Hedera Hashgraph price flirts with 10% drop on Friday

- Hedera Hashgraph price forfeits on important technical moving average.

- HBAR flirts with the break of an important trendline from March.

- The first substantial support is only 10% lower than the current levels.

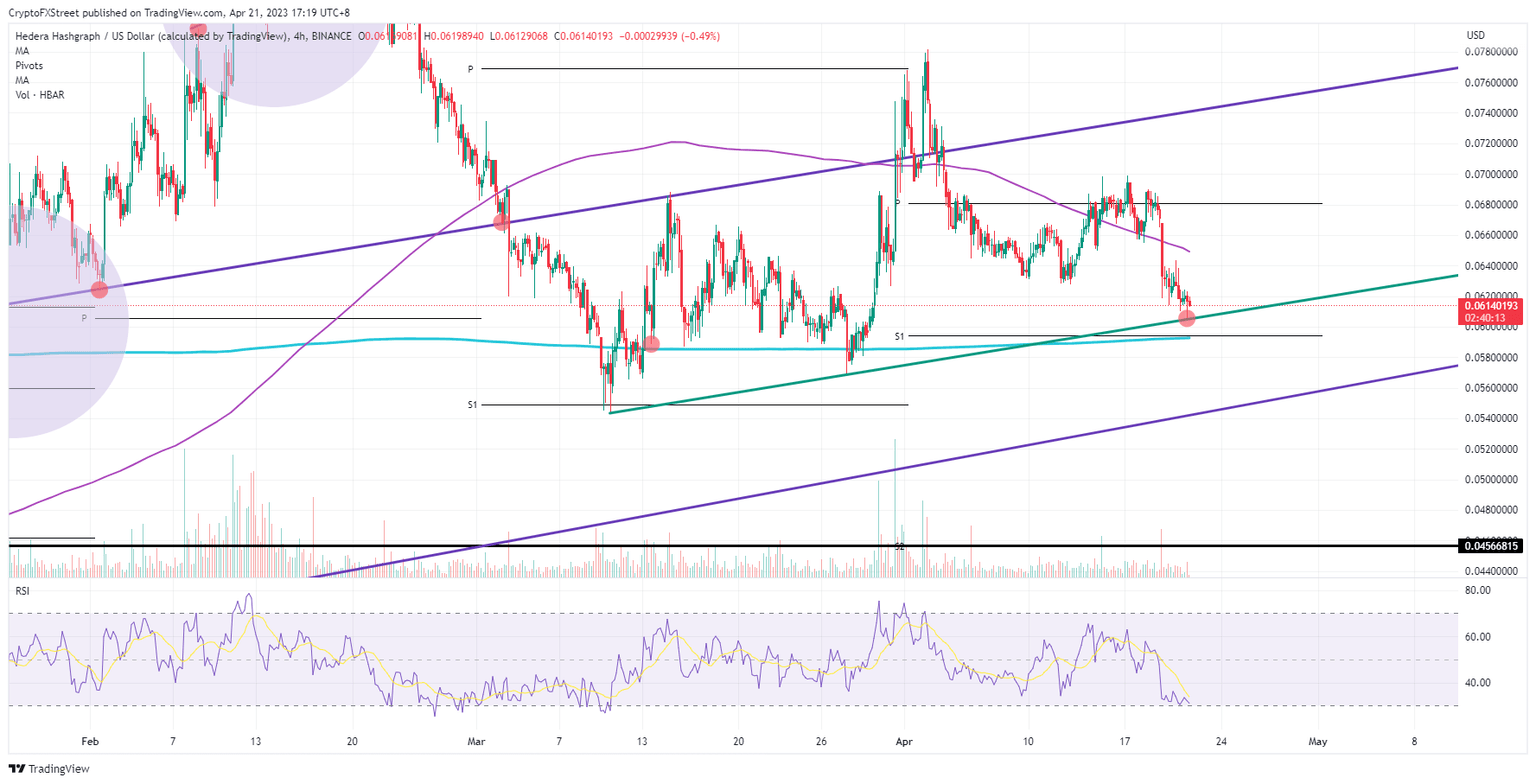

Hedera Hashgraph (HBAR) price has seen sentiment changing overnight on Wednesday with a sharp drop in price valuation. Since then, bulls have not been able to claw back ground from bears in an attempt to pare back any losses. With only a small bounce off current support, bearish pressure does not look to be easing and a leg lower for HBAR looks inevitable with price set to reside near $0.054.

Hedera Hashgraph price to crack under pressure

Hedera Hashgraph price was primed to rocket higher at the beginning of the week after only some small fades were recognized in its behavior on Monday. Instead, those fades have stepped up their pace with an acceleration on Wednesday. HBAR and several other altcoins like Sushiswap are bearing a similar pattern with more than a 10% loss since Wednesday.

HBAR sees bulls only showing small signs of presence with the bounce off the green ascending trendline this Friday. The bounce is so minor that a breakdown is nearly inevitable and will see HBAR tank further. Expect the next support to come from the lower end of the trend channel near $0.054.

HBAR/USD 4H-chart

For now the ascending trendline still holds and the bounce can still pick up gains because the Relative Strength Index (RSI) is primed to move away from the oversold region. In that case, the 55-day Simple Moving Average (SMA) near $0.064 becomes crucial to see how strong this recovery can become. When bulls can break above it, the road to $0.074 is wide open with a 20% gain on top and even pushing the RSI into overbought territory.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.