Bitcoin price jumps in line with stock-to-flow model, $288,000 BTC by 2024

- Highest level of Bitcoin short liquidations noted on Binance since May 2021, analysts predict further short squeeze.

- On-chain analyst Will Clemente predicted the short squeeze on July 23.

- Plan B confirms that the S2FX model and on-chain signals point toward a second run of the bull market.

The short squeeze that triggered Bitcoin price recovery now signals that the asset is likely headed toward a new top. On-chain analysts share a bullish outlook, recovery in line with Plan B’s S2FX model.

Short squeeze triggers Bitcoin price recovery, analysts predict second bull run

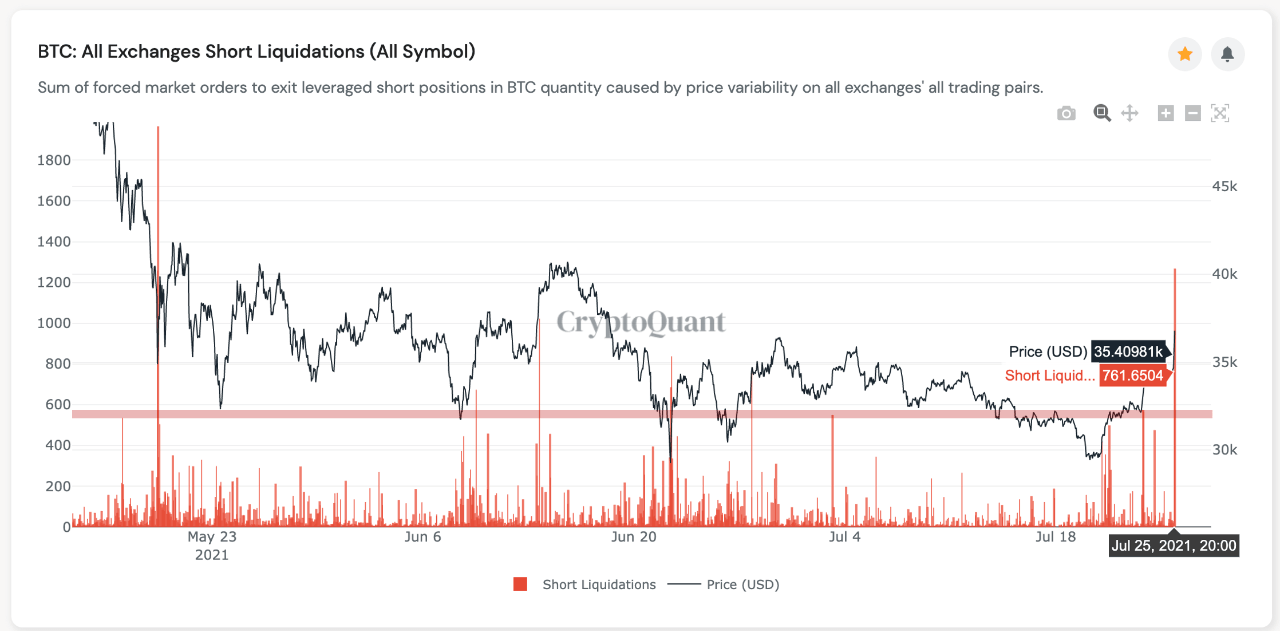

Short settlements recorded on Binance hit the highest volume since May 2021 based on data from CryptoQuant. The liquidation of several short positions within a short period of time, over 761 positions within an hour, led to a temporary Bitcoin price rally.

The metric Bitcoin all exchanges short liquidations is the sum of forced market orders that exit leveraged short positions in BTC due to increased volatility on all exchanges, all market pairs. A spike was noted on the chart on July 25, and this acted as a driver for Bitcoin price. Following this event, BTC climbed above the $35,400 level.

Bitcoin: All exchanges shorts liquidation

A short squeeze is an event in which several short-sellers are forced out of their positions within a short time, usually triggered by a sharp increase in the asset’s price. Though short sellers were betting that the price will decline, the rise in BTC price led to mass liquidation of short positions.

Since short sellers close their positions by buying, an increase in buy orders is typical. This leads to a temporary price rally if accompanied by an equivalent spike in trading volume. On-chain analyst Will Clemente had predicted a short squeeze event ahead of time on July 23.

In his email newsletter, “Bitcoin on-chain updates by Will,” Clemente discussed the factors responsible for a supply squeeze and an upcoming rally in Bitcoin’s price. Observing the funding rates that have mainly remained negative since late May 2021, Will stated,

“Seeing funding stay negative throughout this pump over the last 24 hours shows we could potentially be setting up for a short squeeze.”

On-chain analysts like Willy Woo and Plan B agreed with the short squeeze in supply narrative and the bullish outlook for Bitcoin price.

Plan B tweeted

To reconfirm: on-chain signal still indicates this bull market is far from over, $64K was not the top. This is in line with S2F(X), of course. https://t.co/Ok1S496HB4

— PlanB (@100trillionUSD) July 26, 2021

The Stock to Flow cross-asset (S2FX) model is derived by replacing time and adding silver and gold to the original Stock to Flow (S2F) model put forward by Plan B. The model predicts a Bitcoin price of $288,000 by 2024. Based on the analyst’s prediction, the BTC price aligns with the S2FX model and on track for hitting $288,000.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.