Is second time the charm for Tezos' XTZ price breakout?

- XTZ price puts up a bullish front but are about to be tested.

- If bulls manage to break out above $1.62, the chances of a move to $1.78 improve vastly.

- A four-hour candlestick close below $1.33 will invalidate the bullish thesis for Tezos.

XTZ price has been stuck trading between a support floor and a resistance barrier since mid-June. Tezos is at an inflection point and could decide its fate soon.

XTZ price ready for a volatile move

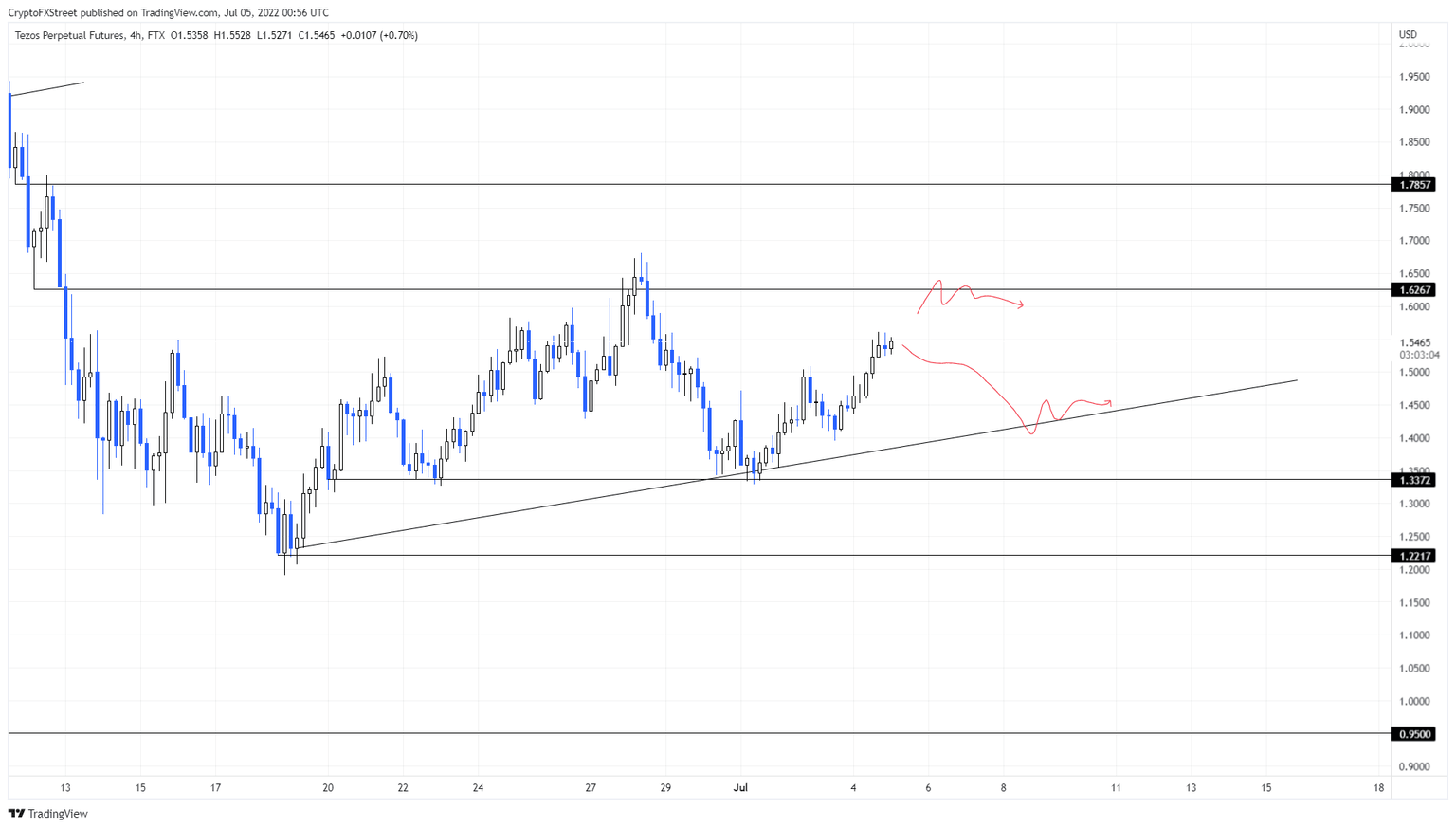

XTZ price set a bottom on June 18 at $1.19 and started producing higher highs and higher lows shown in the chart below. However, the upside was capped at $1.62, which prevented the altcoin from rallying higher.

As a result, XTZ price retraced to the positively-inclined trend line and bounced. This bounce has pushed Tezos up by 16% and is likely to advance another 5% before arriving at the $1.62 hurdle again.

Here, the bulls will face a test that will gauge t their grit; a four-hour candlestick close above $1.62 will signal a breakout. In such a case, XTZ price could rally 10% to retest the $1.78 hurdle. However, a failure to do so, could knock the altcoin back into the range to produce a higher low at roughly $1.40. The bulls may try again from here.

XTZ/USDT 4-hour chart

While things are favoring the bulls, investors need to pay close attention to the inclining trend line. A failure to stay above this support will indicate bulls’ weakness. In such a case, XTZ price will revisit the $1.33 support floor, where the buyers have another chance at a comeback.

However, a four-hour candlestick close below $1.33 will invalidate the bullish thesis for Tezos. In such a case, XTZ price could revisit the $1 psychological level or the $0.95 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.