The unfortunate truth about Polygon's MATIC price that traders aren't seeing

- MATIC price has risen 195% since June 18.

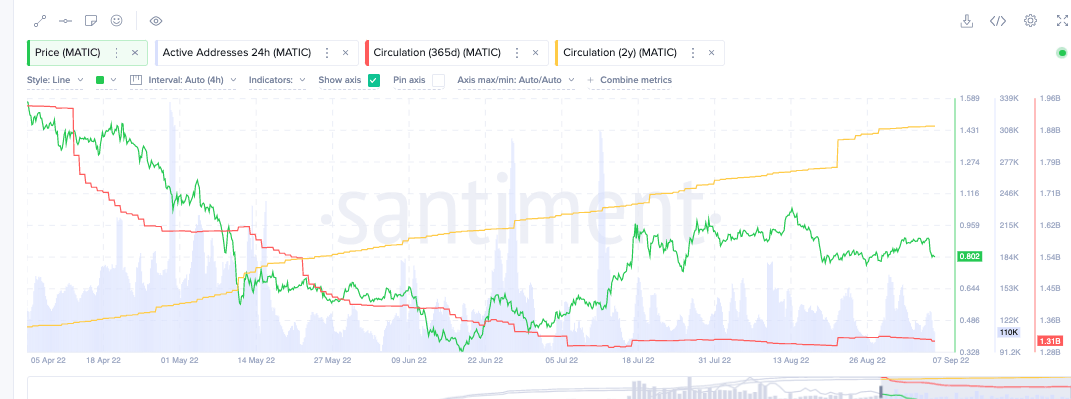

- The 2-year circulating tokens indicator shows a recent influx of 9 billion tokens entering the market during the final week of August.

- Invalidation of the bearish thesis could be a reattempt at the $1.04 price level.

MATIC price shows a concerning signal underneath the hood that traders solely using technical analysis are unaware of.

MATIC price has a decision to make

Polygon's MATIC price has been one of the best-performing crypto assets this summer. Since June 18, the Ethereum gas-fee solution token rallied an impressive 195%. While the MATIC price shows underlying bullish technicals, the on-chain analytics is a different picture of what could lie for the future MATIC price.

MATIC price currently auctions at $0.80 as the self-proclaimed Ethereum killer token is down 20% since the summertime high at $1.04. The Volume Profile indicator shows a persistent tapered reading signaling traders are still holding their positions in anticipation of more profits in the future. Santiment’s Active Wallet’s Addresses Indicator confounds the hodl idea as active wallets are also fading out amidst the downtrend.

Despite the optimistic technical,s there are some metrics underneath the hood that warrant concern. For instance, during the final week of August, Santiment's Token Circulation indicators showed an uptick of 9 billion tokens being moved. The uptick in movement is significant because cryptocurrencies tend to experience sharp liquidations when whales start moving dormant tokens.

Santiments’ Price, Active Addresses, Circulation and 2-year Circulation Indicators

The 9 billion tokens increased the 2-year circulating supply to new all-time highs of 1.85 billion tokens. In theory, the 9 billion tokens have been dormant, resting in a high-cap investor's possession, and now the owners may be getting ready to sell the digital asset.

If the trend steers in favor of the on-chain metrics narrative, an additional plummet to $0.64 can occur. Such a move would result in a 20% decrease in the current market value. The invalidation level could be the summertime high at $1.04.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.