MATIC price choppy, hinting return to $1.70

- MATIC price continues to trade in choppy conditions.

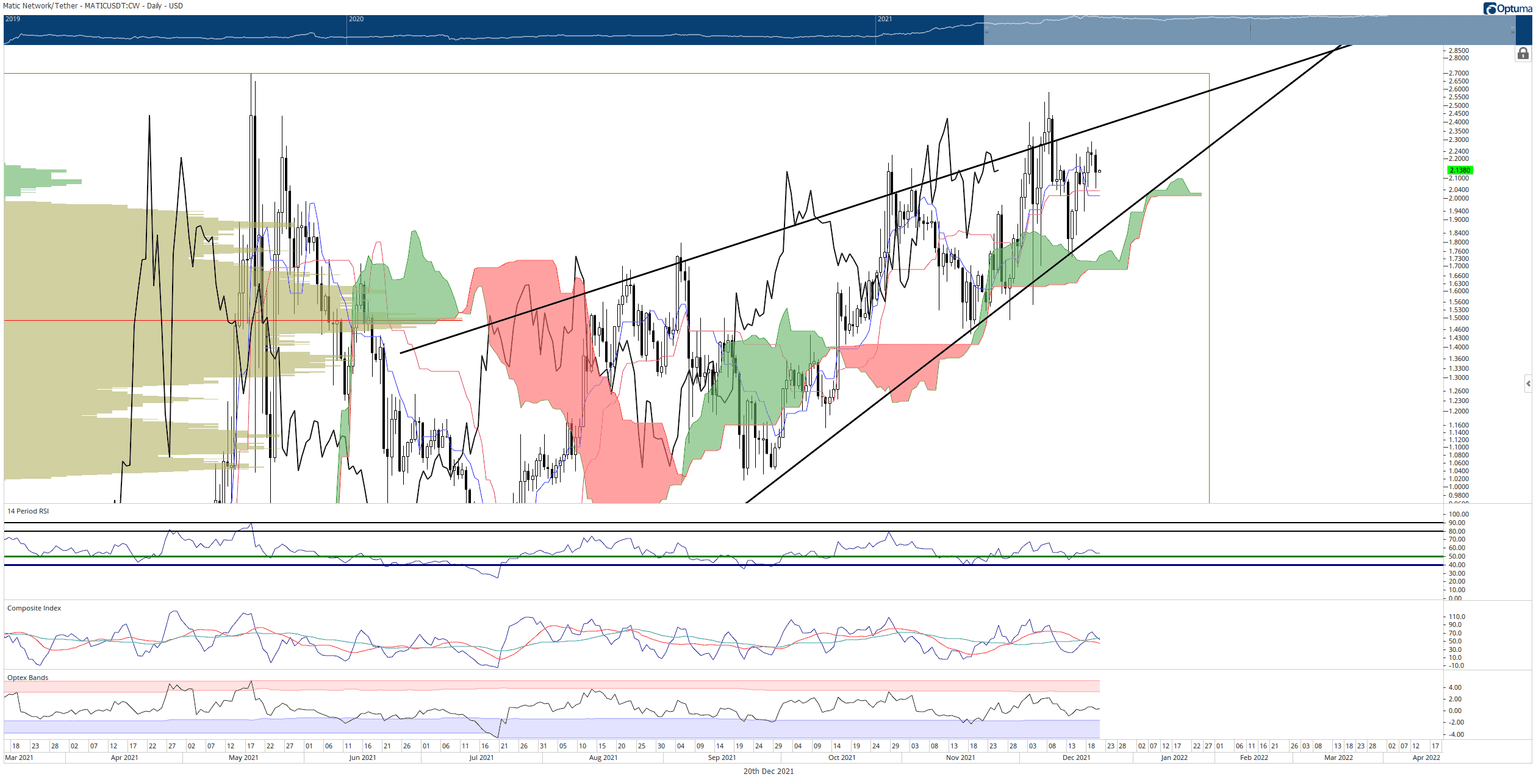

- Whipsaws in price action remain while inside the rising wedge pattern.

- Mixed bias gives mixed signals; equal weight can be given for bearish and bullish directions.

MATIC price action remains extraordinarily indecisive and full of false moves. Despite this, the overall trend is up, which is very tenuous.

MATIC price may break out higher, but a resest of $1.70 is very likely

MATIC price is positioning for a bearish fakeout on the daily candlestick chart. The oscillators show that momentum has tapered off a bit, and participants could see MATIC begin a slight shift to the downside. The ultimate downside risk should be limited to the $1.70 value area.

A move to $1.70 would be a fantastic opportunity for bulls to give the bears a little taste of what a fakeout feels like. There have been four attempts by buyers to push MATIC up and out of the rising wedge, but all attempts have failed and have resulted in MATIC returning inside the rising wedge.

If sellers push MATIC to $1.70, that would be the first close below the rising wedge since its inception – but it would also position MATIC right on top of the most substantial level of support within the Ichimoku Kinko Hyo system: Senkou Span B. A close near Senkou Span B may entice some bottom shorting bears to enter in too late and put buyers in the position of trapping bears. However, that kind of move is not without risks.

MATIC/USDT Daily Ichimoku Chart

If MATIC price moved to $1.70, it would need to spike higher promptly. MATIC would be precipitously close to a level where an Ideal Bearish Ichimoku Breakout could occur, creating one of the most vital short signals within the Ichimoku Kinko Hyo system. It would also validate a break of the rising wedge and accelerate any further sell-off.

To invalidate any near-term bearish price action, buyers will need to position MATIC price at a level where the Chikou Span will be in ‘open space’. Unfortunately, that can only occur at $2.43. If MATIC has a daily close at $2.43, then a rise to new all-time highs is all but a forgone conclusion.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.