MATIC price to trigger a 25% comeback rally soon

- MATIC price shows no directional bias as it hovers above the trading range’s midpoint at $1.8.

- Investors can expect Polygon to make a 25% move in either direction and face significant barriers.

- The RSI skews odds in favor of bulls, suggesting a retest of $2.06.

MATIC price has been sloping lower since October 29 and is fast approaching the trading range’s midpoint. A rebound from this downswing is likely to trigger Polygon to climb higher.

MATIC price at make or break point

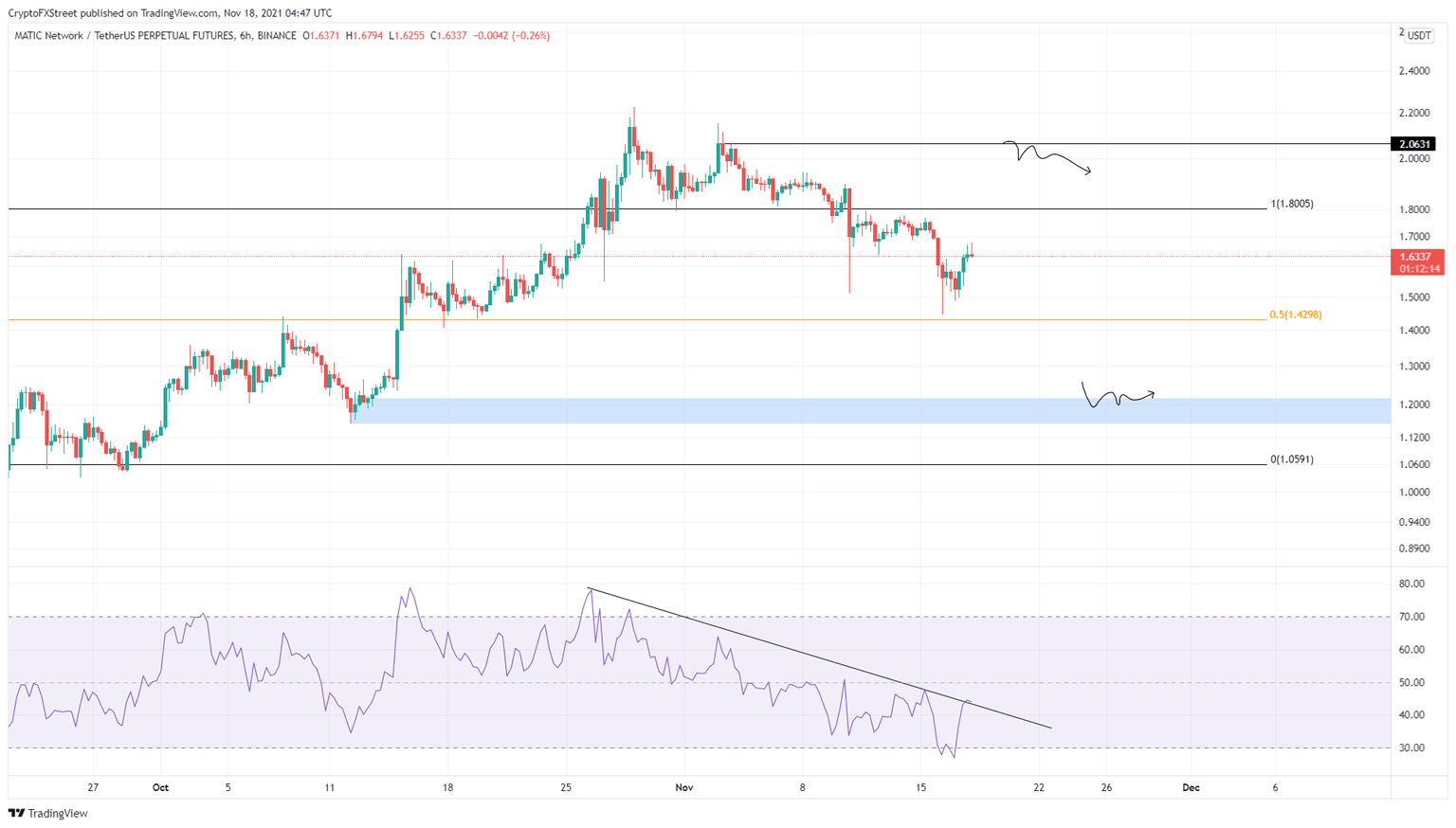

MATIC price has crashed roughly 21% from October 29 to where it currently trades, at $1.63. This downswing has reentered the $1.05 to $1.80 trading range. The pullback that originated on October 29 pushed Polygon close to retest the midpoint at $1.42 but failed to do so.

The premature upswing has propelled MATIC price by 16% and looks ready for a minor down move before it embarks on an upswing.

The Relative Strength Index (RSI) is the main reason for this bullish bias. This indicator has produced roughly six lower highs, which can be connected using a trend line to reveal a sloping resistance barrier. This downswing in the technical indicator suggests it is ready for a breakout to the upside.

If this move were to occur, MATIC price would see a significant rise in buying pressure that propels it past the range high at $1.80 and tags the resistance barrier at $2.06. This upswing would constitute a 25% climb.

MATIC/USDT 1-day chart

While things are looking good for MATIC price, a breakdown of the midpoint at $1.42 will indicate that Polygon is heading into a discount phase. A failure to make a quick comeback above $1.42 will indicate that the downswing could extend to the immediate demand zone ranging from $1.15 to $1.24.

Here, the buyers can give the upswing another go. However, a daily close below $1.15 will invalidate the bullish thesis and trigger a correction to the range low at $1.05.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.