in the market to close their losing positions. This will trigger a massive overdemand and could see XRP peaking towards $0.58 very soon.

XRP/USD 4H-chart

One element in the way of this bullish trade idea is at $0.48, which could be proven to be a resistance level as it did on Friday after a test to the upside got met with a firm rejection. Another rejection could be enough to break the 55-day SMA and head toward $0.42. In this scenario, this time, bulls would be forced to sell their stake and trigger a razor-sharp decline in that process with a 15% loss at hand.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.