Institutional interest in Bitcoin is on the rise, BTC may test $50,000

- Massive Bitcoin outflows are noted across exchanges as BTC reserves plummet.

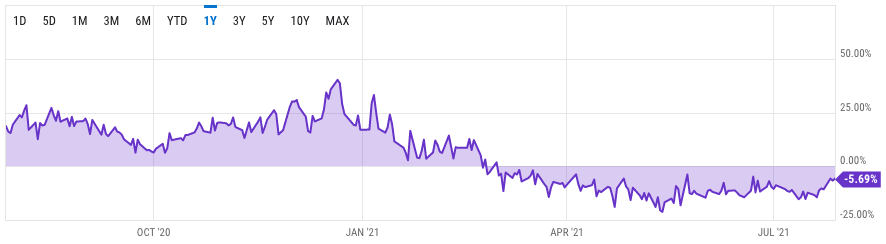

- Grayscale Bitcoin trust shares are trading at a 5.7% discount, up from a 30% discount afew weeks ago.

- Surge in buying interest in BTC seen from institutional investors, no massive unlocks in the next few months.

An increasing percentage of the BTC supply has not moved in over a year, and there is a decrease in Bitcoin available on exchanges. The drop in the Grayscale Bitcoin Trust shares (GBTC) discount has revived institutional demand in Bitcoin.

Bitcoin supply falls amidst rising demand from institutions, a retest of $50,000 likely

Bitcoin outflows have been rising in the last 24 hours, while the asset’s price is testing the $40,000 resistance. On July 28, over 109,690 Bitcoins left exchanges, based on CryptoQuant data. 54% of BTC supply has not moved in a year. The crypto is now more lucrative for traders and investors with decreasing supply.

Plunging BTC reserves represent either institutional purchases for custodial holding or internal exchange wallet transfers. A combination of the two is more likely based on the concentration of the BTC transfers.

The probability of BTC retesting $50,000 has increased further with the renewed institutional interest in the asset. Grayscale Bitcoin Trust represents the institutional interest in BTC most effectively since it is the largest public buyer of the asset. The trust currently has $25.8 billion in assets under management, and the discount on the trust’s GBTC shares has narrowed to 5.7%. This is indicative of increased buying from institutions.

GBTC Premium

Martin Gaspar, a research analyst at digital assets exchange CrossTower, said,

The GBTC discount could be narrowing from investors increasing purchases of GBTC for their tax-advantaged accounts on the belief that BTC will continue to rise with the recent run in price.

The Grayscale Bitcoin trust witnessed several unlocks in July, and unlock events are historically linked to increasing selling pressure on crypto exchanges. Institutional clients are free to sell when restrictions on the sale of GBTC shares are lifted (following six months from the date of purchase). Each GBTC share represents a little under 0.001 Bitcoin, so the sale of 1,000 GBTC shares can be likened to the sale of one Bitcoin.

With no unlocks until early 2022, institutional buyers have resurfaced, driving GBTC shares toward a premium. Nick Hellman, analyst and trader, recently tweeted:

$GBTC premium has gone from -15% to -5% in 5 days... If $BTC can maintain these levels and have @Grayscale premiums flip positive that will add fuel to this #Bitcoin fire https://t.co/1QqGfBhzKQ

— Nick Hellmann (@stunad620) July 26, 2021

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.