Bitcoin rally likely to be a prolonged one based on three key metrics

- Bitcoin price has surged for eight days straight, headed toward a long streak.

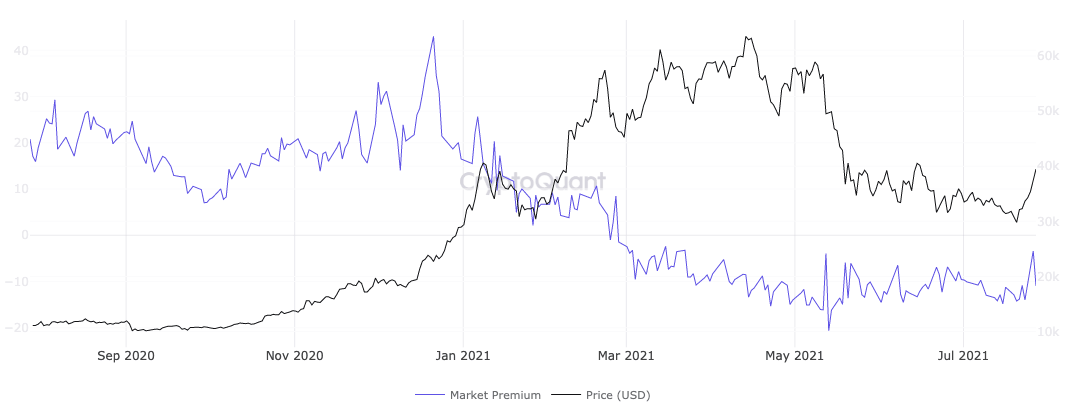

- The Grayscale Bitcoin premium index has significantly rebounded, closer to zero than anytime since May 2021.

- Bitcoin spot exchange reserves show a downtrend, which points to short-term accumulation.

The recent Bitcoin price recovery has put the pioneer crypto on course for another bull run. On-chain analysts state that no great demand is needed for the price to continue to rise.

Bitcoin price recovery set to be the longest one in 2021

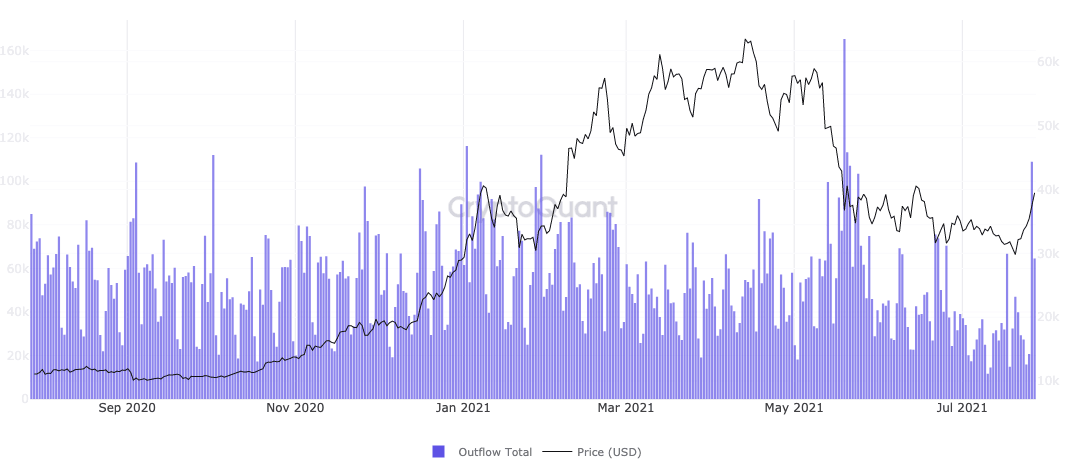

Bitcoin has made a comeback, and the increase in price in the past eight days may lead to the asset's longest rally in 2021. The all exchanges BTC outflow chart shows the total amount of BTC transferred from exchange wallets, and an increase in outflow (less BTC available in exchange wallets) means a decrease in BTC selling pressure.

The outflow of BTC from exchanges has dropped the asset's reserves significantly. This is a sign of accumulation on spot exchanges, and it supports the narrative of a price rally after breaking past the $30,000 price level. Further, no new outflow spike is noted in the past two days.

The interpretation by analysts is that large investors are likely to resist a sell-off to bears. There is no need for significant demand for the price to continue rising.

BTC all exchanges' outflow

The asset's price has advanced every day for over a week. Pankaj Balani, CEO of Delta Exchange, said,

The current momentum is strong, and $45,000 is in sight, but a conclusive break above $50,000 will take some doing.

Another key metric that fuels the bullish BTC narrative is the GBTC premium index. This metric tracks capital flows into the Grayscale Bitcoin Trust (GBTC), the largest BTC investment vehicle for institutional investors. Currently, it indicates that demand from institutions is growing in the US bull market.

The GBTC premium index rebounded significantly to -3.4, the closest to zero it has been in the past three months. Currently, the index is at -11, still above the level seen in the last two weeks.

GBTC premium index

Several metrics signal a bull run. Despite that, BTC price is far below its mid-April high of nearly $65,000. Undeterred by the current price level, on-chain analysts have a bullish outlook and see a potential break in BTC prices past $44,000.

Daniel Joe, an on-chain BTC analyst, tweeted

The recent #bullish price action in #BTC continues to help daily momentum get closer to crossing above neutral. Whenever this happens, we need to see follow through higher for validation. Strong confirmation and validation will likely push BTC to 44.6k to 45.1k.

— Daniel Joe (@DanielJoe916) July 28, 2021

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.