MATIC Price Prediction: Polygon bulls rest, but prepare for 50% advance

- MATIC price is undergoing a correction after a 61% bull rally since May 25.

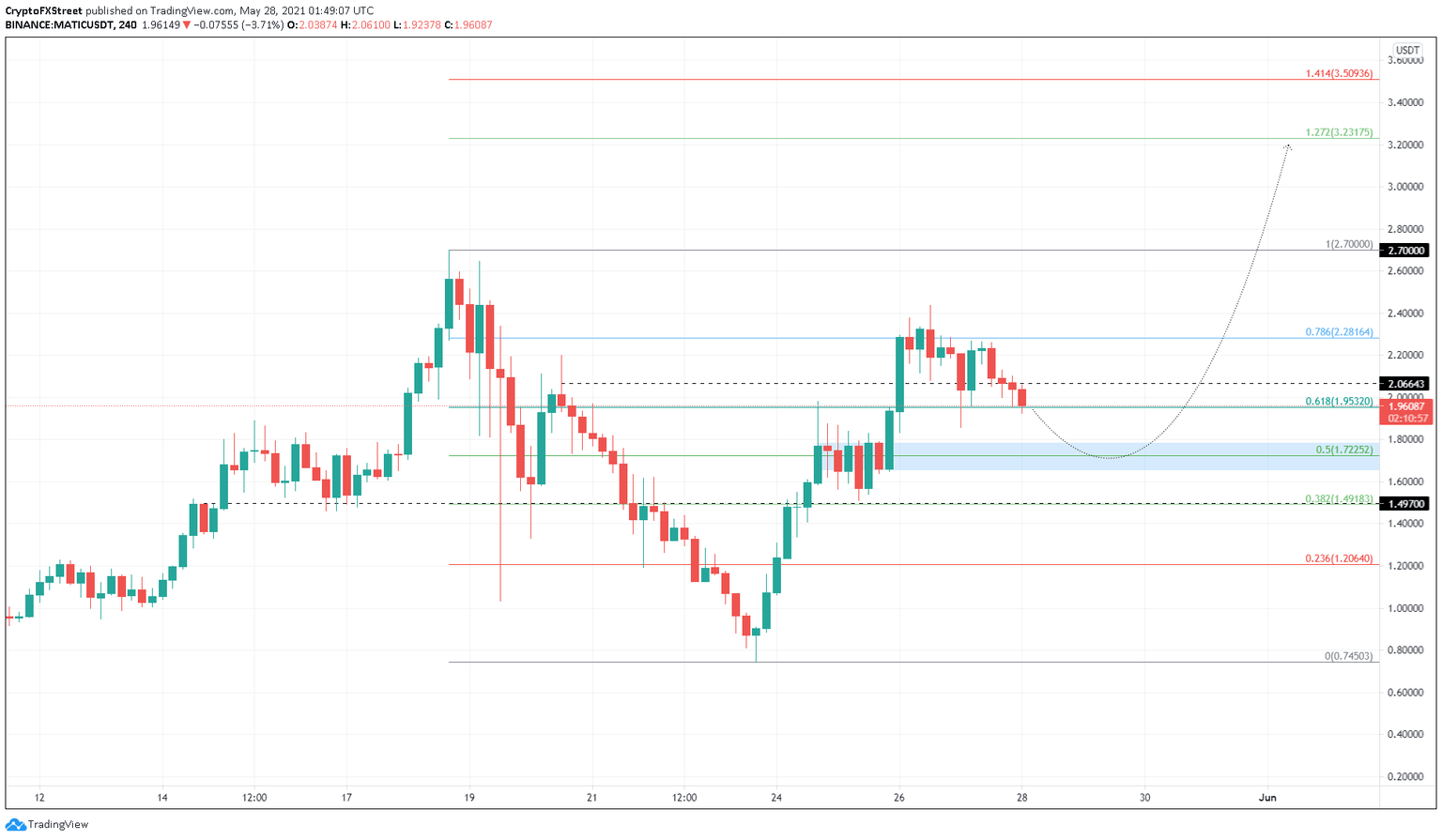

- A retest of the 50% Fibonacci retracement level at $1.722 is likely to trigger an explosive uptrend.

- If Polygon breaks down $1.49, it will invalidate the bullish thesis.

MATIC price shows the exhaustion of bullish momentum after a massive ‘up only’ rally since hitting a local bottom on May 23. Now Polygon is likely to retrace to stable support levels before kick-starting another leg up.

MATIC price pulls back for a higher high

MATIC price created a swing high at $2.44 on May 26 and has retraced nearly 21% since then to the 61.8% Fibonacci retracement level at $1.95. Although unlikely, a bounce from $1.95 could restart the uptrend, but it is unlikely to have a massive buying pressure backing it.

However, a pullback to the 50% Fibonacci retracement level at $1.72 will have the most oomph for a potential uptrend, since it coincides with a demand zone that extends from $1.65 to $1.78.

Assuming this pullback does arrive, investors can expect MATIC price to rally 40% to retest the recently set up swing high at $2.44. Following a breach of this level, Polygon could climb an additional 10% to retest its all-time high at $2.70.

If the bullish momentum continues to pour in, MATIC price will ascend 20% to tag the 127.2% Fibonacci extension level at $3.23.

MATIC/USDT 4-hour chart

Regardless of the demand zone, if the MATIC price produces a decisive close below $1.50, coinciding with the 38.2% Fibonacci retracement level, it would invalidate the bullish outlook.

In that case, Polygon might consolidate here or drop 20% to retest the 23.6% Fibonacci retracement level at $1.21.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.