Polkadot price sees bulls taking a knee over crypto turmoil with 9% slide forecasted

- Polkadot price keeps trading in a bearish pattern.

- DOT could soon see bulls evacuating the current price area in search of a better deal lower.

- A better entry level is offered nearly 9% lower at $5.30.

Polkadot (DOT), Cardano and other altcoins are all plagued by the next big element that could trigger an existential crisis for the crypto industry. With payment service provider Silvergate exiting the crypto industry, the payment service network is at risk of breaking down. After FTX and Terra's LUNA, this could be that one crisis too many for investors to bear, leading them to evacuate their cash out of altcoins.

Polkadot price bears risk of nosediving if sentiment takes another cut

Polkadot price sees investor sentiment wobble again. Since last week, traders are bracing for another brief negative market shock in the altcoin space. The reason this time is not because of FTX or a stablecoin collapsing but an important payment service provider pulling out of cryptocurrencies. With that service provider folding up its tent and leaving the crypto industry under rumors of bankruptcy, money transfers could become very uncertain, with fund transfers unguaranteed of ever arriving at the right crypto-exchange or portfolio company.

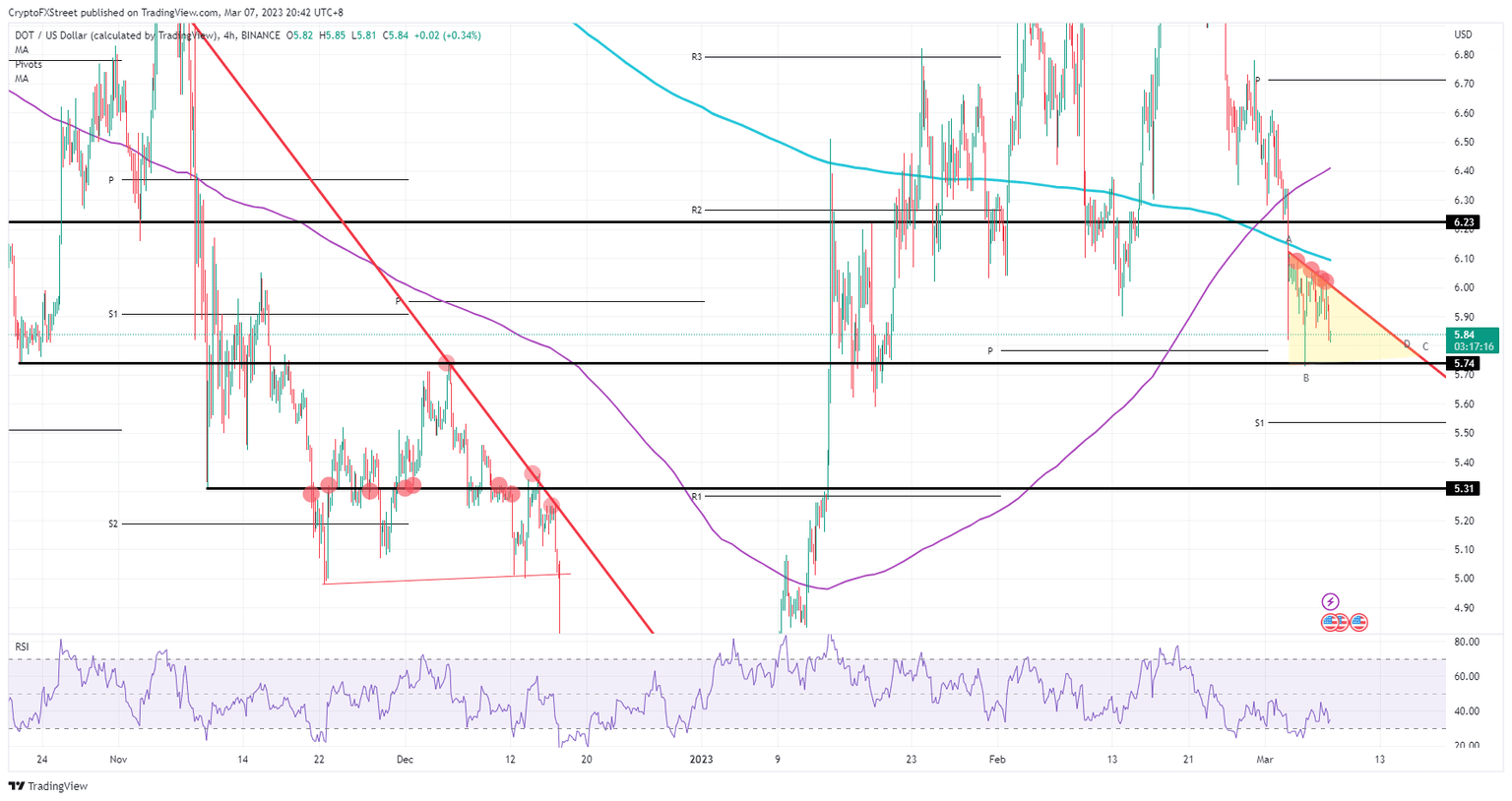

DOT, meanwhile, has been trying to break out of a bearish triangle, while the Silvergate news is not helping at all. Expect another squeeze to the downside with a test and break of $5.74. That opens the road for another sell-off toward $5.31 with bulls ready to start buying into the price action as the Relative Strength Index (RSI) will have deepened into oversold territory.

DOT/USD 4H-chart

Should some tailwinds emerge with another service provider stepping up to fill the gap that Silvergate left, a quick test back at the red descending trend line could be granted. A breakout trade would see some follow-through toward first $6.10 near the 200-day Simple Moving Average. A pivotal level higher at $6.23 could be in reach for bulls but looks rather unlikely due to the current narrative.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.