Polygon price set for a breakout, although the topside looks limited

- Polygon price sees bulls ignoring bearish signs from central bank officials, as European and US traders are more bullish than Asian participants.

- MATIC price is set to pop above the 55-day SMA and pivot to $0.90.

- Although this breakout would be very bullish, the topside is limited, with only 6% gains on the table.

Polygon (MATIC) price recovered a few percentage points from its lows after the beating it took on Tuesday. The rebound was somewhat expected given that as a rule-of-thumb in 90% of the cases, a partial recovery occurs after a broad sell-off session. ASIA PAC traders were poised to continue the downfall; European and US traders look to be more positive as the energy crunch starts to stabilise in Europe, and Ukraine is set to yet again book gains on the battlefield with the tides of war turning a bit against Russia.

MATIC price sees EU and US traders try to turn the tide

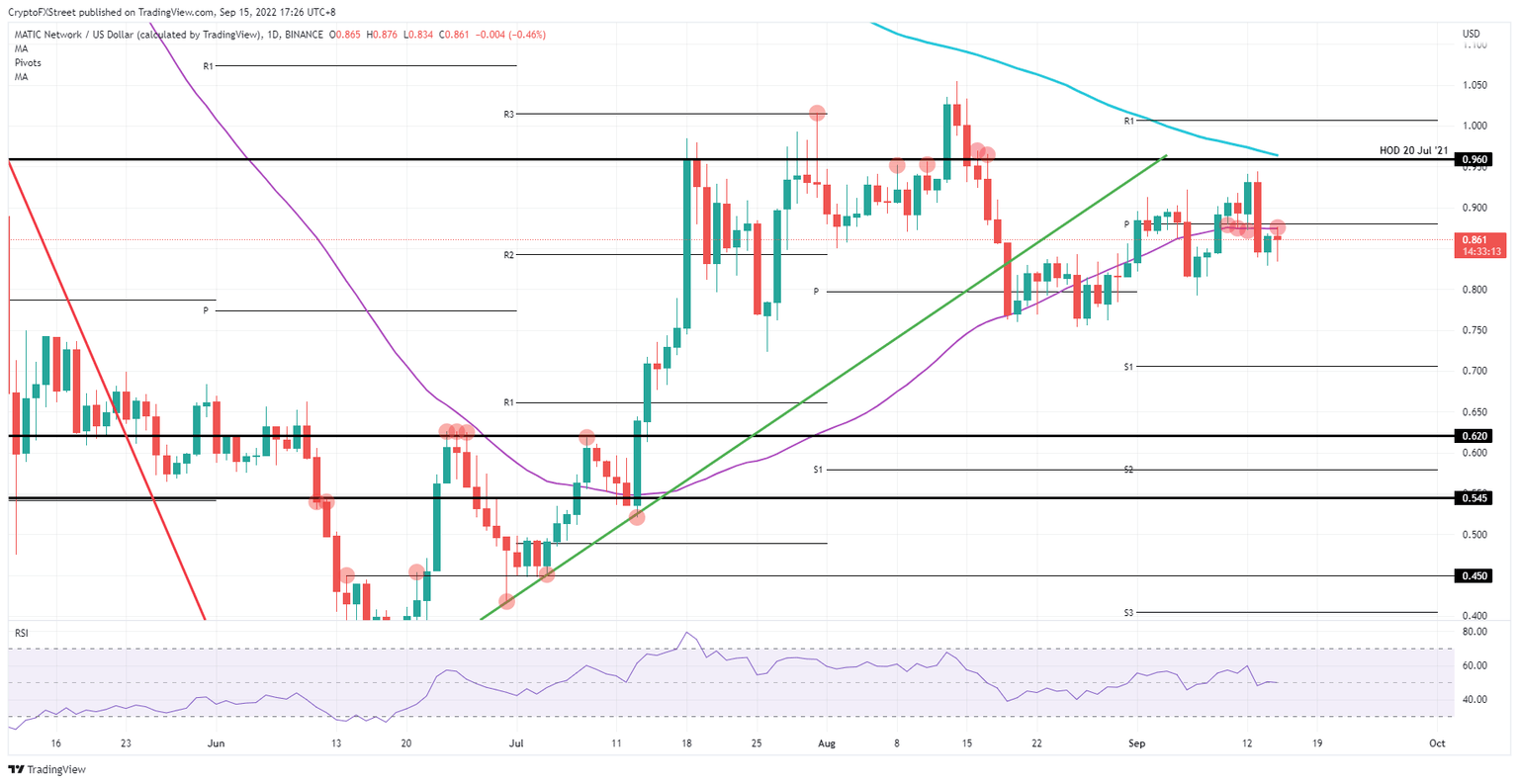

Polygon price remains under pressure from the 55-day Simple Moving Average (SMA) and the monthly pivot currently providing a ceiling for the bulls. Although the ASIA PAC session was quite negative, the European and US traders look to be more positive and focus on the silver lining, with left and right a few positive signals on the energy crunch and from the battlefield in Ukraine. With that in mind, a squeeze to the upside looks to be unfolding.

MATIC price could see a breakout above $0.88 towards $0.90 today should EU, and US traders keep pushing for a rally. Although that rally might look promising, do not be fooled to get in and sit tight for an extensive advance. The rally will likely only bring roughly 6% of gains as, quite quickly, bulls will be facing a bearish fortress at $0.96 with a historic pivotal level and the 200-day SMA coming in from above.

MATIC/USD Daily chart

A downside scenario could emerge if US equities roll over again, and team stocks closes firmly in the red towards the closing bell. That would point to the fact that the positive sentiment from this week has been broken, dragging cryptocurrencies down with it. From there, expect to see a decline in MATIC price to $0.80.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.