As the top 3 crypto’s rally, Polygon’s MATIC remains sidelined

- Polygon price is down for today as price action tumbles since Sunday.

- MATIC price is underpinned for now, but support looks like it is starting to crack.

- Expect a possible drop to $0.80 and a near 10% decline.

Polygon (MATIC) price is trading sideways early this morning after a gloomy day on Sunday. Although it looks like bulls might be storming out of the gates after Bitcoin printed over 10% on Friday, the spread and deviation between the top three cryptocurrencies and alt-coins could not be bigger. It is quite clear that hedge funds are solely buying into the top three and not the whole spectrum of the crypto market.

MATIC falls out of the boat for hedge funds

Polygon price sees big bets being placed this morning as markets focus on two elements , on one hand, some dollar weakness that got triggered in the ASIA PAC session and, on the other, risk on in the markets as equities are heavily bid. The two factors emerged after headlines that mentioned that Ukraine is winning the war as it regained some important technical regions and pushed Russia back into a corner. Although this is perceived as good news, only Bitcoin and equity markets are getting a lift from the news, while MATIC fails to see substantial inflows.

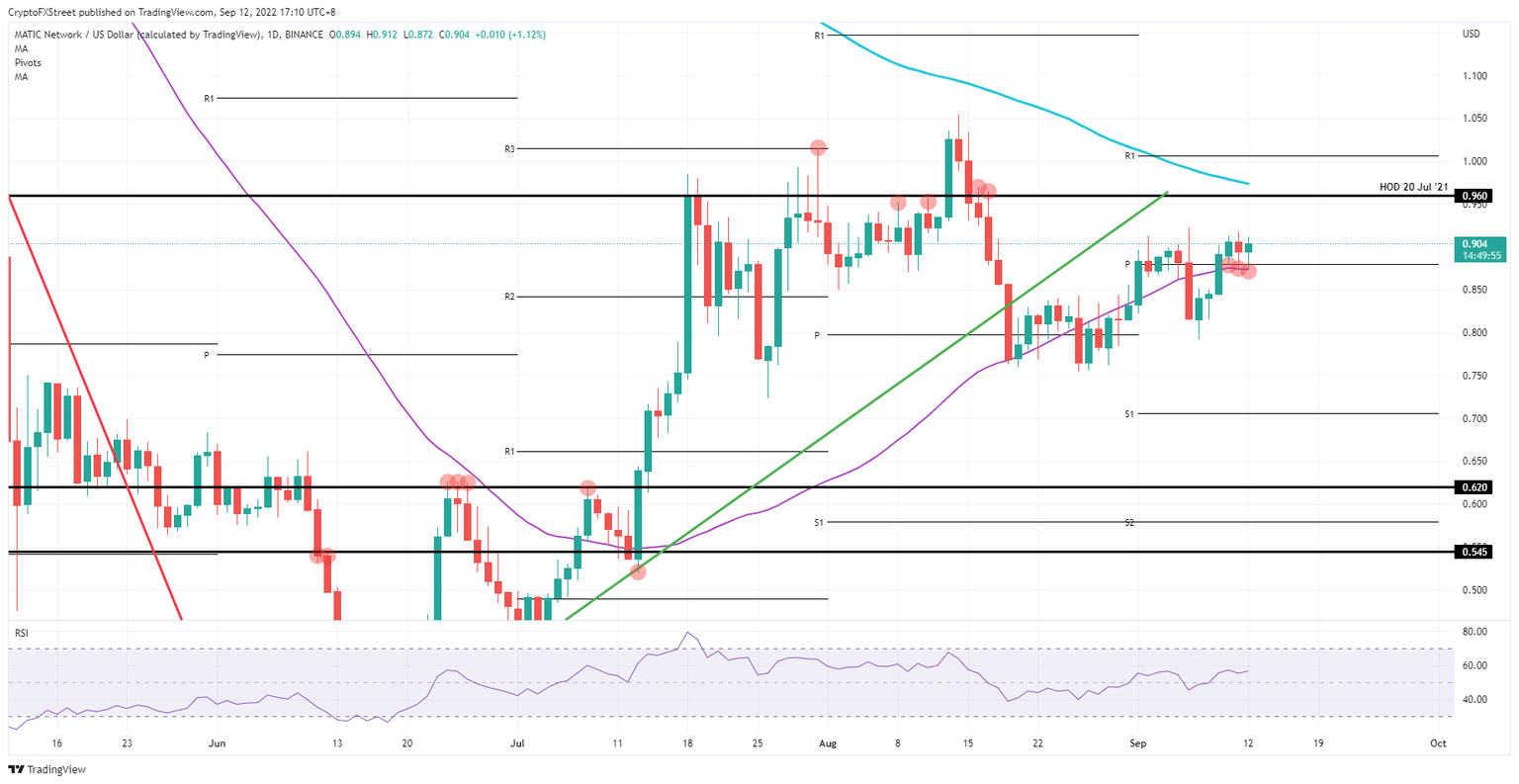

MATIC price thus could go either way today as the price action remains underpinned by the 55-day Simple Moving Average (SMA). The risk is that price action faded after the high on Sunday and needs to print a new high today not to trigger some selling pressure onto the same 55-day SMA. Should the MA break, expect a sharp decline towards $0.80 as the nearest support level to catch any sell-offs.

MATIC/USD Daily chart

With the price action still underpinned and the Relative Strength Index (RSI) not far off from the overbought area, bulls could be seen eking out those last portions of gains to the upside. The high of July 20, 2021, is nearby at $0.96. That would mean another 7% of gains has prospected, with the 200-day SMA coming in from above as a cap on the price action. At the same time, limited gains could still be available before MATIC is pushed into oversold and then steps back to the downside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.