MATIC price struggles to find support, increasing risk of 15% correction

- MATIC price returns inside the rising wedge.

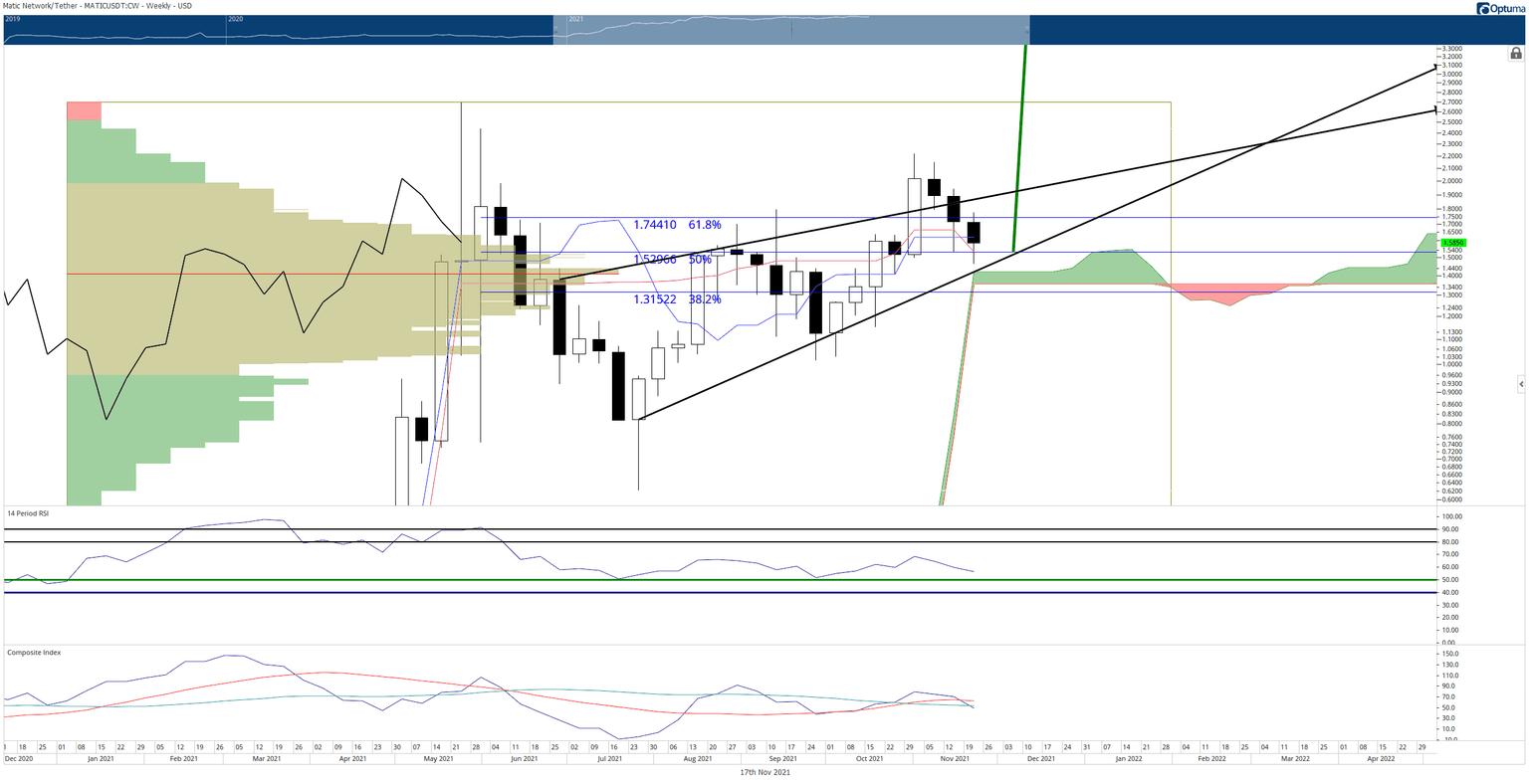

- Strong support for MATIC is near $1.30, but zero support exists below that value area.

- Market awaits buyers to step in and support price.

MATIC price continues to push lower, facing the same weakness affecting the broader cryptocurrency market. Significant support zones exist below, but failure to hold that support could trigger a sell-off.

MATIC must hold the $1.30 - $1.40 value area; a return above the rising wedge would re-initiate bullish sentiment

MATIC price performed a very bearish price action event last week by returning inside the rising wedge. That bearish price action has continued into the current week. Bears are testing one of the primary support zones at $1.50 and appear to gain control.

Below the $1.50 support zone is the final but most vital support level in the $1.30 value area. The 38.2% Fibonacci retracement, Senkou Span B, Senkou Span A, 2021 Volume Point Of Control and lower rising wedge trendline exist within the $1.30 to $1.40 value area.

As long as MATIC price can maintain a weekly close above $1.45, the threat of collapse can be eliminated. However, some warning signs in MATIC’s oscillators should be observed, specifically on the Composite Index.

The Composite Index has just crossed below its moving averages in neutral territory – usually a very bearish warning sign. However, the Relative Strength Index may mitigate any effect of that bearish signal. MATIC’s Relative Strength Index remains in a bull market territory and is up against a strong support level at 50, a level tested twice and held as support.

MATIC/USDT Weekly Ichimoku Chart

Failure to hold the support levels discussed could result in MATIC returning to the $0.80 value area. Any near-term bearish outlook would be nullified if MATIC can return and close above the rising wedge pattern.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.