MATIC Price Forecast: Polygon positioned to retest all-time high as Polystarter launches

- MATIC price retests a critical support area that could propel it upward by 51% to tag the all-time high at $2.70.

- A further spike in buying pressure could propel Polygon by 20% to $3.232.

- Polystarter receives backing from Polygon, a decentralized launchpad.

MATIC price looks ready to bounce after it tagged a crucial demand barrier. With the recent development of a platform that supports projects built on Polygon, a test of the all-time high or a record level seems likely.

Polystarter to accelerate growth for Polygon-based projects

Polygon is known for its developments and a plethora of partnerships over the past years, which has helped many projects scale on Ethereum. In a recent announcement, MATIC, the blockchain that provides L2 scaling solutions, announced backing for the launch of Polystarter, a decentralized fundraising platform for projects built on Polygon.

The newly unveiled Polystarter consists of teams from the MATIC project and aims to overcome early-stage projects’ hindrances.

The blog further reads,

In addition to being a decentralized fundraising platform, we will also enable the projects to access an array of solutions including marketing support, advisory and technical support from a network of ecosystem partners and prominent stakeholders.

More details on the project, including the whitepaper, technical roadmap, future milestones, etc., are yet to be released.

MATIC price eyes a higher high

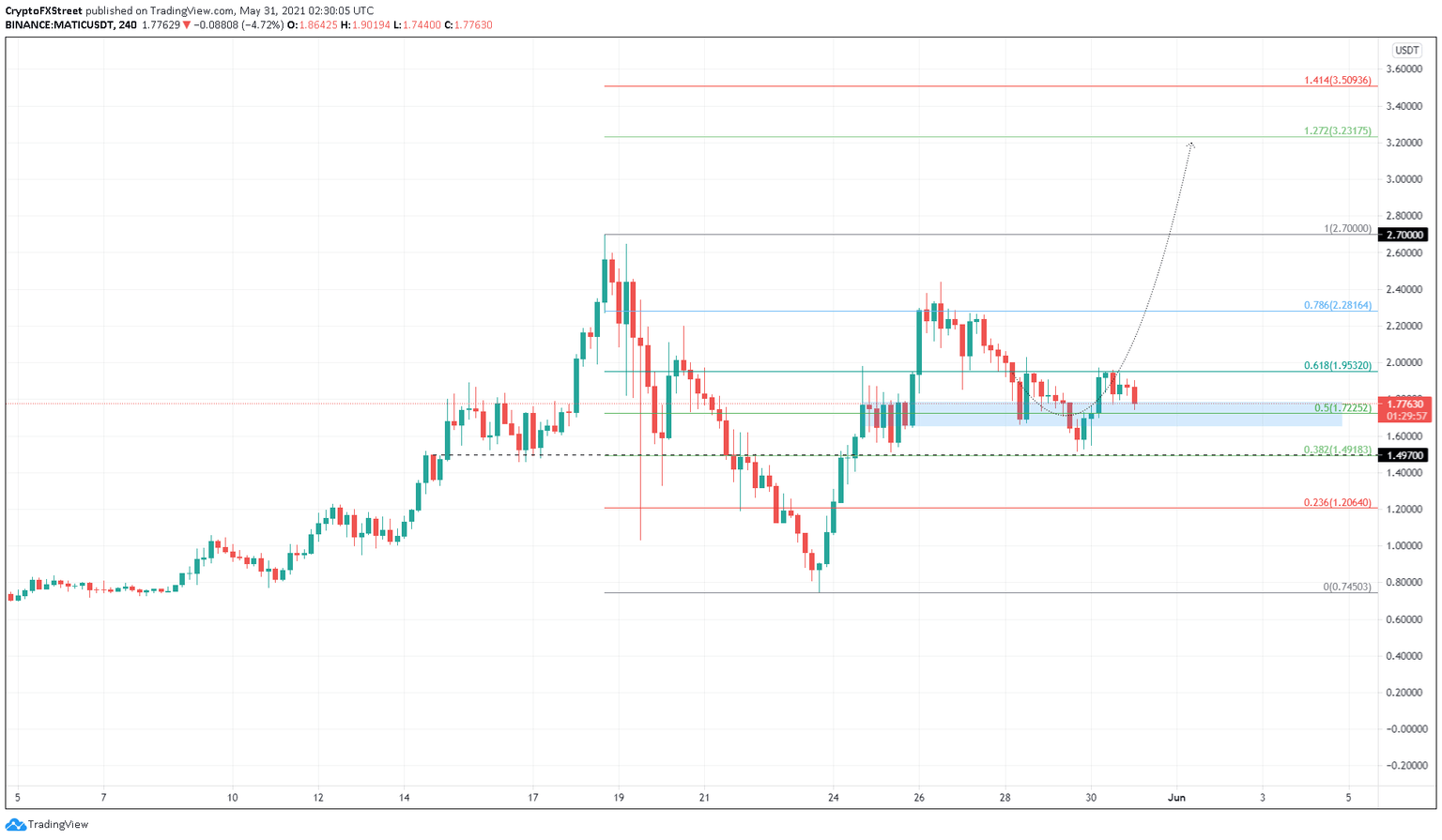

MATIC price is currently testing a demand zone that extends from $1.652 to $1.783. A decisive 4-hour candlestick close above the 61.8% Fibonacci retracement level at $1.953 will signal the start of an uptrend.

In that case, Polygon could rally nearly 25% to retest the recent swing high at $2.438 on May 26. Following a breach of this, MATIC price could retest the all-time high at $2.70.

If the bid orders continue to pour in, the L2 scaling token’s market value could likely surge an additional 20% to test $3.232, the 127.2% Fibonacci extension level.

MATIC/USDT 4-hour chart

On the flip side, if the MATIC price breaks down the 38.2% Fibonacci retracement level at $1.492, it would signal a bearish breakout. In that case, Polygon could slide 20% to tag the 23.6% Fibonacci retracement level at $1.206.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.