MATIC price eyes 20% pullback while proposal to deploy Uniswap on Polygon gains traction

- MATIC price hints at a 15% downswing as the $1.51 swing low breaks down.

- This move could push the Layer 2 token to $1.41 and, in dire cases, $1.30.

- Uniswap governance forum saw a proposal that discusses deploying the AMM to Polygon.

MATIC price has been consolidating for the past ten days and hints at a further descent to support levels. This downswing is a result of the violation of a recent swing low and the bearish outlook of the big crypto from a short-term perspective.

Proposal to launch Uniswap on Polygon

Uniswap governance forum saw a proposal to deploy the Automated Market Maker (AMM) on Polygon to reduce the gas fees considerably. With the popularity of Ethereum in the 2021 bull rally and the entry of new investors, the gas fees have skyrocketed. These ‘push and pull’ mechanics have been around for as long as one can remember.

Despite the implementation of the London hard fork and the introduction of Proof-of-Stake mechanics, the cost has not seen a staggering reduction that will allow retail investors to transact on the ETH blockchain without having to pay massive gas fees.

Polygon has become the go-to scaling solution for Ethereum, and other platforms like SushiSwap, Matcha, Aave, Curve, Balancer, etc., have all launched their respective platforms on the Polygon PoS. Since Uniswap has not done the same, this proposal aims to do that.

If successful, this will further add a tailwind to the already bullish fundamentals of the MATIC token. While the adoption of Polygon is bullish from a long-term perspective, the short-term technical outlook for MATIC price shows bearish signs.

MATIC price to return to mean

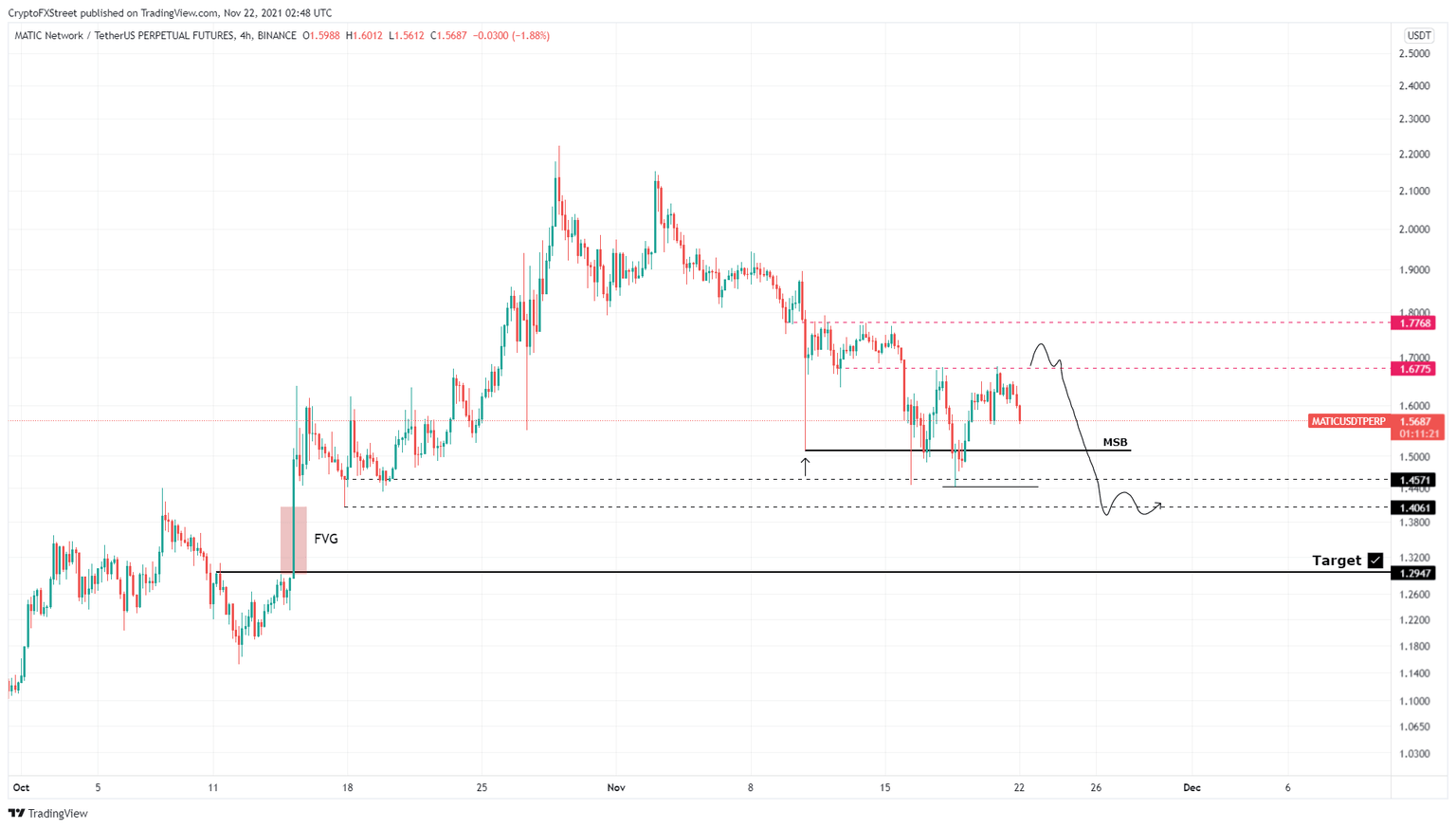

MATIC price breached through the November 10 swing low at $1.51 on November 16. This downswing indicates that the market makers are anticipating the token to head lower. So far, Polygon reacted below the $1.67 resistance barrier and dropped 6.4% to where it currently trades - $1.57.

Going forward, investors can expect MATIC price to continue its descent to retest the $1.45 and $1.41 support levels. While the Layer 2 token will likely consolidate around $1.41, market participants should expect the market makers to drag the token down to fill the Fair Value Gap (FVG).

Therefore, a breakdown of these two barriers should knock the MATIC price to $1.30, constituting a 22% drop from $1.67.

MATIC/USDT 4-hour chart

While the downswing is likely, MATIC price could head higher and sweep the $1.67 resistance barrier for ‘buy stop’ liquidity. If this uptick in buying pressure pushes Polygon to produce a higher high above $1.77, it will invalidate the bearish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.